On-chain data shows that Bitcoin mining hashrate has fallen to its lowest level since early March.

The average 7-day Bitcoin mining hash rate has continued to decline recently

“Mining hash rate” refers to a metric that tracks the total computing power that miners currently have tied to the Bitcoin blockchain. The value of this metric can be viewed as a proxy for sentiment among miners.

As the index value increases, existing miners expand their mining farms, and new ones enter the space. This trend suggests that the blockchain is looking attractive to these chain validators.

On the other hand, the metric that records the decline indicates that some miners have decided to turn off their machines, perhaps because they no longer find the cryptocurrency profitable.

Now, here’s a chart showing the average 7-day Bitcoin mining hash rate over the past year:

The 7-day average value of the metric seems to have been going down in recent days | Source: Blockchain.com

As shown in the chart above, Bitcoin’s seven-day average mining rate hit an all-time high (ATH) last month, but the metric has been declining since then. This decline is likely the bearish momentum the cryptocurrency’s price is experiencing.

Miners earn most of their revenue through Bitcoin block rewards, which they receive as compensation for solving blocks. These rewards are fixed in value and have a fairly fixed frequency. Therefore, the only variable associated with them is the spot price of Bitcoin.

When the price of assets falls, the value of the rewards these miners receive also falls, which naturally leads to lower revenues. Bitcoin has taken a big hit recently, so it makes sense that some mining companies are going under.

After the recent drop in mining hashrate, its value has fallen to its lowest level since early March. If BTC continues at its current lows or drops further, the index is likely to extend its decline.

Due to the plight of miners, they have also recently sold their stored rewards, as noted by an analyst at CryptoQuant Quicktake. mail.

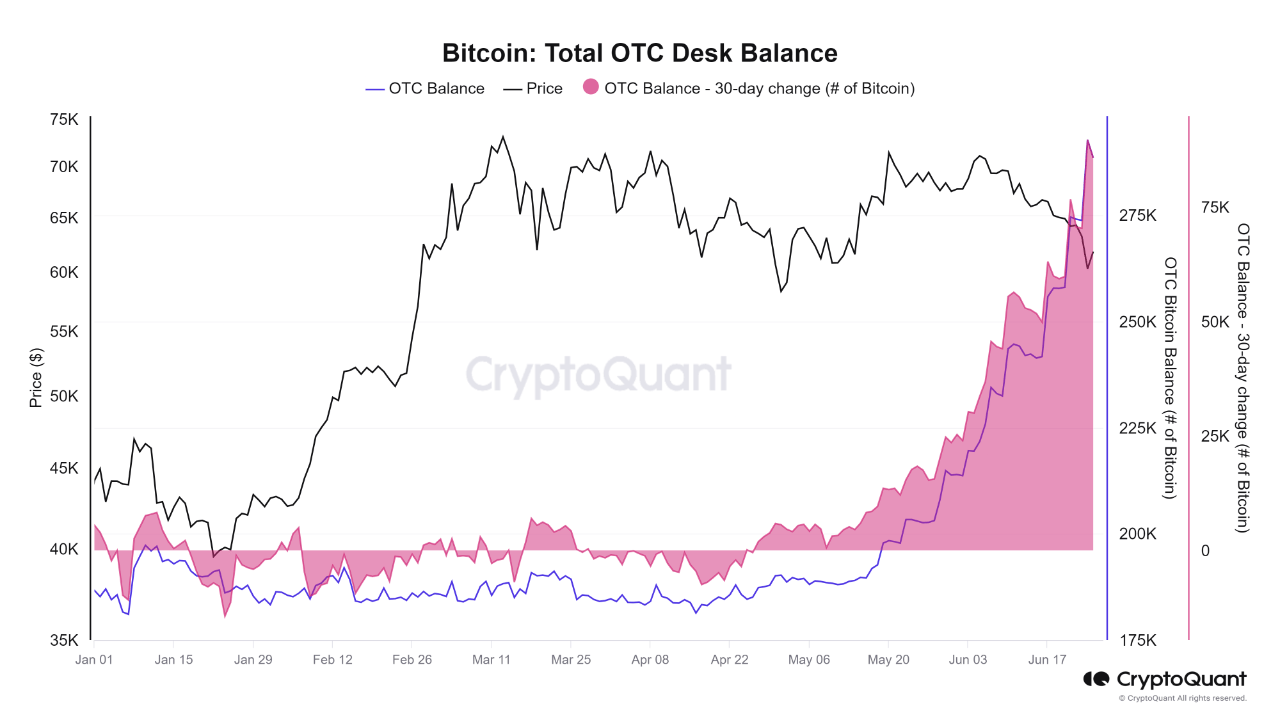

The data for the BTC balance sitting in the wallets connected to the OTC desks | Source: CryptoQuant

The chart above shows the trend in Bitcoin holdings at over-the-counter trading desks. This metric appears to have seen a significant increase recently. According to Quantitative, selling moves by Bitcoin miners have been a factor behind this growth.

Bitcoin price

Bitcoin is trading near the lower end of its recent consolidation range at around $61,700.

Looks like the price of the asset has been stuck in a downtrend recently | Source: BTCUSD on TradingView

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com