Over the past four days, Bitcoin has fallen by more than 15%, with a massive 7.8% drop in the past 24 hours alone. From a high of around $72,000 in early June, Bitcoin is now down around 25%. Here are the key factors behind yesterday’s sharp price drop.

#1 Bitcoin Payments from Mt. Gox

The imminent distribution of 142,000 BTC by the defunct cryptocurrency exchange Mt. Gox has caused major market concern. The amount, which represents 0.68% of the total Bitcoin supply, is set to be distributed among creditors of the exchange, which ceased operations in 2014 due to a major hacking incident.

The distribution has already seen significant transfers, with 52,633 BTC moved in the last few hours, indicating that preparations are underway for a large-scale disbursement. Market watchers and analysts are closely watching these moves, as the potential for massive selling by these lenders could inject significant volatility into the market.

The psychological impact of this distribution is believed to have led to preemptive selling among Bitcoin holders, amplifying market fears.

#2 German Government

The German government’s decision to start liquidating its Bitcoin holdings has also sent ripples through the market, with transactions recorded on major exchanges like Bitstamp, Coinbase, and Kraken.

Related reading

Over the course of two weeks, the government has reduced its holdings from 50,000 BTC to 42,274 BTC. Market participants are understandably nervous that continued selling by a major holder like the government could put downward pressure on prices.

#3 Long Mega Filter

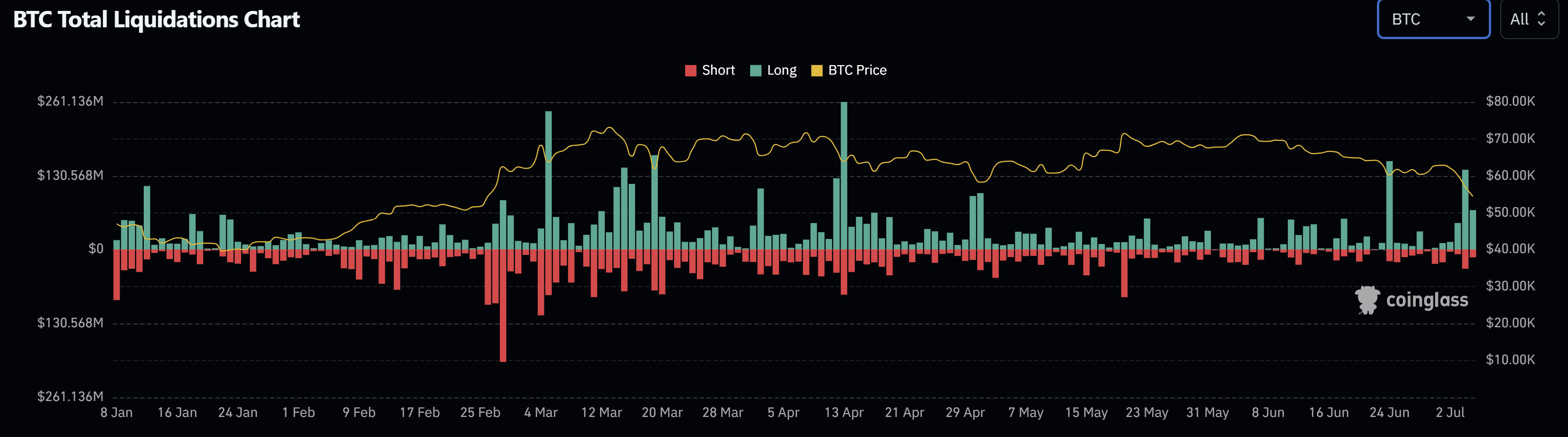

The Bitcoin market has seen a sharp increase in long liquidations, with $212 million worth of Bitcoin liquidated in the past 48 hours alone. This liquidation is the largest since April 13, when $261 million worth of long positions were liquidated, leading to a sharp drop in the price of Bitcoin from $68,500 to $61,600.

Such liquidation often leads to a chain reaction, resulting in forced selling and further price declines. Such liquidation indicates a highly leveraged market where investors may be overextended, contributing to increased market volatility.

#4 Bitcoin Miners Surrender

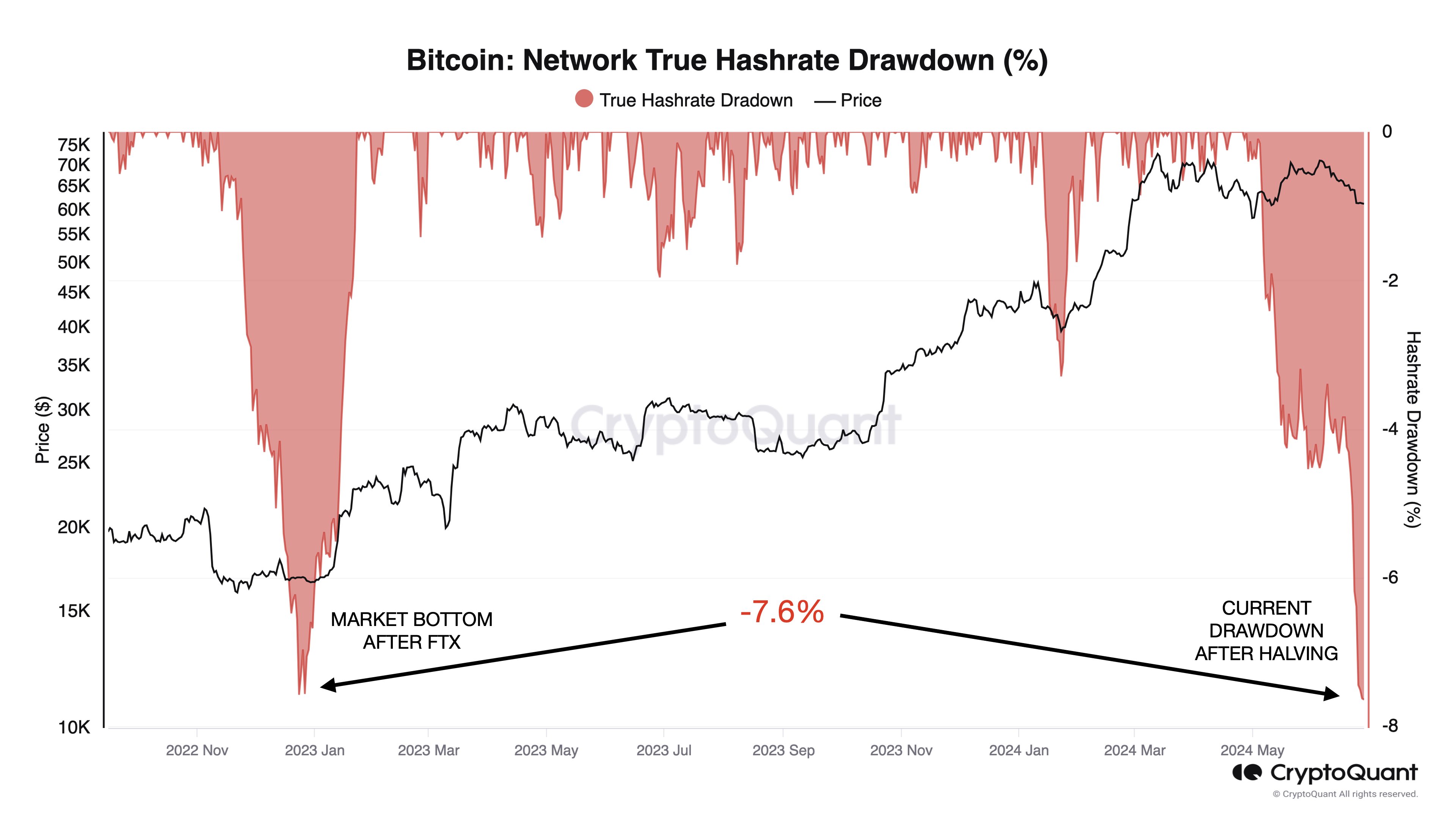

Following the Bitcoin halving event on April 20, 2024, the mining reward was halved from 6.25 to 3.125 BTC, which led to increased economic pressure on miners. This reward cut was expected to increase the price of Bitcoin, but the increase did not materialize, leaving miners with diminishing returns.

Related reading

Researchers from CryptoQuant recently revealed that the current capitulation among miners is similar to the previous market bottom, such as the one we saw after the FTX collapse. Indicators of miner distress, including a massive 7.7% drop in hashrate and a sharp drop in mining revenue per hash to all-time lows, suggest that many miners have been forced to shut down their equipment and sell their BTC holdings.

#5 Bitcoin ETF Activity Slows in the US Market

Contrary to expectations of a vibrant market driven by institutional investment through spot Bitcoin ETFs, the sector has seen a marked slowdown. The anticipated “second wave” of institutional money has yet to materialize, leading to muted activity in the ETF space. Instead, spot ETFs are currently experiencing a summer lull.

The enthusiasm surrounding Bitcoin ETFs has not been able to counteract the overwhelming negative sentiment in the market; however, its direct impact remains relatively minor. Leading blockchain analyst James “Checkmate” Cheek recently said estimated Only 20% of spot trading volume is attributed to spot ETFs, with the rest coming from traditional spot markets. Over the past few weeks, long-term Bitcoin holders have been selling their holdings in droves, which has been the primary driver of the downward pressure on the market.

At the time of publishing this report, BTC was trading at $54,434.

Featured image created using DALL E, chart from TradingView.com