This article is dedicated to examining Bitcoin‘s Q1 technical outlook. For more profound insights into the fundamental factors that will shape the trend for cryptocurrencies in the coming months, download DailyFX’s all-inclusive first-quarter trading guide.

Recommended by Nick Cawley

Get Your Free Bitcoin Forecast

Bitcoin Technical Outlook

Bitcoin had a strong performance this year, rallying from an opening level of around $16.6k to a recent high of $44.7k with little in the way of notable pullbacks along the way. The strong bottoming-out pattern between November 2022 and January 2023 prompted a wave of higher lows and higher highs throughout the year, culminating in an 80% rally between early September and early December. The next target on the weekly chart is just above $48k, the end of March swing high. The current strength of Bitcoin can be seen in the three simple moving averages which are currently situated between $29k and $32.3k. The 50-day SMA is also looking to create a golden cross by breaking above the 200-dsma. Weekly support at $40k and just below $38k.

Bitcoin Weekly Price Chart

Source: TradingView, Prepared by Nick Cawley

Improve your cryptocurrency trading skills today with our comprehensive guide packed with essential insights and effective strategies for navigating the world of digital tokens. Get a free copy now!

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

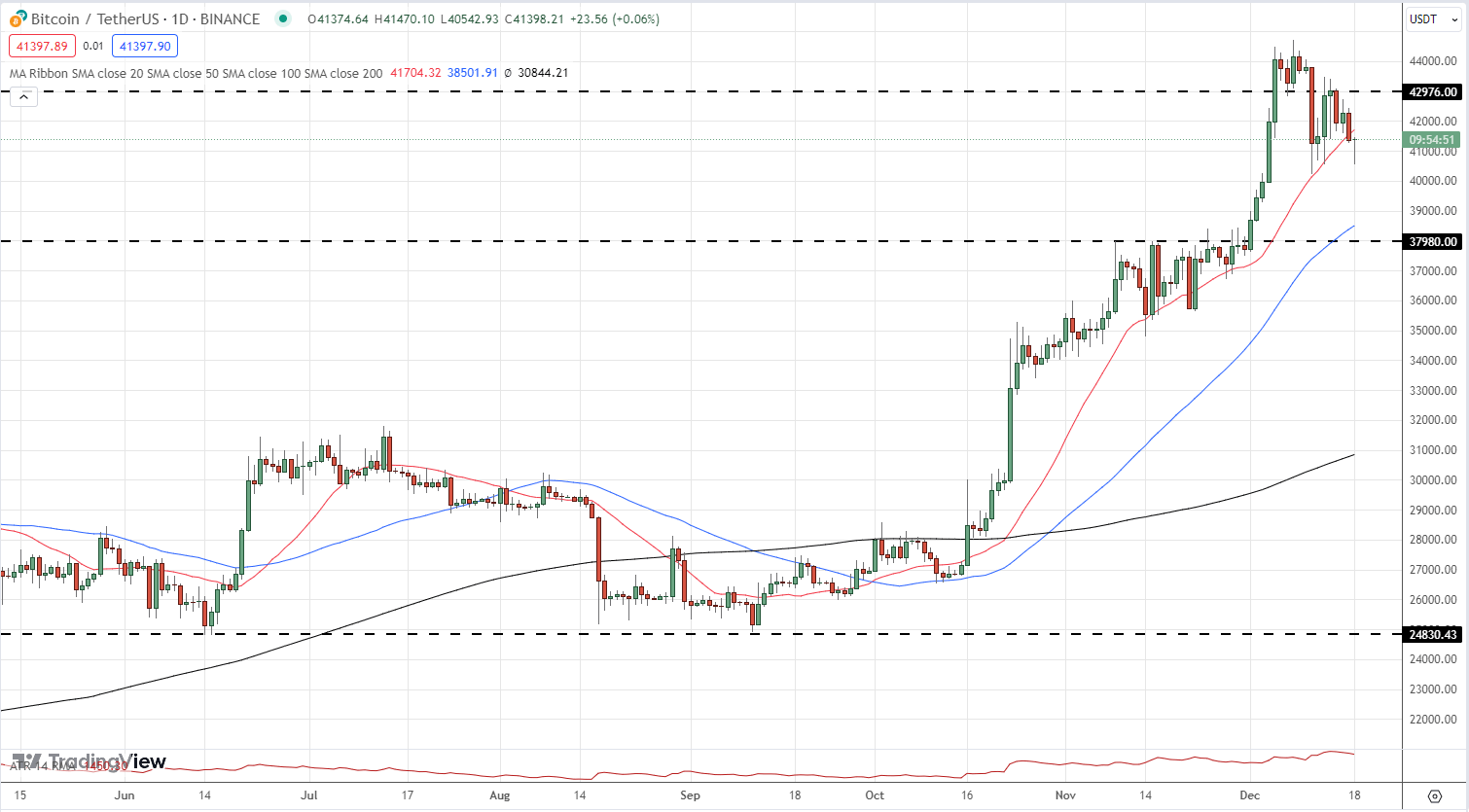

The daily Bitcoin chart remains positive although a short-term pullback cannot be discounted. The 50-/200-dsma produced a golden cross on October 29th ($34.5k) and this allowed BTC to rally to a multi-month high of $44.7k on December 8th. The chart shows a series of higher lows and higher highs since mid-September and a break below $38k would be needed to negate this and turn the chart neutral. The 20-dsma has acted as support during the recent rally but is now being tested. A confirmed break below here could see Bitcoin trade down to horizontal support a fraction below $38k.

Bitcoin Daily Price Chart

Source: TradingView, Prepared by Nick Cawley