Bitcoin has crossed the $67,000 mark and is testing key supply levels to determine its next target. As Election Day approaches, the cryptocurrency market is experiencing increased volatility, increasing expectations of a potential rise in Bitcoin.

Key data from CryptoQuant reveals that retail investors are returning to the market, marking a rebound in demand that could signal the beginning of a broader rally. As the price continues to rise, this renewed interest from retail sector participants is seen as a bullish indicator, adding momentum to Bitcoin’s rally.

The cryptocurrency also benefited from a strong buying wall on exchanges, which further supported the price and eased selling pressure. With Bitcoin holding above crucial support levels, market sentiment remains upbeat, suggesting that further gains could be on the horizon.

The coming days will be crucial for BTC and the market in general as they will determine the strength and sustainability of this upward momentum.

Traders and investors alike are looking to see if Bitcoin is able to break through these key supply levels, which could pave the way for a new phase in its upward trajectory.

Bitcoin is rising rapidly

Bitcoin is poised for a major upward movement, and historically, such rallies happen quickly. The entire cryptocurrency market is on the verge of exploding, with price action and on-chain metrics indicating strong upward momentum.

Chief analyst and investor Axel Adler recently Share important data from CryptoQuantHe revealed the return of individual investors. Adler provided a chart showing the 30-day change in retail investor demand for Bitcoin, which currently stands at 7%.

This increase is noteworthy; The additional 3% increase indicates strong demand from retail players, in line with levels typically seen during uptrends.

Retail investors play a crucial role in driving market movements. Their participation often marks the beginning of major price rises as they bring new capital and optimism.

Historically, periods of increased retail participation have been preceded by significant rallies, creating a positive feedback loop that fuels upward price movement and boosts market sentiment.

If momentum continues and retail demand increases, this could lead to rapid price increases that attract the attention of broader market participants. In this environment, the potential for explosive growth remains high, making it an exciting time for those involved in the Bitcoin ecosystem.

BTC pushes above local highs

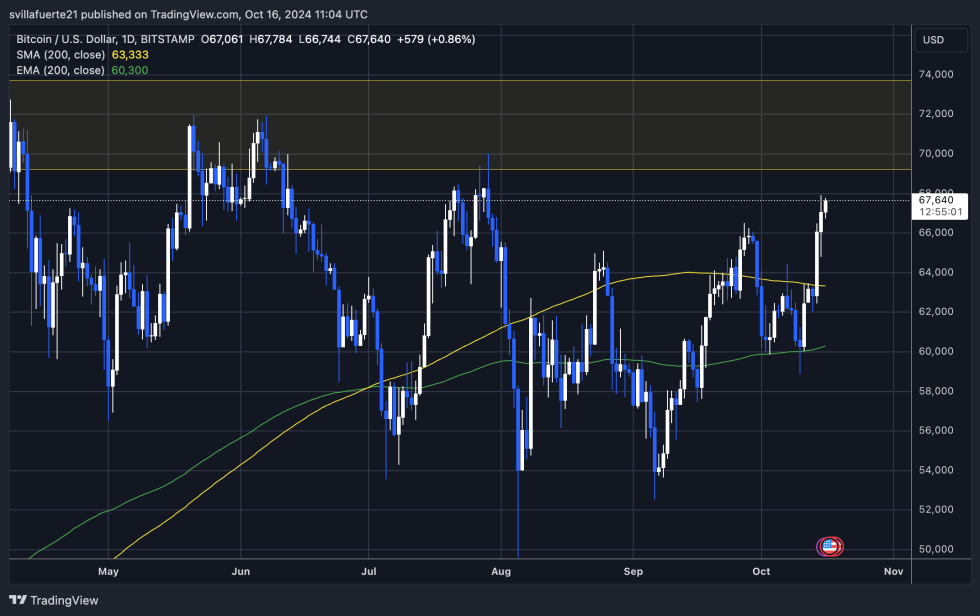

Bitcoin is trading at $67,600 after an impressive 8% rise since Monday. This price action pushed BTC above the 200 daily moving average (MA) at $63,333, marking a new local high above the previous resistance level of $66,500.

This bullish momentum suggests that if the current trend continues, a challenge to the next big demand level at $70,000 is likely to be the next local rally on the horizon.

However, market dynamics suggest a healthy retest of the previous resistance level could occur in the coming hours. This retest would create support and consolidate the uptrend. If the price fails to maintain levels above $66,000, we may see a correction back to lower demand areas around $62,000, which could indicate potential weaknesses in the current uptrend.

As traders closely monitor the price action, it will be essential to know how Bitcoin responds to these critical levels. Overall, the outlook remains optimistic, but caution is warranted as the market seeks to confirm the strength of this recent rally.

Featured image by Dall-E, chart from TradingView