Bitcoin is still strong, up about 30% from a low of $49,000 in early August. With bulls gaining strength and fundamentals swinging in favor of the world’s most valuable cryptocurrency, prices are holding below $65,000. Looking at the daily chart, this reaction level coincides with the August highs.

Technically, if buyers find the momentum and break this level, the price could rise to $70,000, a psychological level, and even break $72,000. If this happens, it will mark the first time since June that bulls have overcome resistance at their reaction level.

Bitcoin Price Rise as Selling Pressure Decreases, Why Is It Hard to Break $65K?

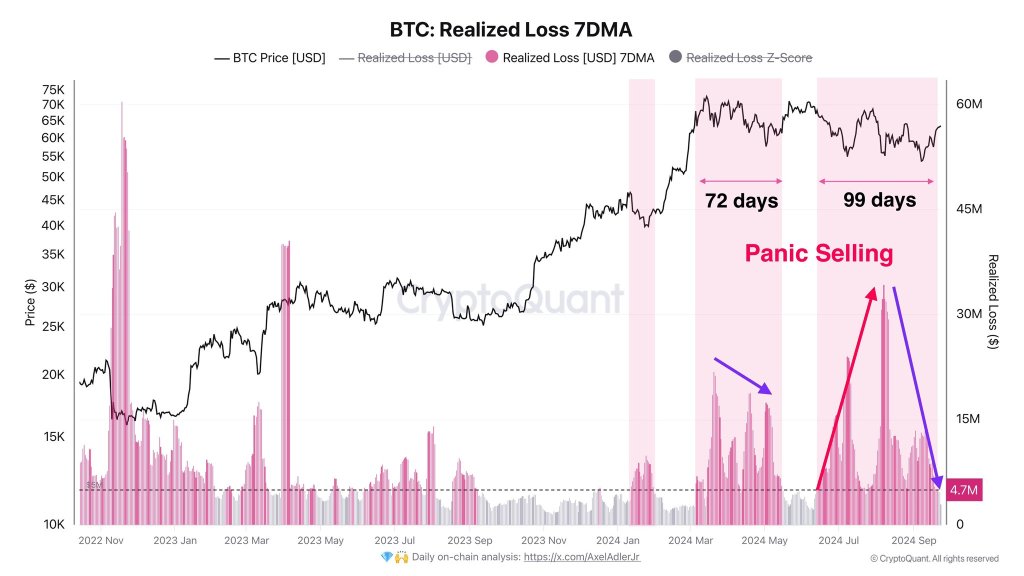

The inability of buyers to surpass $65,000 comes as on-chain data shows that sellers are losing momentum. After the concerns in early September, the rally to spot prices saw traders change their strategy, focusing on buying and cutting losses.

According to an analyst at X, Signal According to trading data, there has been a significant drop in Bitcoin sales at a loss over the past week of trading. The maximum realized Bitcoin shows that traders who lost money over the past week dropped below $5 million to $4.7 million.

This means that most sellers are no longer willing to see their coins lose. Therefore, in theory, the decrease in selling pressure should support the upside, paving the way for further gains.

The immediate resistance level, given the candlestick arrangement on the daily chart, is $65,000. However, the problem is that bulls have not been able to break this liquidation level despite the high confidence.

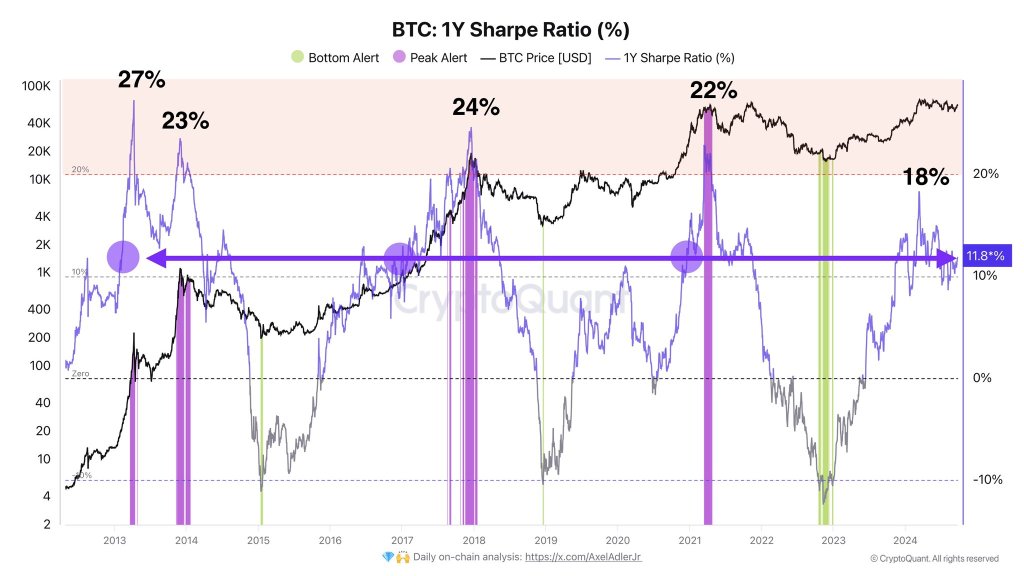

Bitcoin Sharpe Ratio at 11.8%, More Room for Growth

As selling pressures ease, the analyst also said, male Bitcoin’s Sharpe ratio is around 11.8%. On-chain analysts use this ratio to measure risk-adjusted returns compared to U.S. Treasuries.

At these levels, this means that Bitcoin holders, over the past year, have been in a good financial position, earning more than bond holders.

Related Reading: Dogecoin’s $1 Looming: Market Expert Reveals Shocking Timeline

Typically, whenever Bitcoin’s Sharpe ratio rises to around 20%, it indicates a market peak. Since the ratio is at 11.8%, it indicates that there is more room for growth before reaching a speculative peak.

Featured image from Canva, chart from TradingView