BITCOIN, CRYPTO KEY POINTS:

- Bitcoin Remains Below the $38k Mark as Rangebound Trade Continues.

- Crypto Industry Relatively Calm Despite Record Breaking Binance Fine and New CEO for the World’s Largest Crypto Exchange.

- Coinbase Appears to be an Unlikely Winner as it Continues to Advance.

- To Learn More AboutPrice Action,Chart Patterns and Moving Averages,Check out the DailyFX Education Series.

READ MORE: Crypto Forecast: Will Bitcoin Have What it Takes to Break the $38k Mark?

Bitcoin rallied sharply yesterday after threatening to break support at the 35500 level. Yesterday’s aggressive rebound came within a whisker of the 38000 mark before struggling to break higher today. It seems the current range may be here to stay a while longer.

Recommended by Zain Vawda

Get Your Free Introduction To Cryptocurrency Trading

BINANCE FINE, CZ STEPS DOWN AND COINBASE EMERGE AS WINNERS

It’s been a busy week for Cryptocurrencies and the industry despite no word on the much-anticipated Spot Bitcoin ETF. However, developments around Binance (the world’s largest crypto exchange) dominated the headlines. As news filtered through regarding the imminent decision by Changpeng Zhao (CZ as he is known) to step down as CEO of Binance with Richard Teng taking his place. In a statement posted on the X platform the former CEO stated that this is best for him, Binance and the crypto community. The CEO did close out his post by confirming that the deal in place with US regulators do not allege misappropriation of user funds or market manipulation.

Along with a new CEO Binance have to pay a $4.3 billion fine which had raised concerns about the health of the company. Incoming CEO Richard Teng was quick to address concerns citing robust revenues and profit. Mr Tang went further stating that the funadamentals of the Busines remain strong as they have a debt free capital structure and modest expenses. There was also an interesting back and forth between the Binance CEO and Coinbase (Coin) director Conor Grogan who shared that based on the Proof of Reserves document shared by Teng, Binance would have to sell some of its crypto assets. This was denied by Binance who says the reserves will be fine for the repayment programme.

Looking at Coinbase and things do get interesting. The US exchange which has faced some troubles of its own in the recent past appears to be the biggest winner so far in 2023 as competitors falter. In recent times the announcement of the Spot Bitcoin ETF application by many companies who listed Coinbase as the storage partner. As news grows of a potential ETF approval Coinbase has been a beneficiary, coupled with a recovery over the last two weeks in US equities and the Crypto exchange is enjoying an excellent run. Further validating this belief is the recent metrics from both Coinbase and Binance which showed a sharp uptick in Bitcoin Holdings for the former while the latter’s Bitcoin holdings continues to slide. A Bitcoin ETF approval might add a further layer of credibility to Coinbase and 2024 could be huge year for the exchange and equally as important for Binance.

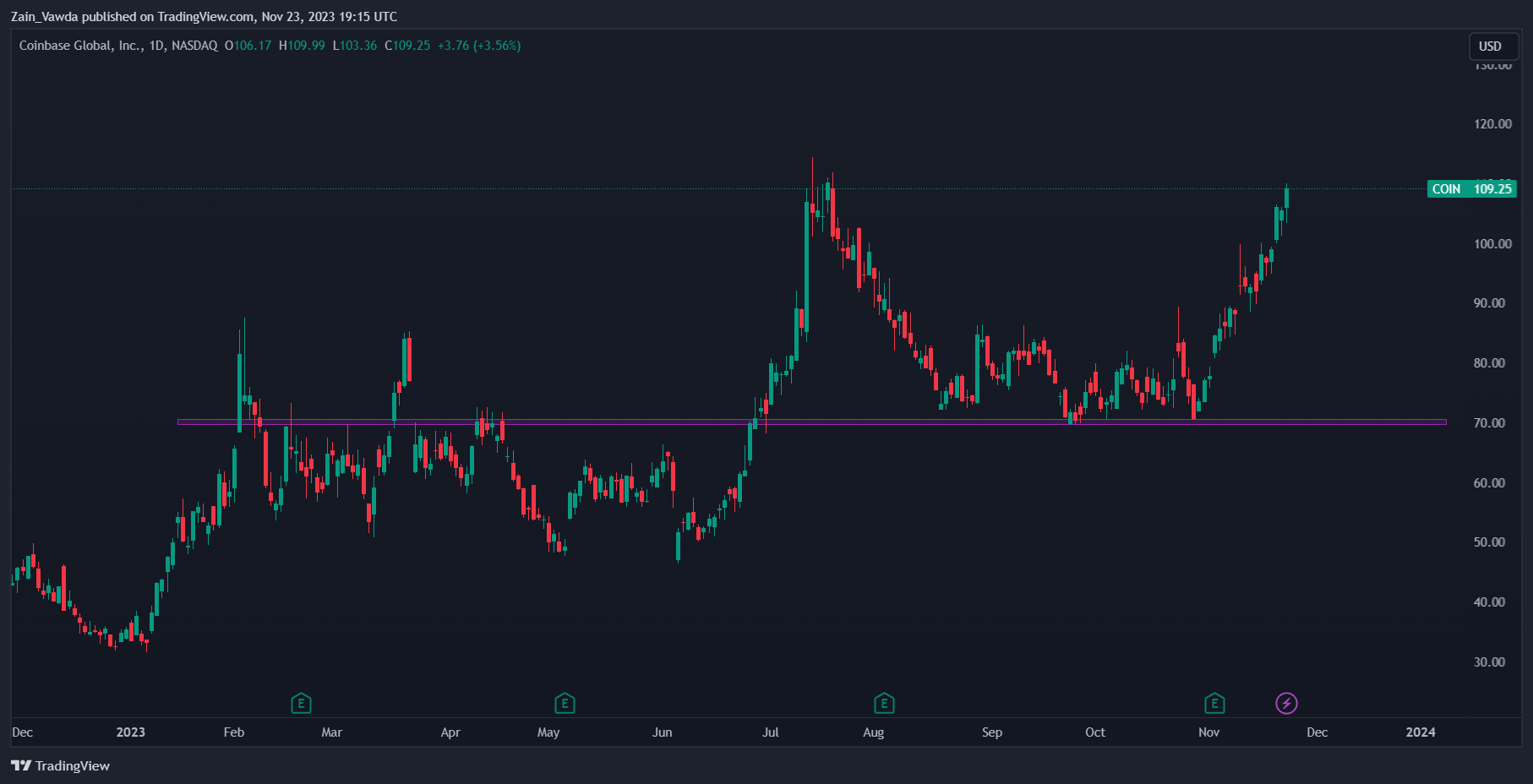

A brief look at the Coinbase (Coin) chart below and you can see that share price has been on a steady rise since bottoming out at around the $30 mark in January before a double bottom pattern in June helped the share price return to July highs around the 109.00 handle. Given the promising Fundamentals for Coinbase and the potential ETF approval it would take a wise man to bet against further gains in the coming months.

Coinbase Daily Chart, November 23, 2023

Source: TradingView

READ MORE: HOW TO USE TWITTER FOR TRADERS

BITCOIN TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical standpoint BTCUSD is interesting as it hovers just below the $38k mark. Nothing much has changed from a technical standpoint from my article earlier this week (link at the top of the article). The 38000 mark remains a stumbling block to further upside and I fear the longer we stall at this level the greater the likelihood for a selloff becomes.

Resistance levels:

Support levels:

BTCUSD Daily Chart, November 23, 2023.

Source: TradingView, chart prepared by Zain Vawda

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda