Bond investors and rates traders are increasingly betting interest-rate cuts will start by the summer, challenging policymakers’ mantra of high borrowing costs for the foreseeable future.

Article content

(Bloomberg) — Bond investors and rates traders are increasingly betting interest-rate cuts will start by the summer, challenging policymakers’ mantra of high borrowing costs for the foreseeable future.

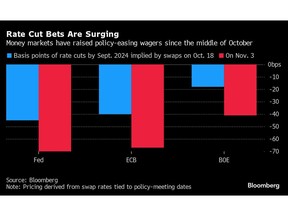

Markets are now wagering that the Federal Reserve will cut rates for the first time in June, and will have enacted almost 100 basis points of reductions by the end of 2024. A similar amount of cuts is priced from the European Central Bank, potentially starting as soon as April. And in the UK, the Bank of England is seen reducing the benchmark rate by close to 70 basis points.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

Article content

Article content

That could prove a problem for central bankers, who’ve acknowledged the degree to which expectations for policy to remain tight have boosted bond yields, helping cool the economy.

“Officials will want to push back against this for as long as possible to avoid easing financial conditions,” said Henry Cook, senior economist at MUFG. If data continue to sour over the coming months — as Cook expects — the stance of central bankers “will become increasingly hard to maintain,” he said.

The pricing highlights market skepticism that’s set in after 2021 as central banks insisted inflation would prove transitory. For rate setters, the drop in bond yields threatens to ease financial conditions whether officials cut or not, undermining the impact of the hikes they’ve already delivered.

ECB Executive Board member Christine Lagarde has pushed back, warning that any discussion of when to cut interest rates is “totally premature.”

“The challenge is how to prevent the market from getting a bit too excited,” said Sebastian Vismara, senior economist at BNY Mellon Investment Management. “As long as there isn’t any credible risk of a rate hike, I think the market will continue to have this tendency to price in rate cuts.”

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

On Friday, traders scrambled to bring forward expectations for the first US cut to June from July after data showed weaker-than-expected payroll numbers and rising unemployment.

‘Self-Defeating’

There’s a danger the aggressive positioning could be their undoing. It wouldn’t be the first time they’ve been on the wrong side of the trade. Time and again this cycle, the market has either jumped the gun and called an end to the rate hikes too soon — or priced in tightening that rapidly looked excessive.

The US 10-year yield has dropped from 5% to 4.50% in less than two weeks on expectations that rate hikes are over. Just as Fed Chair Jerome Powell acknowledged last week that rising bond yields had helped policymakers, so central bankers are alert to signs that financial conditions may be easing too quickly.

Such an outcome “might be self-defeating and central banks might have to come out again strongly and try to reverse that,” said Vismara.

Read More: Powell Touts Tight Financial Conditions, Causing Them to Loosen

In the UK, where inflation is running at three times the 2% target, Bank of England Governor Andrew Bailey has tried to slap down market wagers directly. On Thursday, at the BOE’s post-rate decision press conference, he repeated that it’s much too soon to be thinking about easing.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

“Markets don’t believe the BOE would resist cutting rates if activity contracts or employment deteriorates, whatever the inflation backdrop,” said Axel Botte, head of markets strategy at Ostrum Asset Management in Paris.

Too Hasty?

To be sure, some strategists say the market pricing has it wrong and investors have been too hasty switching their focus to cuts.

Mark Dowding, chief investment officer at BlueBay Asset Management, doubts any of the major central banks will deliver cuts for at least another nine months. Inflation is still above target and there are scant signs of a serious weakening in the US economy so far, he said.

Those positioning for 100 basis points of cuts from the ECB next year will be disappointed, according to Adam Kurpiel and colleagues at Societe Generale SA.

“The last FOMC meeting provided an excuse for markets to factor in a rate-cutting cycle again and for risky assets to rally,” they wrote. “This may prove more complex than markets would like it to be.”

Read More: US Yields Dive After Jobs Data as Traders Move Up Rate-Cut Bets

At the same time, the view policy is already overly restrictive is taking hold, suggesting market pressure will remain potent.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

In Canada, the central bank’s decision to keep the possibility of another hike open was decried by Pimco’s former head of Canadian portfolio management, who argued policymakers should already be talking about cuts.

David Zahn, head of European fixed income at Franklin Templeton, meanwhile, says bets on cuts in Europe from April may be premature, but further into the future the ECB will have to loosen by more than what’s currently priced in order to shore up the economy.

“It’s very clear that they’re done hiking and so it’s now just a question of when they’re going to start cutting,” he said. “You want to start looking at being long duration in portfolios to be ready for a sustained rate cutting cycle in Europe.”

—With assistance from Andrew Langley, James Hirai and Naomi Tajitsu.

Article content

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.