Research warns that Bitcoin (BTC) may see a “market correction” if BTC price moves above $33,000.

In the latest edition of its weekly newsletter, “week on seriesAnalytics firm Glassnode has flagged speculative selling risks on the horizon.

Bitcoin speculator average earnings 12%

Bitcoin short-term holders (STHs) – Bitcoin’s most speculative investors – are back in the spotlight this year.

Recently, their total cost basis appeared to form a broader support for BTC price near $26,000. For Glassnode, which has noticed the importance of the cost basis in recent weeks, the opposite effect may soon appear.

As part of their coverage of short- and long-term holder (LTH) activity, the researchers highlight the levels at which speculators must take profits collectively.

It did this using the Market Value Realized Value (MVRV) metric, which divides the spot value of the coins against the price at which they last moved. The resulting number, which constitutes a measure of profitability or loss, fluctuates around 1, which corresponds to the ‘break-even’ price.

“We can also see a strong reaction in the short-term bearer MVRV index, reacting strongly to the break-even level of MVRV = 1,” explains the Week on Series.

“This ratio is currently at 1.12, which indicates that, on average, the short-term holder group is sitting at a 12% profit.”

If BTC price continues to make gains, STH-MVRV will go up with it – and once it crosses 1.2, the profit-taking risk becomes historically real.

“The risk of market corrections tends to rise when this metric crosses levels between 1.2 (~$33.2K) and 1.4 (~$38.7K), as investors take increasingly large unrealized profits,” Glassnode added.

$25,000 representing “seller exhaustion”

In the meantime, additional data reinforces the notion that recent declines near $25,000 have prompted those looking to sell.

Related: Bitcoin Rise, Fundamentals Fall? 5 things to know in Bitcoin this week

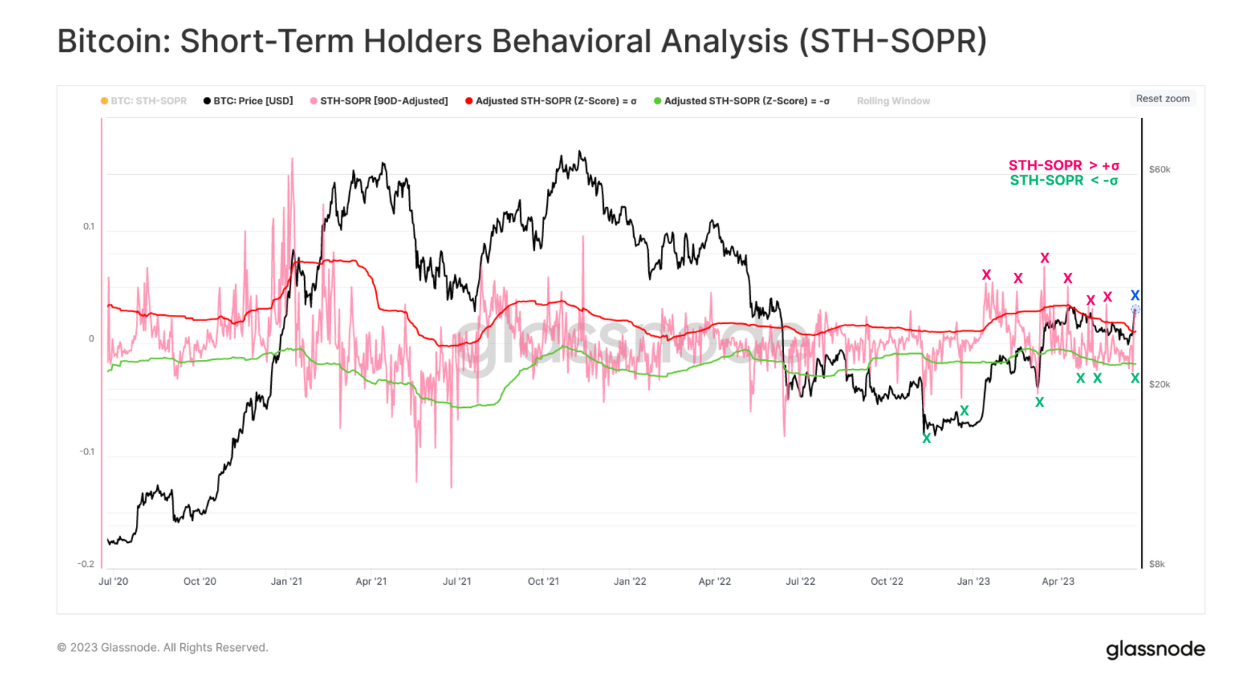

The Output Profit Spent Ratio (SOPR), which looks at the relative profitability of BTC moving on-chain, has repeatedly shown what Glassnode calls “exhaustion” among sellers at or near that level.

Exhaustion levels have been rising since the end of 2022, past current multi-year lows in Bitcoin in the wake of the FTX exchange debacle.

“On multiple occasions in recent weeks, we can identify immediate seller exhaustion occurring below the lower band including the recent low set at $25.1K before recovering back above $30K,” Glassnode sums up along with the corresponding chart.

The Journal: Gary Gensler’s Job at Risk, BlackRock’s First Bitcoin ETF and Other News: Hodler’s Digest, June 11-17

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.