Yuanmonino

The Industry Specific Index (XLI) fell for the second week in a row, ending -0.49%. XLI was among eight of the 11 sectors of the S&P 500, which closed the week in the red. SPDR S&P 500 Trust ETF (SPY) sank -0.79% In the midst of a week witnessed by the Federal Reserve Walking tour rates increased by 25 basis points, and Banking services The crisis that continues to see new events, this time First Republic Bank was taken over by JPMorgan.

The five biggest gainers in the industrial sector (stocks with a market cap of more than $2 billion) gained more than +11% All this week. To date, all five of these stocks are in the green.

FirstSource builders (New York Stock Exchange: BLDR) +17.39%. Shares of the Dallas-based company rose +12.88% on Wednesday after first-quarter results beat estimates.

BLDR has been assigned a quantitative SA rating – which takes into account factors such as momentum, profitability and valuation among others – for comment. The stock has a factor grade of A+ for profitability but an F for growth. Wall Street analysts’ average rating varies with Buy, with 7 out of 13 analysts seeing the stock as a Strong Buy. Year-to-date, the stock is up +71.47%the most among the five biggest gainers this week.

Arconic (ARNC) +17.37%. Arconic said Thursday it was acquired by private equity firm Apollo Global for $5.2 billion, sending shares of the aluminum products maker soaring. +28.29%. The company also reported mixed results for the first quarter.

The quantitative rating of the SA on the ARNC had a score of B- for evaluation and C for momentum. Wall Street’s average rating agrees with a holding rating of its own, with 3 out of 3 analysts marking the stock as such. YTD, + 37.29%.

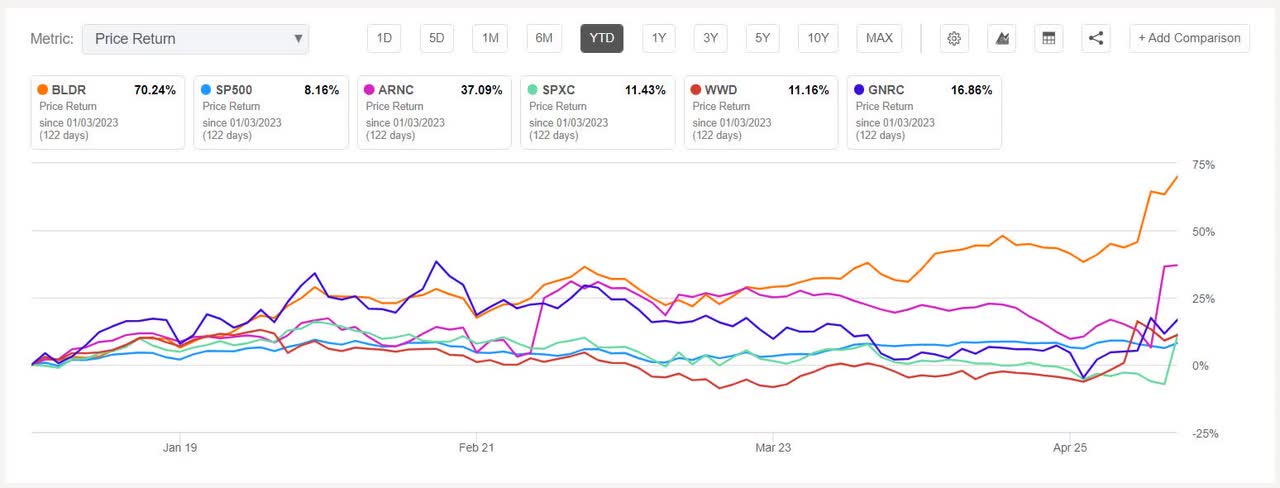

The chart below shows the year-to-date price-return performance of the five biggest gainers and the SP500:

SPX Technologies (SPXC) +16.36%. The company’s stock rose 20.14% after first-quarter results exceeded analyst expectations and the company raised its outlook for the year.

SPXC has a quantitative SA rating for Buy with a B- for Momentum and a C- for Rating. Meanwhile, the average Wall Street analyst rating is Strong Buy, with 5 out of 5 analysts seeing the stock as the same. YTD, +12.87%.

Woodward (WWD) +13.39%. The aerospace products maker’s second-quarter results drove the stock +15.38% Tuesday. Year-to-date, shares are up +12.70%. The SA quantitative rating and the Wall Street analyst average rating, both, on WWD is Hold.

Generac (GNRC) +11.70%. Earnings played the kingmaker again as generator-maker stock soared +11.61% on Wednesday after first-quarter earnings and sales beat estimates. SA’s quantitative rating on GNRC is Hold, which contrasts with Wall Street’s average rating of Buy. YTD, +13.43%.

The five biggest losers this week among industrial stocks (market capitalization over $2 billion) lost more than -9% all. To date, 3 of these 5 stocks are in the red.

spirit aviation systemsNew York Stock Exchange: SPR) -17.54%. Shares of the aircraft parts maker fell -12.28% on Wednesday after adjusting for first-quarter loss per share and revenue below analyst expectations.

The SA quantitative rating is maintained on the SPR with a C factor grade + C- rating for momentum. Wall Street’s average rating varies with Buy, with 5 out of 15 analysts seeing the stock as a Strong Buy. YTD, -17.09%.

Mercury Systems (MRCY) -15.80%. Shares of the company, which makes products for the aerospace and defense sector, fell despite FQ3 results that beat estimates, but lowered the forecast range for GAAP net income and adjusted EBITDA.

The SA’s quantitative rating on MRCY carries a factor grade of A+ for growth but D+ for profitability. This rating contrasts with Wall Street analysts’ average rating of Buy, with 3 out of 8 analysts indicating the stock as a Strong Buy. YTD, -10.28%.

The chart below shows the year-to-date price-return performance of the five worst losers and XLI:

Embraer (ERJ) -14.05%. The Brazilian aircraft maker has seen its shares drop throughout the week, with its biggest drop on Thursday -9.02% After the results of the first quarter. The SA’s quantitative rating on ERJ is pending, with an A+ for momentum but a D for growth. The average Wall Street analyst disagrees with the Buy rating, with 7 out of 14 analysts seeing the stock as a Strong Buy. Year-to-date, the stock is up +21.50%the most among this week’s five biggest losers.

ADT (ADT) -14.03%. The company’s shares fell -14.26% on Tuesday after first-quarter revenue came in below expectations. SA’s quantitative rating on ADT is Hold, while Wall Street’s average rating is Buy. YTD, -36.49%the most among the five worst artists this week.

WESCO (World Council of Churches) -9.74%. Although first-quarter results beat estimates, shares of the supply chain solutions provider fell -14.72% Thursday. The South African quantitative rating and Wall Street analysts’ average rating, both, on the WCC are Strong Buy. YTD, +3.81%.