Bullish Gold: Top Trade Q1 2024

Gold has certainly been on the move throughout 2023, rising around 15% from the start of the year until May, then dropping 13% into October before rising nearly 19% to print an all-time high at the beginning of December. There are several factors influencing gold’s price that appear to be pulling in the same direction ahead of Q1 of 2024. These help to form the trading thesis and are outlined in the rest of this article along with technical considerations.

Elevate your 2024 game: Discover DailyFX’s top trading opportunities for the first quarter of 2024. Request the guide now!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

Weaker US Dollar and Declining Treasury Yields Support Gold

Gold inherently has an inverse relationship with US Treasury yields as well as the US dollar. When the dollar weakens this stimulates gold purchases for foreign buyers and since gold offers no yield, the metal gains in attractiveness whenever yields drop as the opportunity cost for holding gold declines.

Despite the Fed still not ruling out the possibility of another rate hike, markets have decided that the pathway for the Fed funds rate is to the downside. This is revealed via the sharp drop in Treasury yields and the subsequent move lower in the dollar. The chart below reveals how far gold prices have risen while USD and yields have fallen. Therefore, even if gold prices were to stall, the lower trend in yields and USD are likely to keep XAU/USD prices supported at the very least.

Spot Gold Price (gold line) with DXY (green) and US 10-Year Yield (blue) Overlayed

Source: TradingView, Prepared by Richard Snow

The macro-outlook for the US economy is uncertain but conversations have advanced around two possible outcomes: a soft landing, or a hard landing. Under a soft landing, inflation makes great strides towards the 2% target, allowing interest rates to be lowered while the economy shows moderate growth. The hard landing is more ominous and would see economic growth and unemployment deteriorate to such a degree that the Fed would need to cut interest rates in an effort to stimulate the economy again.

In either outcome, interest rates are expected to come down, a scenario that bolsters the value of gold and that’s before even considering the safe haven appeal of the precious metal. Next year is likely to see a continuation of two major geopolitical conflicts with the potential for another in Asia.

Curious about gold’s future direction? Learn about the yellow metal’s prospects with our first-quarter trading forecast. Download a free copy now!

Recommended by Richard Snow

Get Your Free Gold Forecast

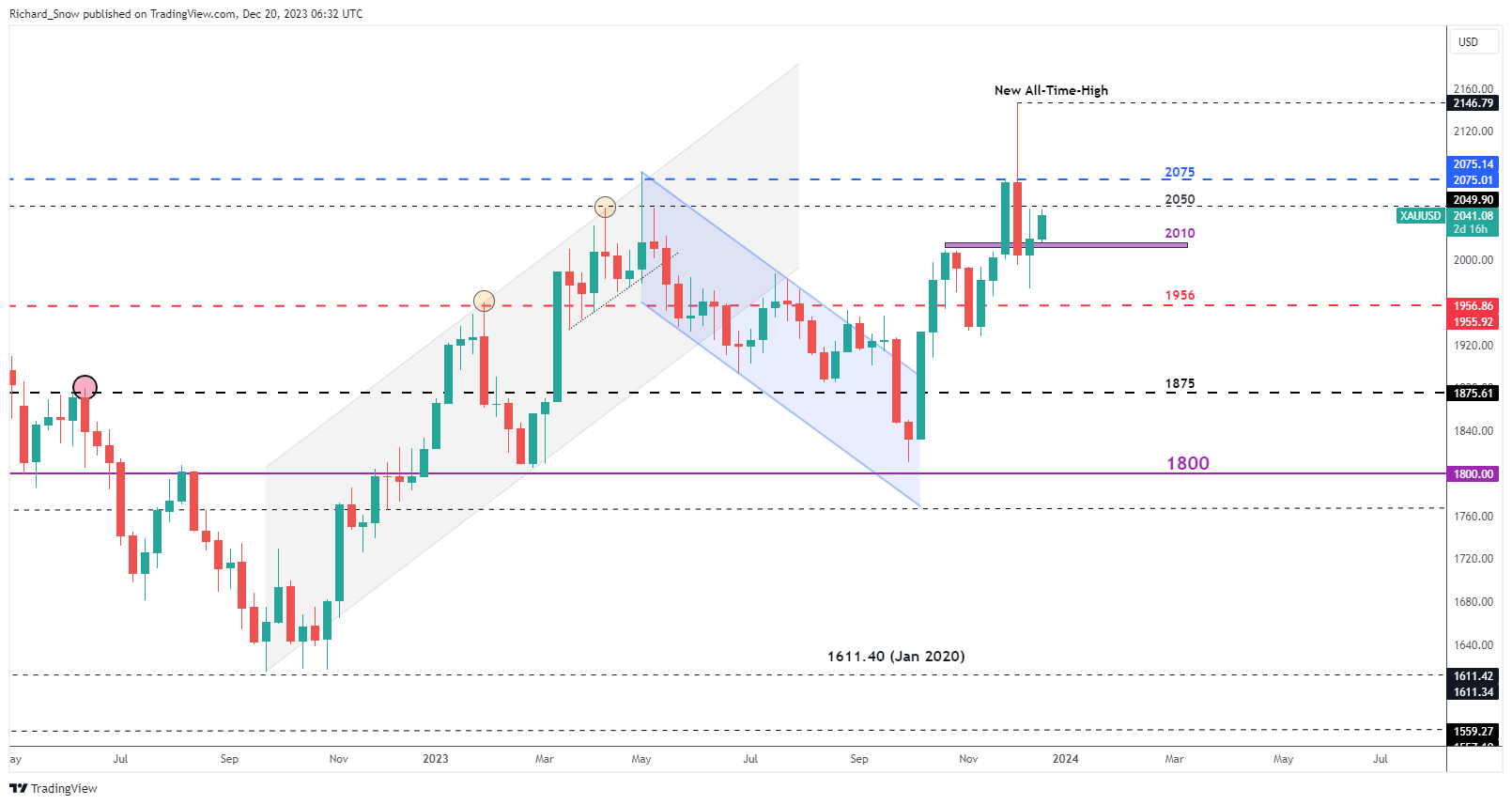

Gold (XAU/USD) Technical Considerations

From a technical standpoint, the bullish outlook on gold is a little more complicated than the fundamental thesis suggests. A lot of positive momentum has already been priced in, providing a less impressive risk-to-reward ratio.

It is with this in mind that an extended pullback would be favourable prior to assessing bullish continuation setups. The first level of support that could provide a springboard for gold is the zone around $2010, with a deeper pullback highlighting $1956. The medium-term uptrend has provided notable periods where gold prices cooled before continuing higher and therefore, it would be reasonable to foresee the potential for another pullback developing in Q1 of 2024.

To the upside, levels of interest appear at $2075 and if price action can muster up enough momentum, a retest of the new all-time-high of $2146.79 appears as the next level of resistance. This trade idea requires discipline to wait for a better entry into what remains a bullish trend.

Gold (XAU/USD) Weekly Price Chart

Source: TradingView, Prepared by Richard Snow