A plan to reform Caixabank SA anxiety among some directors that changes may lead to a greater government impact.

Article content

(Bloomberg) – A plan to reform Caixabank SA has caused concern among some directors that changes may lead to a greater government impact.

Article content

Article content

Familiar people this month said that with the end of the conditions of five managers in April, the board of directors is expected to nominate the candidates at the earliest of this month. However, some independent board members pointed to the fear that the largest shareholders of the lender – and the government – were seeking to replace them with people close to the socialist administration.

Advertisement 2

This announcement has not yet been downloaded, but your article is continuing below.

Article content

Tensions show in -depth relationship between the government and standards, the largest industrial investment group in the country. Over the past year, the standards sought to set itself as a major partner in the private sector in the government at a time when the administration of Prime Minister Pedro Sanchez is increasingly practical approach to corporate management.

Fears in the council-other than so far-have arisen-from the sudden decision of Jose Gennasio Gorgolzari in October, according to people familiar with the matter. This led to the independent board members of Joaquin Ayuso and Francisco Javier Campo saying that they were considering resigning to support him, amid concern that his exit might damage corporate governance, according to the people.

“The current Board of Directors had no changes,” Caixabank said in an e -mail statement. “On February 20, the Board of Directors will contact the annual shareholders meeting and will submit proposals based on what the appointment committee proposes. We need to wait for the meeting of the general shareholders meeting.”

Article content

Advertising 3

This announcement has not yet been downloaded, but your article is continuing below.

Article content

A government spokesman denied that the government tried to influence the process.

The company said in a statement that the criteria “do not participate or interfere in the selection or renewal of independent managers in Caixabank, because it is the bank’s privilege. CEO Gonzalo Gortazar said at a press conference on February 30, that Caixabank has a” great painting “with” Great Harmony ” .

The conditions of Ayu and Cambo are scheduled to end in April. The calls or messages that seek to comment are not answered.

Currently, the bank seeks to choose candidates who have strong technical profiles, according to one person. A person said that no decisions were taken yet.

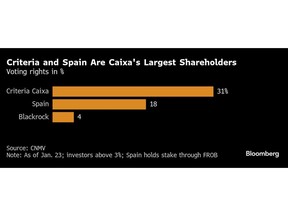

The standards have 31 % of Caixa and carry two seats, while the government has 18 % and has one seat. The Chairman of the Standards is the former Caixabank Chairman.

Last month and government standards joined the forces to remove the Chairman of the Telefonica SA company for a long time and replace it with a government photographer. The government and standards have a combined share of 20 % in the carrier.

Advertising 4

This announcement has not yet been downloaded, but your article is continuing below.

Article content

A similar achievement in Caixabank is likely to be more difficult in light of the organizational audit by the European Central Bank. Caixabank still says what will happen with the five managers whose conditions are in the end, specifically who will remain and any of them will come out and replace it.

The government has been contributing Caixa since 2021 after the bank seized the smaller competing Bankia SA, in which Spain owned the majority share. Goirigolzarri was the head of Bandia, traditionally sought to maintain the interference of the government with the length of the arm.

Caixabank is currently consisting of 14 members: representing Criteriaaixa, including Tomas Muniesa Chairman; One represents Spain. CEO Gortazar is nine independent; And one “external”. New directors are proposed to the Board of Directors by a five -member appointment committee, which includes four independent managers, and must be elected by shareholders. Goirigolzarri seat is still empty.

Under the current rules, independent board members should not serve more than 12 years. Three of the two independent managers at Caixa originally joined the Bankia board in 2012, and became members of the Caixa Board of Directors when Bankia bought.

Standards maintain assets in industries ranging from energy and communications sectors to banking and real estate services.

Article content