This article is also available in Spanish.

Cardano (ADA) has now reached a critical price level after weeks of extreme volatility and uncertainty. After a dramatic series of price swings – first a 27% rise, then a 20% bounce, then a 10% rise, and now a 7% drop to $0.34 – Cardano finds itself at one of its most important support levels. Holding this level is essential for the bulls to maintain momentum and avoid a deeper decline.

Related reading

Market data from Coinglass suggests that ADA may be entering a consolidation phase, which often precedes a significant price move. Investors and traders are watching this level closely, as it could determine whether Cardano is ready for an upward breakout or a deeper correction.

With the entire cryptocurrency market in a state of anticipation, ADA’s upcoming price action will be a key factor in indicating its next direction. As sentiment remains mixed, this period of consolidation will likely set the tone for Cardano’s trend in the coming weeks.

Cardano’s funding rate indicates market consolidation

Cardano (ADA) is showing signs of entering a potential consolidation phase, a crucial moment for investors as they evaluate what’s next. Recent on-chain data highlights an increase in large transactions followed by a stabilization, indicating that the market is calming down after weeks of volatility. This stability could pave the way for a more balanced price action as ADA hovers around a key support level.

Coinglas data Which reinforces the unified narrative. ADA’s weighted open interest (OI) funding ratio decreased but remains positive. The low but positive funding ratio indicates that demand for ADA is slowing, but not to the point where the market is anticipating significant short selling.

In cryptocurrencies, when funding rates decline but remain in positive territory, the market consolidates instead of preparing for a sharp downward movement. This indicates that although ADA’s bullish momentum is slowing, there is still no significant bearish sentiment.

Related reading

If ADA can hold above current levels during this consolidation phase, it will indicate healthy price action. The key is whether the bulls can defend these levels, which could lead to a more sustainable rally in the coming weeks. Investors should monitor these indicators closely as the market tests the resilience of ADA.

ADA testing critical support

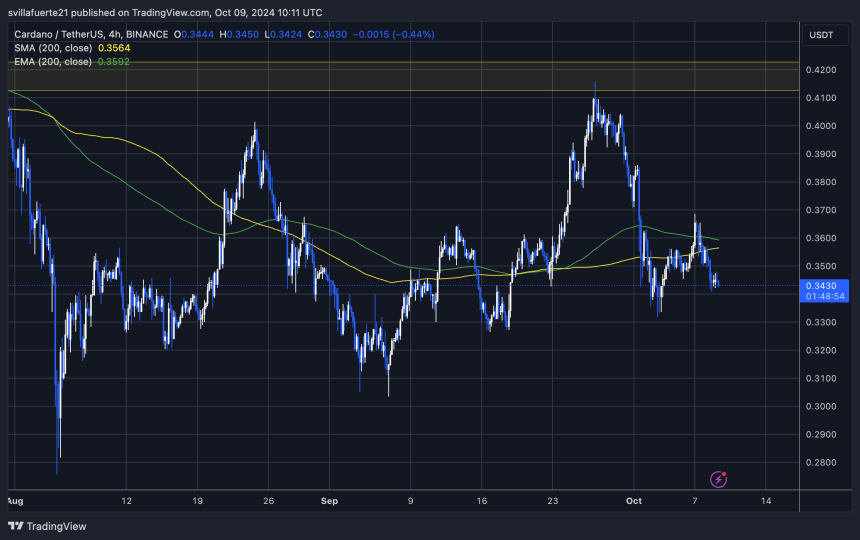

Cardano (ADA) is currently trading at $0.34 after failing to reclaim two crucial levels: the 4-hour moving average (MA) at $0.356 and the 200 exponential moving average (EMA) at $0.359. These indicators are crucial for ADA to regain upward momentum, and their rejection indicates potential weakness in price action.

Despite this, ADA remains firm above the key support level at $0.34. If this level is lost, the price could face a significant bounce, testing lower demand levels around $0.32 and possibly $0.30. This makes the $0.34 support crucial to maintaining the current market sentiment.

Conversely, if ADA can reclaim the 200 MA and 200 EMA over $0.36, it could pave the way for a rally towards higher resistance levels. The next important supply area to watch will be around $0.41, where more bullish momentum may be challenged next.

Related reading

The coming days will be pivotal for ADA as it consolidates and prepares for its next move. Investors closely watch these key technical levels to gauge the short-term direction of price action.

Featured image by Dall-E, chart from TradingView