On-chain data has provided insights into how Cardano (ADA) Investors It is likely to react to the recent surge in the price of the cryptocurrency. Cardano was one of the Leading Winners In the cryptocurrency market over the past seven days, with prices rising by more than 14% during this period.

Related reading

Cardano may face heavy selling pressure

Cardano may face High selling pressure From investors who recently entered the funds after the cryptocurrency price rose. Data from Santiment On-Chain Analytics Platform It shows that over 12% more of Cardano’s supply is now being converted into profits, which could pave the way for holders of these tokens to secure their profits, especially given Cardano’s unstable price action so far this year. Market cycle.

Despite recent price gains, Cardano has been one of the weakest performing coins since the start of the year and boasts a loss of over 35% since the beginning of the year. As such, Cardano holders Investors are likely to lock in their profits rather than cling to the belief that the recent price rally is a bullish reversal rather than a recovery.

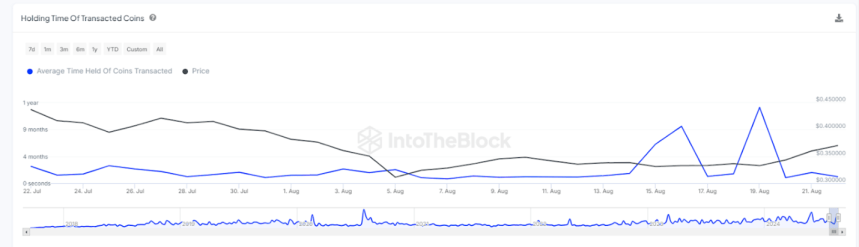

The recent trading pattern among Cardano holders also suggests that they are losing confidence in the cryptocurrency token and are likely to lock in their profits as soon as possible. Data from IntoTheBlock Market Intelligence Platform The data shows that the average holding period for coins traded in the past 30 days was 5 months, indicating that Cardano holders are dealing with their tokens on paper.

Meanwhile, other data from IntoTheBlock shows how many addresses could dump their tokens if Cardano holders start locking in profits. 481,370 ADA addresses bought the cryptocurrency between the $0.3 and $0.35 price range. This group of investors could be the first to start locking in profits, considering they could easily lose money if Cardano’s recent price surge is just a Relief bounce.

ADA Investors Guide

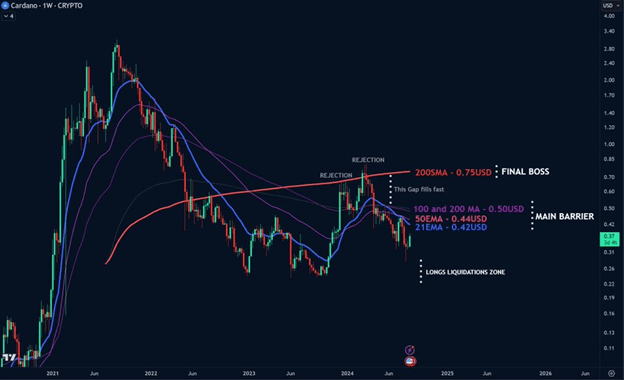

Cryptocurrency Analyst Trend Rider newly available A guide for Cardano holders, which he said they can use as a “master plan to stay calm and ignore the noise.” This guide came in the form of a chart that outlines key levels that holders of the coin should pay attention to and use to make a well-informed investment decision.

The analyst explained that the range between $0.22 and $0.31 is Filter areawhich offers Strong buy zone For those looking to add more to their positions, he also mentioned that Cardano’s main barrier area is between $0.42 and $0.55, indicating that this area is ideal for taking profits.

He added that Cardano could enjoy a quick rally to $0.75 if it breaks through this key barrier area. The analyst claimed that $0.75 is “a major last resistance and a prime place to take profits.” Those with more conviction in Cardano may want to hold the token for longer if it reaches $0.75. Trend Rider stated that a break above $0.75 would mean that the token is entering a bull market province.

At the time of writing, ADA is trading at around $0.379, up about 4% in the past 24 hours, according to Data From CoinMarketCap.

Related reading

Cover image from Dall-E, chart from Tradingview