Global bond markets witnessed heavy selling this week as investors worried about persistent inflationary pressures and heavy government borrowing.

Article content

(Bloomberg) — Global bond markets saw a selloff this week as investors worried about persistent inflationary pressures and heavy government borrowing.

Article content

Article content

The sell-off deepened in the $28 trillion U.S. Treasury market after a strong employment report boosted bets among Wall Street traders and economists that the Federal Reserve will hold off on further interest rate cuts. The latest bond turmoil in Britain has drawn comparisons to the 2022 mini-budget debacle by Liz Truss, while yields in Japan have risen to their highest levels in more than a decade.

Advertisement 2

This ad has not loaded yet, but your article continues below.

Article content

Here are some charts featured on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

world

The Treasury market is looking scary again, and politicians should take notice, as should everyone else. These sales are more complex and nasty than some. It is also not limited to the United States. Bond markets in major European economies are also testing the high reached in late 2023. There was a belief that interest rate cuts, made by all major central banks, would ensure that peak remained. The matter has now been called into question.

The American Port Workers Union has reached a tentative agreement on a new labor contract with a group of shipping companies and terminal operators, potentially easing global supply chain pressures that a World Bank gauge says are the worst since the pandemic.

United States and Canada

Last month, the US economy added the most jobs since March, and the unemployment rate unexpectedly fell, concluding a surprisingly strong year and supporting the case for a pause in the Federal Reserve’s interest rate cuts.

Long-term inflation expectations for US consumers have jumped to their highest levels since 2008 due to concerns about potential tariffs from the incoming Trump administration.

Article content

Advertisement 3

This ad has not loaded yet, but your article continues below.

Article content

A preliminary estimate of the financial impact of the Los Angeles fires ranks the incident among the costliest natural disasters ever in the United States, and likely the nation’s costliest wildfires ever. The disaster would likely cause damage and economic losses ranging from $52 billion to $57 billion, according to AccuWeather Inc.

The end of Prime Minister Justin Trudeau’s nine-year term largely reflects growing discontent over the cost of living and weak economic growth. Now, as Canada prepares for the era of Donald Trump, the Conservative Party is in a prime position to seize power and push the country away from the progressive policies that have defined Trudeau’s term.

Europe

Over the past few days, the UK’s long-term borrowing costs have risen and the pound has fallen – a rare combination that could indicate that investors have lost confidence in the government’s ability to control the national debt and control inflation. These events mirror the “nightmare” debt crisis of 1976 that forced the government to request a bailout from the International Monetary Fund, according to Martin Weil, a former interest rate-setter at the Bank of England.

Advertisement 4

This ad has not loaded yet, but your article continues below.

Article content

Eurozone inflation accelerated last month, supporting the European Central Bank’s gradual approach to lowering interest rates, without derailing them completely. This improvement will not be a surprise to the European Central Bank, which has repeatedly warned that the road back to its 2% target will be bumpy. It only expects to reach this milestone sustainably at the end of the year.

The ambition to turn Germany into a semiconductor superpower, described by insiders as personally driven by Chancellor Olaf Scholz, now looks increasingly hopeless. Germany’s attempt to reinvent itself as a semiconductor hub is part of a global race to win control of the oil of the digital age, the driving force behind future technologies such as artificial intelligence.

Asia

The Indian government has cut its economic growth forecast for the fiscal year to the weakest level since the pandemic, with economists saying even that forecast may be too optimistic. The Ministry of Statistics said that gross domestic product is expected to grow by 6.4% in the year to March, down from 8.2% in the last fiscal year.

Advertisement 5

This ad has not loaded yet, but your article continues below.

Article content

Investors in China’s $11 trillion government bond market have never been more pessimistic about the world’s second-largest economy, with some now betting on a deflationary spiral similar to what happened in Japan in the 1990s.

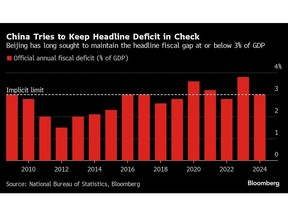

China said it has enough financial strength to respond to external challenges, and pledged to better implement pro-growth measures before Donald Trump returns to the White House later this month. Deputy Finance Minister Liao Min reiterated his pledge for a higher deficit-to-GDP ratio for 2025, adding that details will be announced after due process.

Emerging markets

The leaders of Malaysia and Singapore officially signed an agreement to create a special economic zone linking the border region between the two countries, with the aim of attracting 50 projects in the first five years of its establishment. Officials in Johor previously said they expect the region to create up to 100,000 new jobs and add $26 billion annually to the Malaysian economy by 2030.

Argentines are becoming more optimistic about the future of their country’s beleaguered economy, a shift that could embolden austerity-minded President Javier Miley ahead of midterm elections later this year.

—With assistance from Philip Aldrick, Ram Anand, John Authers, Ruchi Bhatia, Liz Cabo-McCormick, Finbar Flynn, Patrick Gillespie, Eric Hertzberg, Camille Qualci, Christina Kyriasoglou, John Liu, Lucille Liu, Brian Platt, Greg Ritchie, Yasufumi Saito, Augusta Saraiva Thomas Sale, Anisa Shukri, Brian K. Sullivan, Randy Thanthong Knight, Fran Wang, Alexander Weber, Guan Wong, and Yi Shih.

Article content