Business activity in the euro zone unexpectedly contracted this month, raising concerns about the outlook for the European economy and suggesting that the European Central Bank will need to be more aggressive with interest rate cuts.

Article content

(Bloomberg) — Business activity in the euro zone unexpectedly contracted this month, raising concerns about the outlook for the European economy and suggesting the European Central Bank will need to be more aggressive with interest rate cuts.

The euro fell to its lowest level since 2022 against the dollar after a weak purchasing managers’ measure for service providers and manufacturers. Political crises in Germany and France, as well as the threat of tariffs from Donald Trump’s presidency in the United States, also affected the currency.

Advertisement 2

This ad has not loaded yet, but your article continues below.

Article content

Here are some charts featured on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe

Business activity in the euro zone unexpectedly contracted in November, a sign of the damage caused by political chaos and growing disagreement over trade. The euro fell to its weakest levels since 2022 against the dollar as traders expected more interest rate cuts from the European Central Bank. The chance of a 50 basis point rate cut in December has risen to 50%, from around 15% at Thursday’s close.

UK inflation accelerated more than expected in October, far exceeding the Bank of England’s 2% target. Consumer price inflation rose 2.3% from a year earlier after a jump in energy bills. Services inflation – which is closely monitored by rate setters for signs of domestic pressures – remained high at 5%.

The euro zone’s main measure of wages jumped by the most since the single currency was introduced in 1999, complicating the European Central Bank’s plans to cut interest rates as inflation declines. Negotiated wages in the third quarter rose 5.4% from a year ago. This is up from 3.5% in the previous three months and was largely driven by Germany.

Article content

Advertisement 3

This ad has not loaded yet, but your article continues below.

Article content

A dormant stock market, a fragile currency, a crisis-plagued political system, a stagnating economy – this was the scene in Europe even before Donald Trump won the election in the United States. Now, the continent faces new trade tariffs against its largest companies and investment outflows, as Trump’s plans to cut taxes and regulate the gut make US stocks more attractive. Add to that growing anxiety about the upcoming snap elections in Germany and escalating tensions with Russia, and even the most optimistic investors are struggling to remain optimistic.

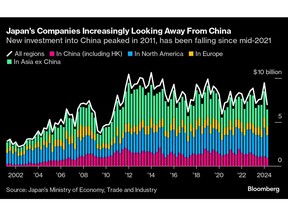

Asia

Japanese companies in China are becoming more pessimistic about the world’s second-largest economy, with about two-thirds of them saying the situation is getting worse, and about half of them reducing or stopping investments. About 64% of Japanese companies said the Chinese economy was performing worse than last year, according to the latest survey conducted by the Japan Chamber of Commerce and Industry in China.

South Korea’s household debt grew at the most pace in three years in the latest quarter, highlighting a development that kept the central bank from focusing on policy until last month. Mortgage loans, a key component of credit, also rose by the most since the third quarter of 2021.

Advertisement 4

This ad has not loaded yet, but your article continues below.

Article content

United States and Canada

The number of home starts in October fell to the slowest pace in three months as hurricanes exacerbated a decline in overall construction activity. Residential construction has struggled to gain traction this year on the back of a growing number of new homes for sale and mortgage rates approaching 7%.

Trump’s pledges of “fracking, fracking” are about to collide with a global crude oil glut that is finally set to squeeze record shale production.

Inflation in Canada rose more than expected and core price pressures accelerated again, hiccups that may dissuade policymakers from a second straight 50 basis point cut in interest rates next month. The first acceleration in headline inflation in five months may strengthen the Bank of Canada’s case for gradually lowering borrowing costs, after officials intensified the pace of easing in October.

Emerging markets

Years of hyperinflation are testing the physical limits of Turkey’s cash-focused economy, with the largest banknotes becoming increasingly insufficient to cover even daily spending. The highest value banknote, 200 lira ($5.80), now represents more than 80% of total cash in circulation, up from 16% in 2010, according to central bank data. Having lost almost all of its purchasing power, each bill was worth enough to buy two cups of filter coffee at Starbucks.

Advertisement 5

This ad has not loaded yet, but your article continues below.

Article content

Mexico’s inflation slowed in early November as the economy continues to lose momentum, giving the central bank room to cut interest rates for a fourth straight meeting next month.

world

Ukrainian forces earlier this week carried out their first strike on a border region in Russia using Western-supplied missiles, as President Vladimir Putin approved an updated nuclear doctrine that expands conditions for the use of atomic weapons. The news sent investors flocking to some of the world’s safest assets.

The Icelandic central bank accelerated its monetary easing campaign, while South Africa also cut interest rates. The Bank of Indonesia warned that there is less room to cut them. Hungary, Angola, Paraguay and Egypt maintained stable borrowing costs. Türkiye also held firm while implying that a cut may soon be justified due to slowing inflation.

—With assistance from Irina Angel, Alice Atkins, Maja Averbush, Tailan Bilgic, Kevin Crowley, Robert Jameson, Lucia Kasai, Sam Kim, Aliaksandr Kudritsky, James Major, Henry Meyer, Michael Messika, Tom Rees, Michael Sasso, Zoe Schneeweiss, Mark Schreurs, Patrick Sykes, Randy Thanthong Knight, Alex Vasquez and David Wyeth.

Article content