The US labor market has softened somewhat, but it still shows remarkable resilience even as other parts of the economy slow and OPEC+ announced a sudden cut in oil production.

Article content

(Bloomberg) — The U.S. labor market has softened somewhat, but it still shows remarkable resilience even as other parts of the economy slow and OPEC+ announced a sudden cut in oil production.

Advertising 2

This ad hasn’t been uploaded yet, but your article continues below.

Article content

An increase of 236,000 jobs for the month of March followed the strong advance in the past two months, and the US unemployment rate fell to near record lows. At the same time, annual wages rose at the slowest pace since June 2021.

Article content

While moderate wage growth should help the Fed fight inflation, developments outside the control of the US central bank, as well as its global counterparts, risk keeping price pressures high. OPEC+ members earlier in the week shocked the markets by announcing a cut in crude oil production in an effort to prop up prices.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

we

US payrolls rose at a steady pace last month with the unemployment rate again falling near record lows, paving the way for the Federal Reserve to increase interest rates at its next meeting. The numbers suggest that the supply and demand for workers are more in balance, which, if sustained, may help to further moderate wage gains.

Article content

Advertising 3

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Last week’s jobless claims indicated that the labor market was still relatively strong, though revisions to the data indicated some signs of abating. Initial jobless claims were 228,000 in the latest week. The government has also revised previous weeks’ figures.

The economies of nearly half of US states have barely grown or even shrunk since the pandemic, underlining the unevenness of the country’s recovery. GDP was lower in 2022 in eight states, including tourism-dependent Louisiana and Hawaii. Immigration shifts during the pandemic brought hundreds of thousands of people to Florida and Texas — which saw the second- and third-largest economic growth, respectively.

Advertising 4

This ad hasn’t been uploaded yet, but your article continues below.

Article content

world

Central bankers who have spent the past weeks puzzling over how the financial turmoil will affect their forecasts now have a jolt in the form of higher oil prices to consider. The production cuts announced by OPEC+ and the risk of a further increase in crude oil costs complicate the debate in Frankfurt, London and Washington about where inflation is headed and how much extra interest rates to bring it under control.

The Central Bank of Israel eased the pace of its monetary tightening, acknowledging potential risks to monetary policy from the government’s judicial plan. Sri Lanka kept interest rates steady after taking out a loan from the International Monetary Fund, while Australia, Romania, Chile, Poland and India left borrowing costs unchanged.

Advertising 5

This ad hasn’t been uploaded yet, but your article continues below.

Article content

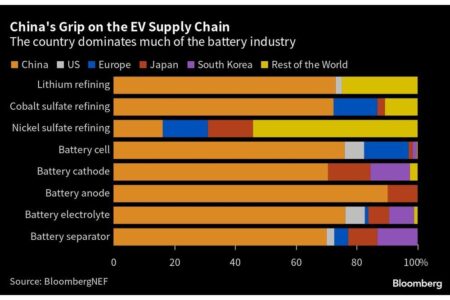

The US Treasury Department has released its long-awaited guidance to clarify who can benefit from tax subsidies for electric vehicles. Consumers can claim up to $7,500 in federal tax credits if they purchase a clean-energy vehicle that meets certain US rules regarding critical metals and battery components. The rules are broadly aimed at weakening China’s market power over raw materials such as lithium, cobalt, nickel and magnesium, which are key components of electric motors and batteries.

Asia

China’s manufacturing activity unexpectedly eased in March, a private survey showed, leading to a drop in factory metrics across Asia as the global economic outlook darkened.

Japan is preparing to sharply increase its spending on chip equipment in a bid to boost its position in the global semiconductor market, as it tightens exports amid a US-led push to curb China’s technological ambitions. Japan is expected to spend $7 billion on off-the-shelf equipment next year, which would be an 82% jump from this year — the largest in the world — according to data from SEMI, a global association of chipmaking equipment producers.

Advertising 6

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Europe

Europe’s battle with the worst cost-of-living crisis in a generation is far from over, and food is the latest focal point. Even as general inflation begins to ease, the upward pressure on food prices remains constant. This means that a large part of household spending, i.e. the weekly supermarket trip, is increasing more and more rapidly.

developing markets

The World Bank said in a report released on Tuesday that Latin America and the Caribbean will experience only modest growth this year as the region’s economies suffer from high interest rates and low commodity prices. The Washington-based organization forecasts that the regional economy as a whole will expand 1.4% through December, lagging behind all other regions.

Advertising 7

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Argentina is reinstating the temporary exchange rate for soybean exports in an elaborate attempt to shore up the central bank’s dwindling cash reserves and ease economic pain from the historic drought. It adds to the economy minister’s complex strategy to mitigate the effects of a looming recession this year with inflation soaring 100%.

—Assisted by Philip Aldrick, Bryce Bachuk, Maria Eloisa Capuró, Agnieszka de Souza, Ignacio Oliveira Dole, Patrick Gillespie, Mackenzie Hawkins, Michele Gamerescu, Sam Kim, Alessandra Milicchio, Augusta Saraiva, Zoe Schniewiss, and Craigzy Sterling.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation