Over the weekend, we got the official PMIs:

China Manufacturing PMI for August 49.1 (49.5 expected), Services 50.3 (50.0 expected)

More details:

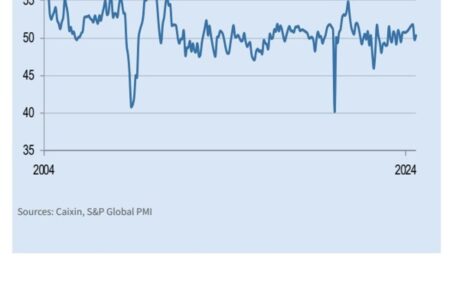

The Caixin S&P Global Manufacturing Purchasing Managers’ Index was much better, at 50.4.

From the report, in brief:

- Demand rose as total new orders resumed growth, with demand for intermediate goods increasing.

- Exports fell for the first time in eight months.

- Employment held steady after 11 months of contraction

- Input and output prices fell.

- Lower prices of raw materials such as industrial metals have led to lower input costs.

- Producer prices fell amid sales pressure, with the corresponding index hitting a four-month low.

—

There are two main PMI surveys in China – the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by media company Caixin and research firm Markit/S&P Global.

- The official PMI survey covers large, state-owned enterprises, while the Caixin PMI survey covers small and medium-sized enterprises. As a result, the Caixin PMI is considered a more reliable indicator of private sector performance in China.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a wider sample of companies than the official survey.

- Despite these differences, the two surveys often provide similar readings about China’s manufacturing sector.

- This will be followed by the Caixin Services Purchasing Managers’ Index (PMI) on Wednesday.