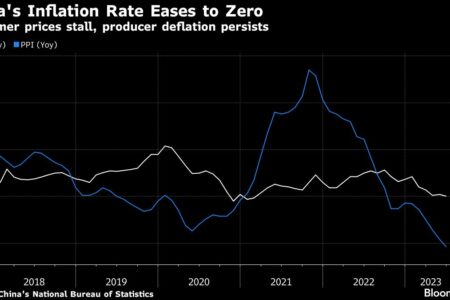

(Bloomberg) — China’s consumer price inflation was flat in June while factory gate prices fell further, fueling concerns about deflationary risks and increasing speculation about possible economic stimulus.

Most Read from Bloomberg

The consumer price index last month was unchanged from a year earlier — the weakest rate since prices fell in February 2021, according to data released by the National Bureau of Statistics on Monday.

Core inflation, which excludes volatile food and energy prices, slowed to 0.4% from 0.6%. Producer prices fell 5.4% from a year earlier, faster than the decline in May and the deepest pace since December 2015.

“The risk of deflation is very real,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd..

Both measures add to the evidence that the recovery is weakening, with concern about deflation weighing on confidence. This is likely to spur more speculation about what potential stimulus might be on the cards to support the economy.

“Today’s data definitely points to more policy easing, which policymakers are already doing, but only in a measured way,” said Michelle Lamm, Greater China economist at Societe Generale SA.

Producers have already spent months grappling with lower commodity prices and weak demand at home and abroad. If consumers and businesses continue to refrain from spending or investing in the hope of lower prices, this could lead to lower prices.

Hang Seng China Enterprises rose 2.4% on Monday, boosted by technology stocks as investors look for normalization in the country’s regulatory environment.

The CSI 300 index of mainland stocks rose as much as 1%, after three weeks of declines. The offshore yuan spent gains of up to 0.2% after the inflation data.

Pork prices were one of the main factors dragging consumer prices last month. The cost of meat – a staple of the Chinese diet – fell 7.2% in June from a year earlier. This was more than May’s 3.2% drop.

The government is trying to put a stop to the decline in pork prices, saying last week that it would buy more pork for state reserves to boost demand.

The deflation in producer prices was driven by the prolonged decline in international commodity prices. In a statement, National Bureau of Statistics statistician Dong Liguan noted continued declines in oil and coal costs, as well as a high base for comparison with last year.

What Bloomberg tells the economy…

Zero consumer price inflation and deep falls in producer prices in June suggest that China’s post-virus recovery has lost more steam. Momentum fluctuation on the price front is a sign of weak demand clouding growth expectations. The need for more stimulus from the People’s Bank of China is increasing.”

David Chu, economist

Read the full report here.

Despite growing calls for Beijing to take action to support the economy, most measures so far have been limited in scope. The central bank cut its main policy interest rate last month by a small amount, and the government expanded tax breaks for buyers of electric vehicles.

Premier Li Qiang last week spoke with some Chinese economists about the potential aid, though he stressed the policies would be “targeted, comprehensive and well-coordinated” — reinforcing expectations that the stimulus would not be huge in scale. One limiting factor: the high debt burden of local governments, which have traditionally been responsible for driving growth through more spending.

– With assistance from Yujing Liu, Tan Hwee Ann, Zhu Lin, and Ishika Mookerjee.

(Updates with more details.)

Most Read by Bloomberg Businessweek

© 2023 Bloomberg LP