China’s deflationary pressures just aren’t going away, underscoring the fragility of the economic recovery as 2023 enters the home stretch.

Article content

(Bloomberg) — China’s deflationary pressures just aren’t going away, underscoring the fragility of the economic recovery as 2023 enters the home stretch.

Data due Thursday will likely show Chinese consumer prices slid back into deflation in October, according to economists surveyed by Bloomberg. Producer prices also probably declined for a 13th consecutive month.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

Article content

Article content

Consumer costs have been stubbornly weak this year. The consumer price index slipped into deflation in July and has since been teetering on and off the edge of negative year-on-year growth. While the People’s Bank of China said in August that prices would rebound from the summer rough patch, another drop may prove that assessment was too optimistic.

Morgan Stanley sees China potentially facing a prolonged fight against falling prices in the next few years, writing recently that Beijing is “at the initial stage of the deflation battle” as it transitions away from an “overextended, credit-fueled growth model.”

Weak inflation figures would add more uncertainty to the nation’s growth outlook following an unexpected contraction in factory activity and slowing growth in the services sector in October.

“China’s consumption demand is still weak,” said Larry Hu, head of China economics at Macquarie Group Ltd. He said the nation’s widest measure of prices, the GDP deflator, will likely be negative in the final three months of the year. It’s already declined for two consecutive quarters for the first time since 2015, according to Bloomberg estimates based on official data.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Other reports due in the coming days may provide additional clues about the trajectory of the economic recovery. Export figures on Tuesday will likely show the drop narrowing in October on a yearly basis, though that’s partly because of a lower base of comparison with a month in 2022 when China was still grappling with pandemic-related lockdowns.

Credit data for last month may also be released, and will probably show overall financing picking up from a year ago as a deluge of government bonds hit the market.

Expectations are growing for the central bank to provide more liquidity support via a cut in the reserve requirement ratio — the amount of cash banks must keep in reserve. Some analysts predict the central bank may do so ahead of its monthly policy loan operations in the middle of November as a surge in government bond issuance pressures interbank liquidity.

What Bloomberg Economics Says:

“We expect mixed signals. Credit growth will probably show recent incentives are working to encourage borrowing. Trade looks set to shrink less than in the prior month, but this would be due to statistical base effects — not a sign of demand perking up at home or abroad. Consumer price inflation will probably stay close to zero.”

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

—For full preview, click here

Elsewhere, Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde are among policymakers from their institutions making dozens of public appearances. Central bankers in Australia are likely to hike interest rates, while those in Poland are expected to cut.

Meanwhile, Bloomberg’s New Economy Forum returns to Singapore Nov. 8-10 as some of the world’s most influential leaders gather to address critical issues facing the global economy. This year’s theme, “Embracing Instability,” focuses on underlying economic issues such as persistent inflation, geopolitical tensions, the rise of AI and the climate crisis. See what’s coming here.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US Economy and Canada

With a lighter-than-usual US data calendar, the focus will be on Fed chief Powell. The US central bank chief is participating in a panel discussion Thursday on monetary policy challenges in the global economy.

Other Fed officials, after leaving rates unchanged on Nov. 1, also return to the speaking circuit. After a weaker-than-expected October jobs report on Friday investors marked down the chances of a rate increase in coming months and boosted bets on an earlier cut next year.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Dallas Fed President Lorie Logan and Kansas City Fed President Jeffrey Schmid address an energy conference on Tuesday. Regional Fed bank heads Raphael Bostic and Tom Barkin will discuss survey data on Thursday.

Among economic releases in the coming week, the University of Michigan on Friday will issue its preliminary November consumer sentiment index. Economists will also watch a report Thursday on weekly jobless claims for additional signs of softness in the labor market.

Further north, the Bank of Canada will publish a summary of the deliberations that led to its decision to hold rates steady at 5% last month due to a slowing economy, despite increased inflation risks.

The central bank will also release two surveys: one querying market participants, which will shed light on expectations for Canada’s growth, and another that collects information about lending practices of financial institutions.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

The Reserve Bank of Australia is expected to raise its borrowing costs to a 12-year high of 4.35% on Tuesday as it ramps up the fight against inflation. The meeting comes amid pay talks at the central bank that could result in a first ever strike by staff there. The RBA will follow up with a monetary policy statement on Friday.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Bank of Japan Governor Kazuo Ueda may offer more clarity on the recent decision to allow more flexibility in bond yield movements when he speaks on Monday. Figures on wage growth, a key factor for nudging the BOJ closer to normalizing policy, come the following day with a summary of opinions expressed at the meeting due Thursday.

Elsewhere in the region, GDP figures for the third quarter are expected to show Indonesia’s economy slowed while output in the Philippines rebounded. Inflation numbers from Thailand, the Philippines and Taiwan are all expected to show price growth slowing.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

Germany’s economy is set for more dire readings, with factory output data Monday and industrial production figures Tuesday both predicted to show contractions in September.

Bundesbank President Joachim Nagel has been among the German officials pushing back against the country’s recent sick-man-of-Europe characterization, and given he’s due to make public appearances every day in the coming week, he’ll have ample opportunity to defend Europe’s biggest economy.

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

Markets will be more interested in Nagel’s views on the European Central Bank’s next steps and here he’s among a dozen Governing Council members — including President Christine Lagarde and Chief Economist Philip Lane — scheduled to speak.

The ECB also publishes its monthly survey of consumers’ inflation expectations.

A monthly meeting of European Union finance ministers in the second half of the week will discuss the EU’s deficit rules, which are supposed to come back in force as of 2024, though the rules themselves are up for review.

Poland, Romania and Serbia hold rate decisions. The former will probably cut its key rate by a quarter point, following a similar reduction in October. The other two are both likely to pause.

In the UK, numbers on Friday are likely to show that gross domestic product contracted in the third quarter. Bloomberg Economics expects this to mark the start of a recession. Bank of England Governor Andrew Bailey and Chief Economist Huw Pill are scheduled to speak.

Investors will be watching on Thursday to see if Egypt’s inflation slowed in October or quickened to another record high. The year-on-year rate was 38% in September, underscoring the country’s cost-of-living crisis. The central bank is under pressure to devalue the pound again — something which may push the inflation rate higher, at least in the short term — but is unlikely to do so before presidential elections in December.

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

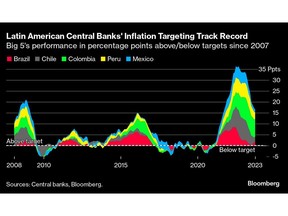

Four of the region’s big five economies — Brazil, Chile, Colombia and Mexico — report October inflation data.

With Brazil’s expected move back down after a three-month jump from 3.16%, disinflation will be once again underway in all five, though none are forecast to be back at target before the end of 2024.

Brazil’s central bank on Tuesday posts the minutes of its Nov. 1 decision to deliver a third straight half-point cut to 12.25%.

In the post-decision communique, policymakers stuck to their guidance calling for 50 basis-point reductions at upcoming meetings, while expressing wariness over a proliferation of economic headwinds and risks.

At its November meeting, Mexico’s central bank is all but certain to hold the key rate at 11.25% amid robust economic growth and above-target inflation.

Banxico is expected to be the last of the region’s big five inflation targeting central banks to begin cutting interest rates; one board member has suggested they may not move until mid-2024.

By contrast, Banco Central de Reserva del Perú began easing in September and a third straight quarter-point cut to 7% is the consensus call after consumer prices fell in October.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

—With assistance from Laura Dhillon Kane, Vince Golle, Paul Jackson, Robert Jameson, Andrew Langley and Paul Wallace.

Article content

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.