Large-cap and mega-cap stocks have performed well in 2024. Retail giant Costco (NASDAQ: COST) The company’s stock, up 32% year-to-date, didn’t miss the party. The membership warehouse club chain is gaining market share in the U.S. and is seeing strong growth across its in-person and online operations, impressing investors.

At $863 per share at the time of writing, the stock could be a candidate for a split in the future. Will the stock hit $1,000 by the end of the year, and is it a good buy at these prices? Let’s find out.

Strong growth and rising prices coming?

The COVID-19 pandemic has been a boon for retailers like Costco. Revenue growth has accelerated, pushing annual sales from $150 billion to $200 billion in just a few years. But unlike other retailers, Costco hasn’t seen the pandemic impact growth. In fact, the company has continued to grow strongly and recently surpassed $250 billion in annual sales.

This was followed by net profit with earnings per share (Earnings per share) nearly 100% in the past five years. That strong growth has investors speculating that Costco’s membership program will soon see price increases. Membership currently costs $60 or $120, depending on the tier. There are more than 100 million members, and the company hasn’t raised its membership price since 2017. Costco typically raises membership fees every five years or so, meaning the company is behind on price increases.

And thanks to the high profit margins on the memberships themselves, the higher prices could help Costco continue to grow earnings per share over the next five years as well.

Forget $1,000 per share – focus on valuation instead

It would take a 16% rise in Costco’s stock price to break into the four-figure area, and since the stock has already risen by twice that amount in the first half of 2024, I have no doubt that Costco could break $1,000 before the end of the year.

Such a high stock price also makes Costco a candidate for a stock split. Investors have recently seen Nvidia And Chipotle The company is going through this process, and Costco’s last stock split was in 2000.

But investors shouldn’t focus on either of these things. Stock splits don’t matter in the long run. Stock splits simply mean there are more shares of the same company available on the market. The actual stock price doesn’t matter; what matters is the valuation.

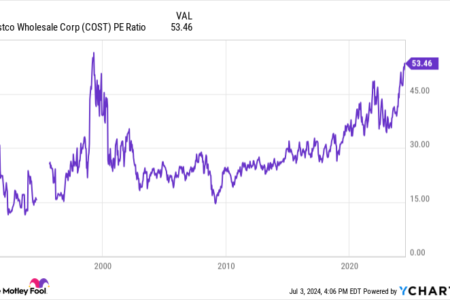

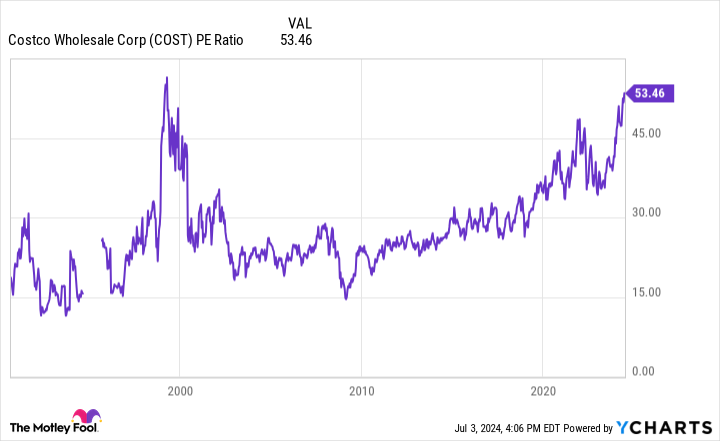

Costco’s value has been steadily rising for years. It currently has a price-to-earnings ratio of 53, which is close to an all-time high and well above its long-term average of 27.

At these levels, investors have very high expectations for Costco’s future growth.

Avoid Costco Stock (For Now)

Costco is a great company. Even with $250 billion in sales over the past 12 months, the company managed to grow comparable sales by 6.5% in the third quarter of fiscal 2024 (ended May 12). E-commerce sales were up 20.7% year over year. Earnings are expected to continue to rise as well, thanks to its track record of slow and steady growth.

But here’s the problem: slow and steady. Costco isn’t a fast-growing stock, but it’s valued at a P/E ratio of over 53.

Forget stock splits. Forget the possibility of stocks hitting $1,000 in the near term. It doesn’t matter how great a company is if you have to pay a hefty premium to buy it: price matters.

Should You Invest $1,000 Into Costco Wholesale Right Now?

Before you buy shares in Costco Wholesale, keep the following in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are 10 stocks available for investors to buy right now… and Costco Wholesale isn’t one of them. The 10 stocks that hit this mark could deliver massive returns in the years to come.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $771034.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of July 2, 2024

Brett Shaffer The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Costco Wholesale, and Nvidia. The Motley Fool has Disclosure Policy.

Costco Stock Up 32% in 2024: Could the Stock Split Candidate Hit $1,000 by Year-End? Originally posted by The Motley Fool