Organizations around the world rely on cybersecurity to protect against hackers. The extent of that reliance became clear on July 19 when the cybersecurity firm updated its software Crowd Strike (NASDAQ: CRWD) The app contained a bug, causing widespread disruptions to many businesses, including airlines, hospitals and banks.

The unexpected incident sent CrowdStrike shares down 11% on the day of the outage. Since then, the stock has continued to slide, falling below $270 at the time of this writing, well below its 52-week high of $398 on July 9. Is this a buying opportunity for the stock?

Or would it be better to buy shares in a CrowdStrike competitor, such as Palo Alto Networks (NASDAQ: PANO)The stock price has surged in the wake of the failed CrowdStrike update. Let’s compare the two cybersecurity companies to determine which is the better investment.

CrowdStrike Evaluation

While the CrowdStrike outage on July 19 is an embarrassment for the company right now, what matters most in an investment decision is how well the company performs over the long term. Based on its results so far this year, a case can be made for long-term investors to take advantage of the current share price crash and buy.

One reason for this is CrowdStrike’s massive revenue growth. In its first fiscal quarter ended April 30, the company generated $921 million in sales, up 33% year over year.

One factor that has contributed to CrowdStrike’s revenue growth has been customer adoption of multiple cybersecurity solutions from the company. Its software platform offers add-ons beyond basic monitoring, such as requiring security personnel to proactively scan for cyber threats. In the first quarter, 65% of customers adopted five or more of these add-ons, and deals with eight or more add-ons grew 95% year-over-year.

In addition to its impressive sales growth, CrowdStrike has financial strength. The company has achieved a record free cash flow Free cash flow (FCF) was $322 million in the first quarter of the fiscal year, representing a 42% increase year-over-year.

The company exited the first quarter with an excellent balance sheet, with total assets of $6.8 billion and cash and cash equivalents alone of $3.7 billion.

Total liabilities were $4.3 billion, of which $3.1 billion was deferred revenue. This deferred revenue represents payments received from customers that will ultimately be recognized as income once CrowdStrike has fulfilled its contractual obligations.

Palo Alto Networks Case

While CrowdStrike has performed well so far, so has its competitor Palo Alto Networks. In its fiscal third quarter, ended April 30, Palo Alto Networks saw revenue rise 15% year over year to $2 billion.

Additionally, the company generated free cash flow in the third quarter of the fiscal year of $492 million, up from $401 million in the prior year. The company’s balance sheet at the end of the third quarter was exceptional with total assets of $17.9 billion and cash and cash equivalents of $1.4 billion. Total liabilities were $13.5 billion, including $10.2 billion in deferred revenue.

As part of a plan to grow its business, the company introduced New strategy This year. The plan encourages customers to consolidate their cybersecurity spending from multiple vendors to Palo Alto Networks. And so far, the results suggest the strategy is working.

In the third quarter of the fiscal year, the number of accounts that spent more than $1 million with the company increased 22% year-over-year, while the number of accounts that spent more than $10 million increased 28% year-over-year.

CEO Nikesh Arora highlighted how a company dissatisfied with its current cybersecurity provider chose Palo Alto Networks because of its “ability to deliver unified capabilities through a platform across half a dozen domains.”

Choosing between CrowdStrike and Palo Alto Networks

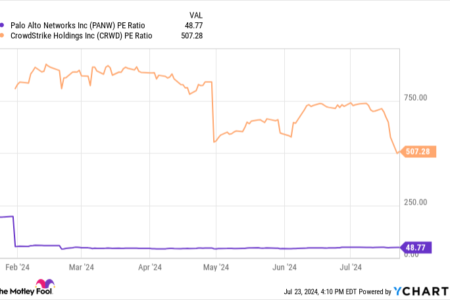

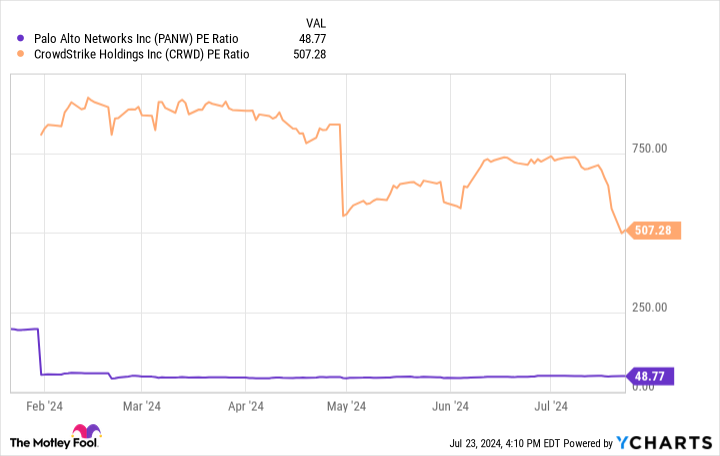

Both CrowdStrike and Palo Alto Networks have performed impressively this year, so another factor to consider when choosing between these two stocks is valuation. The price-to-earnings (P/E) ratio is a commonly used metric for this purpose.

CrowdStrike’s price-to-earnings ratio is about 10x higher than Palo Alto Networks’, even after its stock price plunged due to the outage on July 19. This suggests that Palo Alto Networks’ stock is better valued.

The combination of the company’s strong valuation and performance in fiscal 2024 makes Palo Alto Networks stock a compelling investment. Additionally, the long-term consequences of the failed CrowdStrike software update are unclear at this time.

As a result of the July 19 outage, some Wall Street analysts downgraded CrowdStrike’s stock. “There will likely be a negative impact on the company’s business from the disruption that CrowdStrike has caused around the world, even if it is temporary,” said John DeVucci of Guggenheim.

DeVucci has a point. In fact, Tesla The company’s CEO, Elon Musk, announced that he had stopped using CrowdStrike after a problem emerged in its software.

Considering all these factors, the best stock to buy right now in this competition between cybersecurity giants is Palo Alto Networks.

Should you invest $1,000 in CrowdStrike now?

Before you buy shares in CrowdStrike, keep the following in mind:

the Motley Fool Stock Advisor The team of analysts has just identified what they believe to be Top 10 Stocks There are plenty of companies investors can buy right now… and CrowdStrike isn’t one of them. These 10 stocks that are hitting the mark could deliver massive returns in the years ahead.

Think about when Nvidia I made this list on April 15, 2005… If you invested $1,000 at the time of our recommendation, You will have $692,784.!*

Stock Advisor It provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has More than four times S&P 500 Index Return Since 2002*.

*Stock Advisor returns as of July 22, 2024

Robert Izquierdo The Motley Fool has positions in and recommends CrowdStrike, Palo Alto Networks, and Tesla. The Motley Fool has positions in and recommends CrowdStrike, Palo Alto Networks, and Tesla. Disclosure Policy.

Better Cybersecurity Stock: CrowdStrike vs. Palo Alto Networks Originally posted by The Motley Fool