CRUDE OIL ANALYSIS & TALKING POINTS

- OPEC+ decision to extend cuts unable to bolster crude oil prices.

- Potential USD rebound may hinder crude oil bulls.

- Bearish signals could see crude oil prices breakdown further.

Elevate your trading skills and gain a competitive edge. Get your hands on the CRUDE OIL Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free Oil Forecast

CRUDE OIL FUNDAMENTAL BACKDROP

WTI crude oil and Brent crude oil prices faded after much anticipation created by OPEC+ postponing their meeting around production cuts due to disagreements with certain African nations. Eventually, the announcement revealed voluntary cuts by selected members led by Saudi Arabia resulting in roughly 2.2 million bpd. The inability to unanimously agree has brought into question the organizations efficacy and cohesion. The alliance has subsequently revealed that Brazil (South America’s largest producer) will join OPEC in January 2024 although no further details were given.

Forecasts of a possible surplus in 2024 contributed to the decision by OPEC and with the new extended cuts in place, this may significantly reduce this excess.

From a USD perspective, the week ahead is relatively light yet hard hitting in terms of data releases. Firstly, the ISM services PMI report is expected to tick higher – a print that is key to the US economy being primarily services driven. Rounding off the week, Non-Farm Payroll (NFP) will provide more information as to the state of the US job market. Considering the greenback is trading at multi-month lows, it may be time for some dollar strength that could weigh negatively on crude oil.

ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

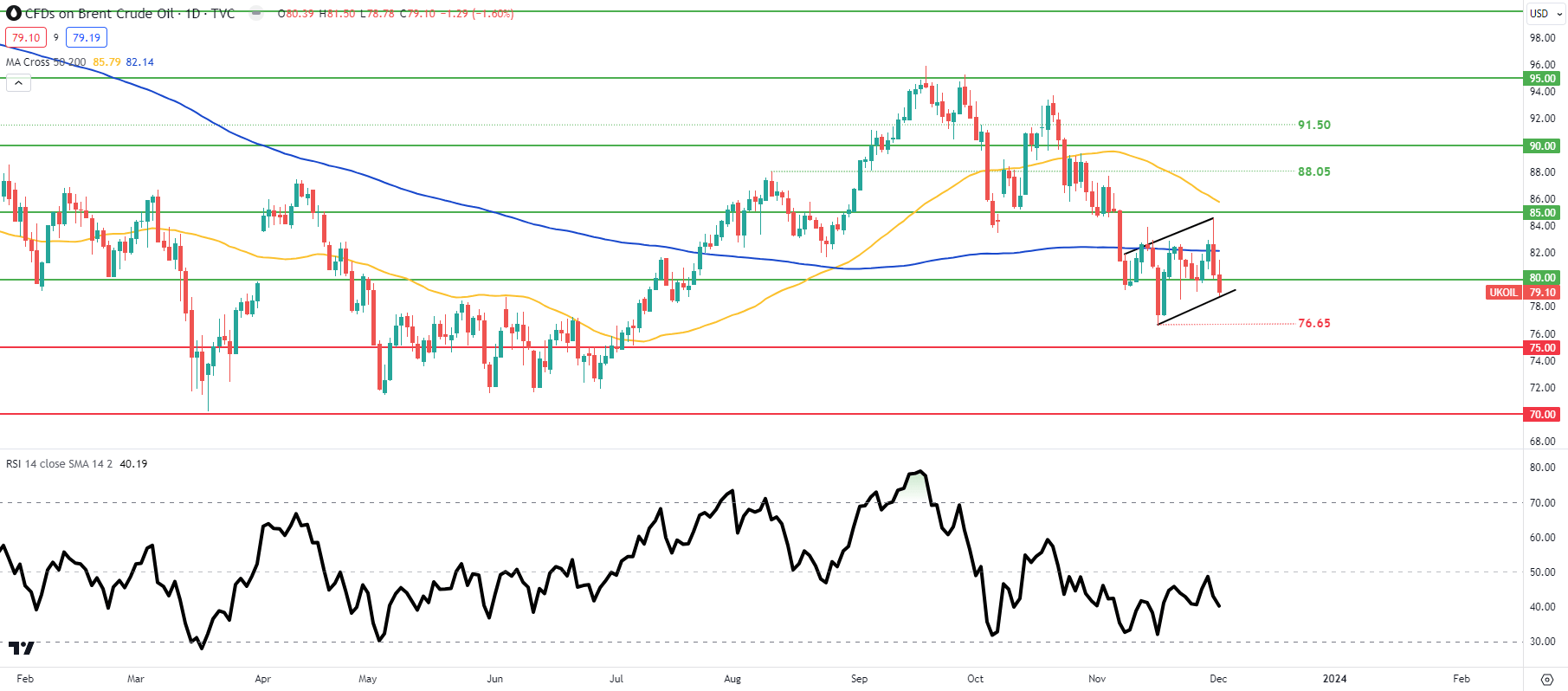

Both Brent crude and WTI daily charts below exhibit similar chart patterns in the form of a bear flag formation (black). Bears closed the prior week around flag support threatening a breakout lower. The weekly candle close further supports a bearish bias due to its upper long wick that could quickly bring into attention subsequent support zones.

ICE BRENT CRUDE OIL DAILY CHART

Chart prepared by Warren Venketas, TradingView

Key resistance levels:

Key support levels:

WTI CRUDE OIL DAILY CHART

Chart prepared by Warren Venketas, TradingView

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: MIXED

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas