The last trading day of the month was a busy one for data traders as they priced in new updates from around the world.

What headlines have moved major assets in recent trading sessions?

We have a list for you:

headlines:

Price movement in the broad market:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Treasury Yield, Bitcoin Chart by TradingView

The day began with core inflation slowing in Australia in June, dampening hopes of a rate hike by the Reserve Bank of Australia. Then weaker-than-expected manufacturing and services PMIs in China raised concerns about global growth, at least until the Bank of Japan surprised everyone with a 15bp rate hike.

The Bank of Japan not only raised interest rates to their highest levels since 2008, but also voted to reduce bond purchases by 3 trillion yen by the first quarter of 2026.

The headlines continued during the European session. A Hamas leader was assassinated in Tehran, raising fears of an escalation in the conflict in the region and sending crude oil prices higher. Eurozone inflation remained stubbornly high, raising doubts about the European Central Bank’s plans to cut interest rates.

In the US, it was all about the Fed cutting rates. Weak ADP data and the Fed hinting at a possible rate cut in September boosted risk appetite. Strong earnings reports from the Middle East and Africa and a rebound in the tech sector also fuelled US stocks higher.

US stocks saw sharp gains, while the 10-year US Treasury yield fell from 4.15% to 4.03%. Gold, a popular counterpart to the US dollar, rose to $2,450, while WTI crude traded above $78.50. Interestingly, Bitcoin (BTC/USD) failed to catch the risk-on rally, falling from $66,800 to just under $65,000.

Forex Market Behavior: US Dollar vs Major Currencies:

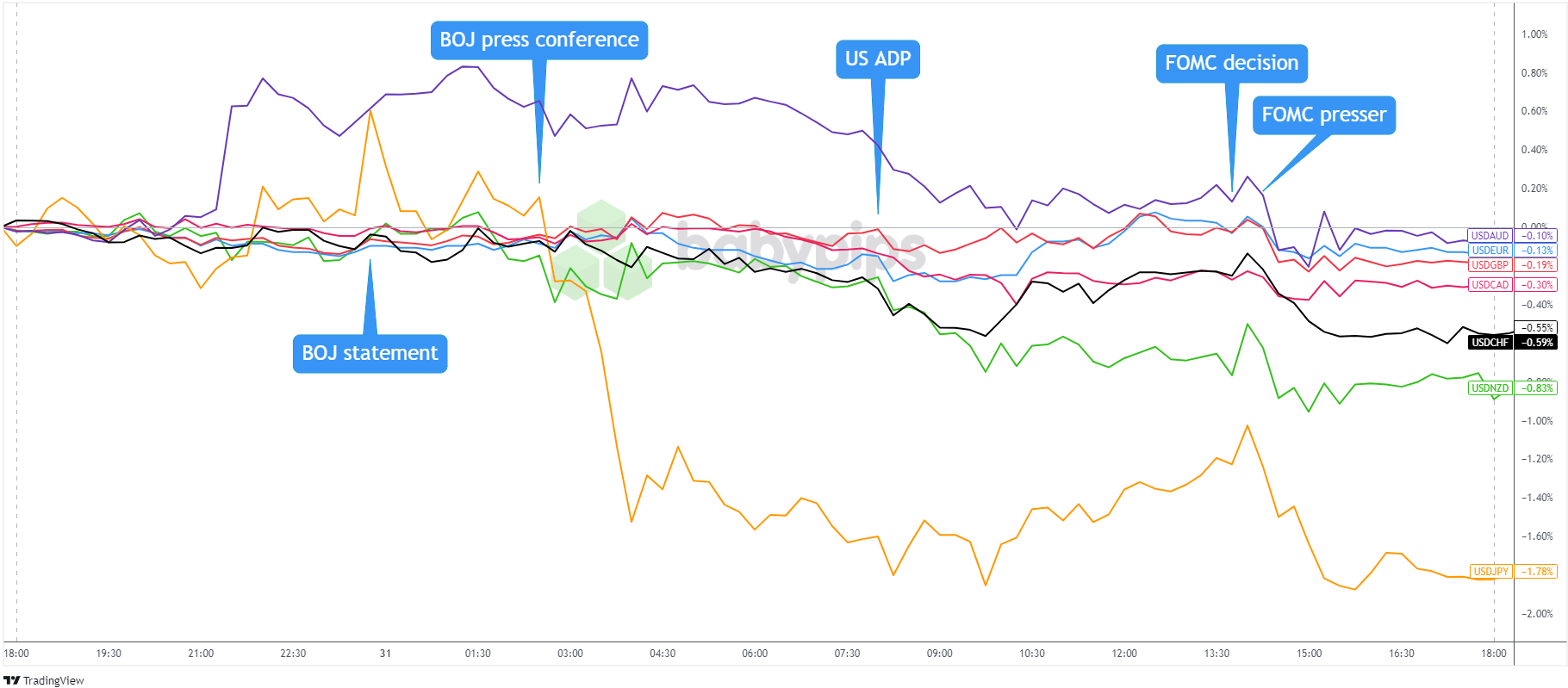

US Dollar Overlay Against Major Currencies Chart by TradingView

As was the case the day before, the US dollar traded mostly as a counter-currency early in the day. It made sharp gains against the Australian dollar following softer core CPI readings in Australia and weak PMI reports from China. It also lost some points against the Japanese yen after the Bank of Japan’s surprisingly hawkish policy adjustments.

The US dollar saw more consistent price action in the US session, which prompted bearish pressures after weaker-than-expected US ADP jobs data and quarterly labor cost index.

The downtrend took a breather ahead of the FOMC decision but quickly regained its downward momentum when Fed members appeared more willing to cut interest rates in September.

The US dollar posted broad daily lows and ended the day in the red against its major counterparts.

Potential catalysts coming up on the economic calendar:

- UK House Price Index at 6:00am GMT

- Spain Manufacturing PMI at 7:15 am GMT

- Italy Manufacturing PMI at 7:45 am GMT

- France Final Manufacturing PMI at 7:50 AM GMT

- Germany Final Manufacturing PMI at 7:55 AM GMT

- ECB Economic Bulletin at 8:00 am GMT

- Eurozone Final Manufacturing PMI at 8:00 AM GMT

- Eurozone unemployment rate at 9:00 am GMT

- Bank of England Policy Decision at 11:00 AM GMT

- Bank of England Governor Bailey to speak at 11:30am GMT

- Challenger job cuts at 11:30am GMT

- US Weekly Initial Jobless Claims at 12:30 PM GMT

- US Nonfarm Labor Productivity and Labor Costs Quarterly at 12:30 PM GMT

- Canada Manufacturing PMI at 1:30 PM GMT

- S&P US Final Manufacturing PMI at 1:45 PM GMT

- US ISM Manufacturing PMI at 2:00 PM GMT

Markets are set to witness another busy day with a batch of manufacturing PMIs due out.

The Bank of England (BOE) is also likely to steal the show during the European session as some traders see the central bank cutting interest rates for the first time since March 2020.

In the US, manufacturing PMIs are expected to mix with labour market reports to either strengthen or weaken assumptions around the US non-farm payrolls report due on Friday.

Keep your eyes glued to the tube!