Global assets returned to trading everywhere on Thursday, as individual catalysts pushed them higher.

In the US, mixed labor market updates led to a volatile trading environment and ultimately a weaker US dollar.

How did your favorite assets trade yesterday? We have the details!

Headlines:

- Average cash income in Japan Down from 4.5% to 3.9% y/y vs. 3.6% expected; Real wages rose for second straight month by 0.4%

- In his speech, Reserve Bank of Australia Governor Bullock He believes that “It is too early to think about cutting interest rates,“He added that the council does not expect that to be”In a position to cut interest rates in the near term.“

- unemployment rate in switzerland It settled at 2.5% as expected in August.

- Factory orders in Germany Growth slowed from 4.6% month-on-month in June to 2.9% month-on-month in July.

- S&P Global UK Construction PMI Down from 55.3 to 53.6 (54.6 expected) in August; “Employment levels broadly unchanged”, “Employment figures remain stagnant”

- Eurozone Retail Sales It rose 0.1% on a monthly basis as expected in July, and the decline in June was revised down from -0.3% to -0.4%.

- Challenger, Gray, and ChristmasLayoffs at U.S.-based companies showed their highest total in August since 2009 while hiring fell to a new record low

- US ADP Non-Farm Employment Change August: 99K (144K expected, 111K previously); July additions revised down from 122K

- Initial Claimants for Unemployment Benefits in the United States Decreased from 232K to 227K (231K expected) in the week ending August 31

- US Non-Farm Productivity Revised upward from 2.3% QoQ to 2.5% QoQ (2.4% expected) in Q2 2024; unit labor costs Decreased from 0.9% QoQ to 0.4% QoQ (0.8% expected)

- S&P Global US Services PMI Final For August: 55.7 (55.0 expected, 55.2 prior); “Selling price inflation falls to lowest in seven months”; “Employment falls for first time in three months”

- ISM PMI Services August reading selected: 51.5 (51.3 expected, 51.4 prior); Employment index down from 51.1 to 50.2; Price index up from 57.0 to 57.3

- Reuters quoted three sources as confirming that: OPEC+ agrees to postpone planned oil output increases For October and November

- Crude Oil Inventory from the US Energy Information Administration It reflected a decline of 6.9 million barrels in the week ending August 30, which was more than the expected decline of 0.6 million barrels and a decrease of 0.8 million barrels from the previous week.

Price movement in the broad market:

Dollar Index, Gold, S&P 500, Oil, 10-Year US Treasury Yield, Bitcoin Chart by TradingView

Major assets danced to their own tune again on Thursday, as traders reacted to specific reports and remained cautious ahead of key U.S. labor data.

Asian markets were influenced by the prevailing trends in the United States, which led to a decline in Bitcoin, oil and stock futures, while bonds and gold remained stable. Europe added some volatility with the release of mixed economic data.

Volatility was more chaotic during the US session when mixed US labor market updates encouraged a volatile trading environment. US 10-year bond yields hit 2024 lows as bond traders shifted from pricing in lower inflation to flight to safety while gold revisited all-time highs near $2,525.

US stocks ended the day mixed, with the S&P 500 and Dow Jones closing lower, while the Nasdaq ended the day higher. Bitcoin retested its weekly lows below $56,000, while WTI crude, boosted by OPEC and EIA updates, closed lower below $69.50.

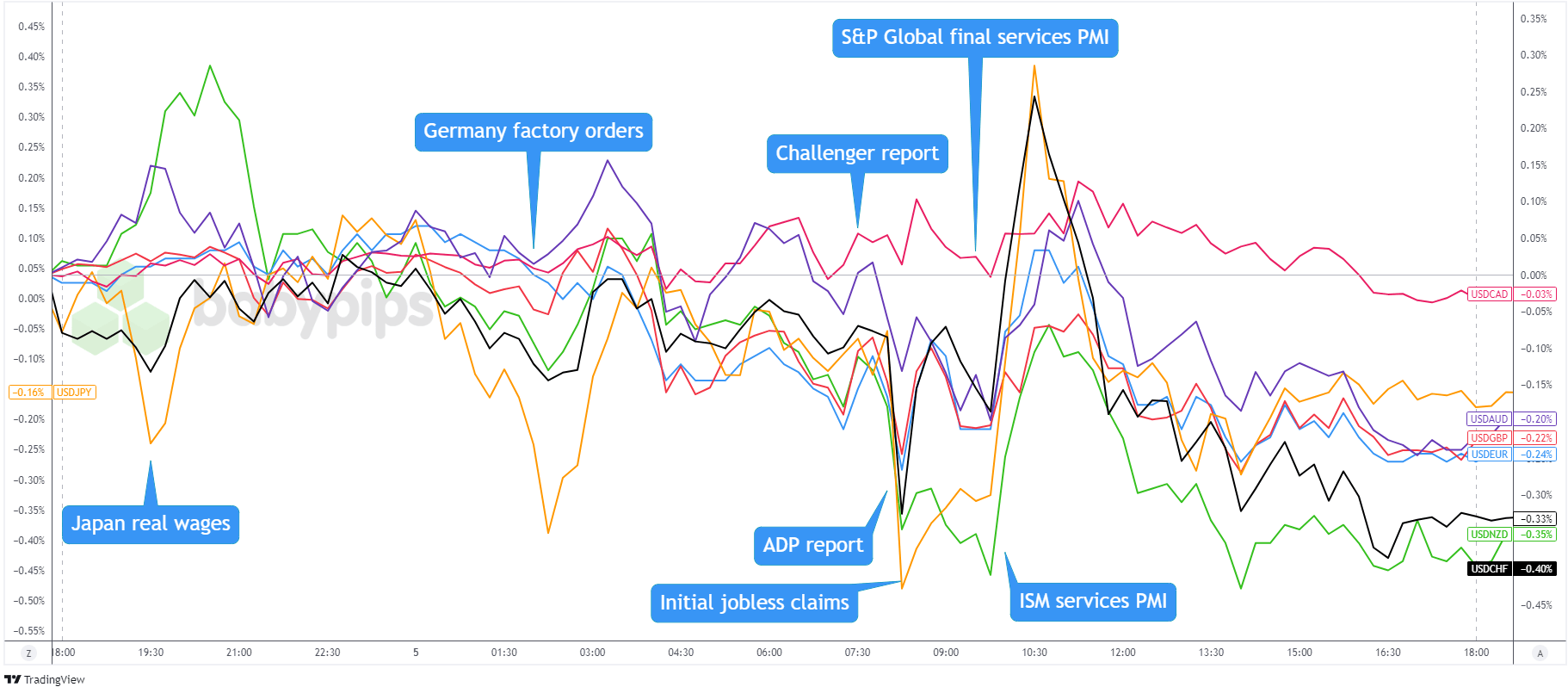

Forex Market Behavior: US Dollar vs Major Currencies:

US Dollar Overlay Against Major Currencies Chart by TradingView

The US dollar fell again as traders digested mixed signals from the labor market, while others awaited Friday’s big nonfarm payrolls report.

The day started mixed for the US Dollar, with USD/JPY, AUD/USD and NZD/USD volatile on the back of rising real wages in Japan and hawkish comments from Reserve Bank of Australia (RBA) Governor Bullock.

The dollar took a bigger hit in European trading as caution grew ahead of U.S. data. With weak employment figures and high layoffs, the dollar fell, although jobless claims and the services PMI provided some relief.

The dollar saw a fresh downward wave towards the end of the European session, perhaps as traders took profits or stayed on the sidelines waiting for higher level updates on Friday.

Potential catalysts coming up on the economic calendar:

- Germany Industrial Production at 6:00 AM GMT

- German Trade Balance at 6:00 am GMT

- Halifax UK House Price Index at 6:00am GMT

- France Industrial Production at 6:45 am GMT

- French Trade Balance at 6:45 am GMT

- SECO Swiss Consumer Climate Index at 7:00 am GMT

- Italy Retail Sales at 8:00 AM GMT

- Eurozone GDP Revised at 9:00 AM GMT

- Final quarterly change in employment in the euro area at 9:00 am GMT

- US Non-Farm Payrolls Report at 12:30 PM GMT

- Canada Labour Market Figures at 12:30 PM GMT

- Canada IVEY PMI at 2:00 PM GMT

Traders are looking forward to a busy day of non-farm payrolls data! Germany may start the party with a manufacturing update, followed by final Eurozone GDP and employment numbers.

In the US, traders will be closely watching August labor market figures for clues on how aggressive the Federal Reserve might be when it cuts interest rates later this month.

Canada could also cause increased volatility for CAD pairs with the release of economic labor market data and the IVEY PMI report.

I wish you good luck and happy trading on your last trading day of the first week of September!

Don’t forget to check out our new Forex Correlation Calculator!