Nvidia The AI company has dominated the AI narrative in the stock market, capturing investor and media attention after rising 2,190% over the past five years and briefly becoming the most valuable company in the world (it currently ranks second).

However, Nvidia is not the only opportunity in the field of artificial intelligence or semiconductors. In fact, one chipmaker just reported 400% year-over-year data center revenue growth and 84% overall revenue growth to $8.7 billion in its latest earnings report (for the quarter ending November 28).

I’m talking about him Micron technology (NASDAQ: MU)which specializes in memory chips, has surprisingly declined by 44% from its recent peak, despite this tremendous growth. This discount and its AI potential make the stock an attractive buy right now. Let’s review the company’s recent results first and then get into a buy mode.

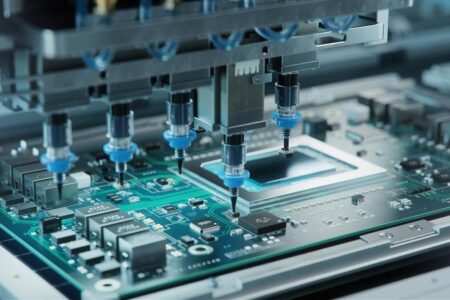

Micron is a leading manufacturer of memory chips, including DRAM, NAND, and high-bandwidth memory (HBM). The company is also an integrated device manufacturer, meaning it designs and manufactures its own chips Intel and Samsung He does.

Memory chips are a highly cyclical business, vulnerable to price fluctuations and industry exuberance, and having its own foundries makes Micron more vulnerable to the boom-and-bust cycle of semiconductors. Operating a foundry requires a high level of capital, but the integrated business model allows the company to obtain better profit margins when the business is performing well.

The chart below, which shows Micron’s price compared to its previous high, gives an idea of how volatile the stock is. As you can see, over the past decade, the stock fell 40% or more on four occasions before hitting a new all-time high.

Cyclicality and volatility are part of the risks of investing in Micron, but there’s no doubt about it Semiconductor sector The industry is experiencing a boom right now, driven by the explosive growth of artificial intelligence, although some subsectors such as computers and smartphones are weaker. In addition to Nvidia’s tremendous growth, it has become an industry leader Taiwan Semiconductor Manufacturing Co., Ltd Revenue was recently reported to have grown 36% in the third quarter to $23.5 billion, showing strong growth in the sector.

Pointing to strong demand for artificial intelligence, management said data center revenue exceeded 50% of total revenue for the first time this quarter, following the path Nvidia first started in the chip business. This now makes the vast majority of Micron’s revenue from the data center, where its AI computing is done.

After reporting fiscal first-quarter earnings on Wednesday, Micron stock fell as much as 19% on Thursday on its weak second-quarter guidance. However, the company has a history of being conservative in its guidance, and the weakness has been due to consumer markets such as smartphones, while its artificial intelligence business remains strong.

HBM, the segment closely linked to AI, is seeing impressive growth. The company said it is on track to meet its HBM target for the fiscal year and reach a “significant record” in HBM revenue, including “significantly improved profitability and free cash flow” in the fiscal year.

Micron expects revenue and adjusted earnings per share (EPS) to decline sequentially in the second quarter, falling from $8.7 billion to $7.9 billion, and for adjusted EPS to decline from $1.79 to $1.43.

However, management’s explanation for the weak outlook should reassure investors. CEO Sanjay Mehrotra said the company had previously warned that seasonal and customer inventory discounts in consumer-facing segments such as smartphones would impact second-quarter results. “We are now seeing a more pronounced impact of customer inventory reductions,” he added. “We expect this adjustment period to be relatively short and expect customer inventories to reach better levels by the spring, enabling stronger shipments in the second half of the year.” Finance and Calendar 2025.”

In other words, the issues causing weak Q2 guidance appear to be more of a speed bump for the company rather than a sustainable headwind, and management expects a return to sequential growth in the second half of the year. The stock’s 17% decline on a one-time guidance cut seems like a misread by the market and a buying opportunity for investors.

Short-term news-driven sell-offs are often a good buying opportunity, but there’s more to the case than that if you buy Micron. Micron is clearly benefiting from the AI boom with data center revenues soaring, and with its largest customer, believed to be Nvidia, now making up 13% of its revenues. The close relationship with Nvidia is clearly a helpful force at this stage of the AI boom, as Nvidia just reported 94% growth in its revenue year-over-year in its third-quarter report.

Micron’s results are notoriously lumpy and cyclical, but it has the potential to generate huge profits under the right circumstances – and these profits appear to be shaping up as the AI boom unfolds. For example, Micron expects the addressable market for HBM to jump from $16 billion in 2024 to $64 billion in 2028 and to $100 billion in 2030. Even if it maintains market share in this segment, HBM’s own revenues It will increase four-fold in four years. years, 6x and six years.

Finally, Micron stock is also significantly cheaper than its AI and chip stock peers, as it trades at a price Forward price Of only 10 based on this year’s estimates. While these estimates are likely to fall below their guidance, Micron still looks like a bargain at anything close to that price.

Micron investors should watch the chip and AI cycle closely, but there’s plenty of upside potential in the stock. A return to its peak this summer would mean a 75% jump for the stock, and shares could continue to rise over the next year or two, especially if they continue to see strong data center growth.

Micron is the rare AI stock that offers fast growth and good value right now.

Have you ever felt like you’ve missed out on your most successful stock buying journey? Then you’ll want to hear this.

On rare occasions, our team of expert analysts issues a “Double Bottom” stock. Recommendation of companies they think are about to emerge. If you’re worried about missing your opportunity to actually invest, now is the best time to buy before it’s too late. The numbers speak for themselves:

-

Nvidia: If you invested $1,000 when we doubled your money in 2009, You will have $349,279!*

-

apple: If you invested $1,000 when we doubled your money in 2008, You will have $48,196!*

-

Netflix: If you invested $1,000 when we doubled your money in 2004, You will have $490,243!*

We are currently issuing “double” alerts for three amazing companies, and there may not be another opportunity like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Jeremy Bowman He has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has Disclosure policy.

This AI stock is down 44%, and it’s a screaming buy right now (hint: it’s not Nvidia) Originally published by The Motley Fool