This article is also available in Spanish.

Ethereum has had a tough year, but recent insights from industry insiders point to a potential comeback. Matthew Siegel, head of digital asset research at VanEck, recently pointed this out Ethereum Oversold.

He believes that increased interest in altcoin speculation will enable its return. This comes as Ether tries to catch up with competitors such as Bitcoin and Solana, which it has far surpassed in 2024.

Related reading

Shift in market sentiment

Sigel spoke in the latest episode of The Tie where he hopes Ethereum is heading in the right direction. He also noted that although Ethereum is facing issues, particularly with regard to EIP-4844 as its economic model has changed, opportunities to hit the “bottom” could still arise.

.@matthew_sigel “I think Ethereum is oversold…speculation will come back into this market and I don’t think it will ignore Ethereum.” https://t.co/5pMcZBLzfi

-Van Eck (@vaneck_us) November 7, 2024

The market is now a bit conservative, but Siegel sees the commodity once again drifting into speculation, causing prices to rise again and calling for trade once again.

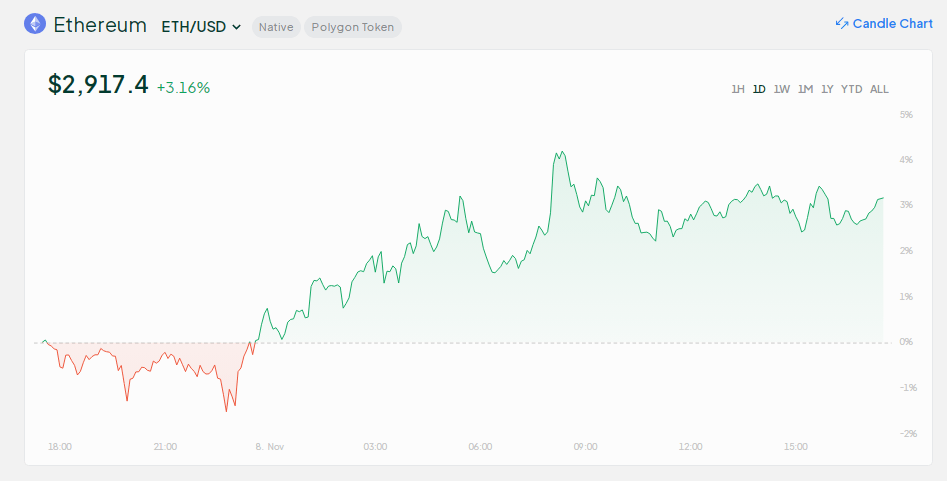

This also brings it in line with the larger Ethereum Expectations. Analysts expect ETH to trade between $2,199 and $3,019 in 2024, with some predicting a rise to over $5,000 by 2025.

The excitement generated earlier this year by the acceptance of Ethereum spot ETFs has provided a regulated gateway for investors to enter the market, both retail and institutional investors. This development may cause massive inflows into Ethereum with massive financial flows, further supporting its price.

Technical analysis and price forecasts

According to the latest technical analysis, Ethereum price must cross the $3,000 level to maintain its bullish sentiment, and many analysts believe that this may open the way to a new high. According to Ethereum In the rainbow chart, we can see all kinds of potential prices for the following years, with estimates reaching $12,000 by 2030.

However, some are concerned about Ethereum’s long-term economic strategy. Layer 2 networks are starting to demand more of Ethereum’s block space, leading to lower transaction fees and income, Siegel said.

This development has led some investors to lose confidence in Ethereum as a deflationary asset. If this trend continues without changes to connect layer 2 networks more closely with the Ethereum ecosystem, VanEck’s long-term price targets could be at risk.

Related reading

The road ahead for Ethereum

Despite these issues, commentators express a real sense of optimism about Ethereum’s future. The prospect of new speculative activity, coupled with the regulatory certainty provided by ETF approvals, could be the spark for a major comeback. As the market evolves and reacts to these developments, investors are looking for signs that the positive trend is returning to Ethereum.

While Ethereum faces challenges, experts believe that a combination of growing interest and good market conditions could pave the way for Ethereum’s comeback in 2024 and beyond.

Featured image from DALL-E, chart from TradingView