This article is also available in Spanish.

Ethereum has faced lackluster price action over the past year, underperforming significantly compared to Bitcoin and many Altcoins that have rallied during the ongoing market cycle. Once seen as a leader in innovation and growth in the crypto space, Ethereum’s slow movement has left many investors frustrated and questioning its short-term potential. However, signs indicate that this period of poor performance may be coming to an end.

Related reading

Recent data from on-chain analytics firm Santiment revealed a bullish development for Ethereum. According to their insights, whales – the holders of cryptocurrencies – have accumulated more than 1.14 million ETH in the past 48 hours. This increase in accumulation indicates increased confidence among institutional players and value investors, who are positioning themselves for a potential bullish collapse.

This important activity for Pisces is often preceded by significant price movements, as it demonstrates strong interest from those with resources to influence market trends. With Ethereum lacking solid fundamentals and adoption of its blockchain ecosystem steadily increasing, recent whale activity could be the catalyst for a reversal in Ethereum’s fortunes.

Ethereum investors are waiting for the collapse

Ethereum has been under significant selling pressure, facing increased volatility over the past two weeks and a multi-month stretch. This prolonged bullish trend has tested the resolve of many investors, causing some to capitulate as Ethereum continues to underperform relative to Bitcoin and other Altcoins. However, a growing number of market participants remain optimistic, convinced that ETH still holds great potential for a major recovery this year.

Among the bullish voices is analyst Ali Martinez, who recently Shared persuasive statements Highlighting an increase in whale activity. According to Martinez, whales have accumulated more than 1.14 million ETH in the past 48 hours, indicating renewed confidence in ETH’s long-term prospects. This widespread accumulation by value investors often indicates belief in an imminent price recovery, as whales are known to position themselves ahead of major market moves.

This whale activity is in line with the broader bullish outlook that many analysts have set for Ethereum this year. With its strong ecosystem, growing adoption, and significant upgrades such as the recent Ethereum integration that enhances its efficiency, Ethereum continues to consolidate its role as a leading blockchain.

Related reading

The coming weeks will be crucial for ETH as it navigates these volatile conditions. Whether Ethereum can capitalize on the bullish momentum generated by whale accumulation remains to be seen. However, the potential for a major shift is clear, and current market dynamics suggest that Ethereum is far from a consideration. Investors and analysts alike are closely watching ETH, anticipating whether it can overcome the selling pressure and prime its upward trajectory in the coming months.

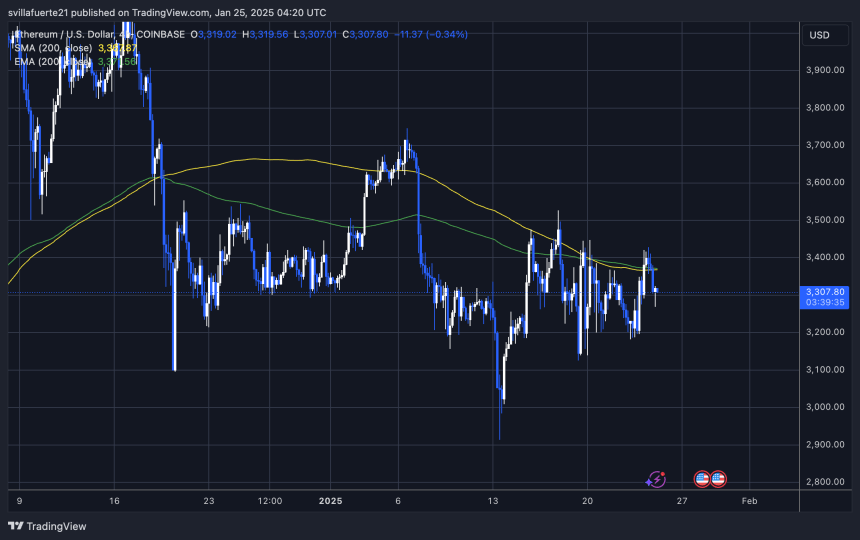

ETH Price Action: Testing Key Levels

Ethereum (ETH) is currently trading at $3,305, holding above key demand levels despite a modest 4% decline since yesterday. Being able to hold the support around $3,300 is crucial for Ethereum to maintain its momentum and avoid further downside pressure. Since the market remains uncertain, this level serves as a pivot point for both bulls and bears.

For ETH to confirm a new uptrend, the price must push above the local highs near $3,525. A break of this resistance would signal renewed buying interest and could pave the way for further upward momentum, which could reverse recent poor performance compared to other assets. A decisive move beyond $3,525 would reinforce the bullish narrative and attract additional investor confidence.

On the downside, missing the $3,200 support level in the coming days would likely signal weakness and could lead to a prolonged consolidation or even a deeper correction. Such a move could test low demand areas, delaying Ethereum’s potential recovery.

Related reading

As Eth navigates this critical juncture, traders are closely monitoring these key levels to determine the asset’s next move. Whether Ethereum holds its ground or faces additional selling pressure, the outcome will likely shape its near-term trajectory.

Featured image by Dall-E, chart from TradingView