USD, EUR, EUR/USD, EUR/GBP, EUR/AUD – Forecasts:

- EUR/USD It is starting to look a bit oversold within the short term downtrend.

- EUR/GBP And EUR/AUD It looks heavy.

- What is the trend and the key levels to watch mainly euro crosses?

Recommended by Manish Grady

How to trade the “One Glance” indicator, Ichimoku

The Euro is starting to appear at least oversold against the US Dollar ahead of the release of key Euro-Zone inflation data, opening the door for a slight recovery. However, the pace and extent of the decline this month has raised the bar for the continued rally in the single currency.

Overbought conditions, extended positions, and a hawkish repricing in US interest rates temporarily halted the euro’s two-month rally against the US dollar. See “How Low Can the Euro Go? EUR/USD, EUR/GBP, EUR/JPY Price Setup,” published on May 16.

Economic surprise index and forex positioning

Source data: Bloomberg; The graph was prepared in Microsoft Excel.

While overbought conditions reversed, the situation has not changed. Despite the recent slide, speculative long positions in the euro are circling around their highest levels since 2020 and within the majors space (see chart), indicating continued overcrowding conditions for the single currency.

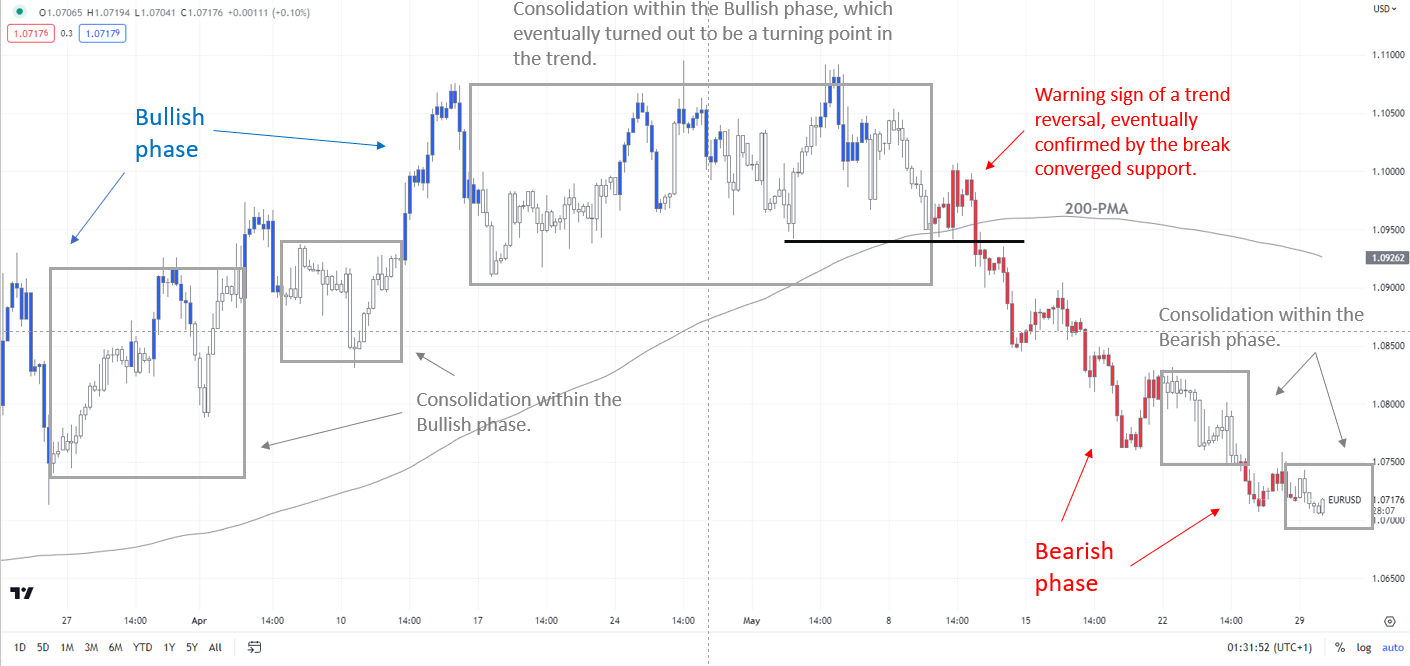

EUR/USD daily chart

Chart by Manish Gradi using TradingView; Notes at the bottom of the page.

From a macro perspective, the macro data for the Eurozone was disappointing, which added pressure on the EUR. The Economic Surprise Index (ESI) for the Eurozone continues to decline, although the ESI for the United States seems to have plateaued recently (see chart). The main focus now is on German inflation data due on Wednesday, Eurozone numbers on Thursday, and US jobs data on Friday.

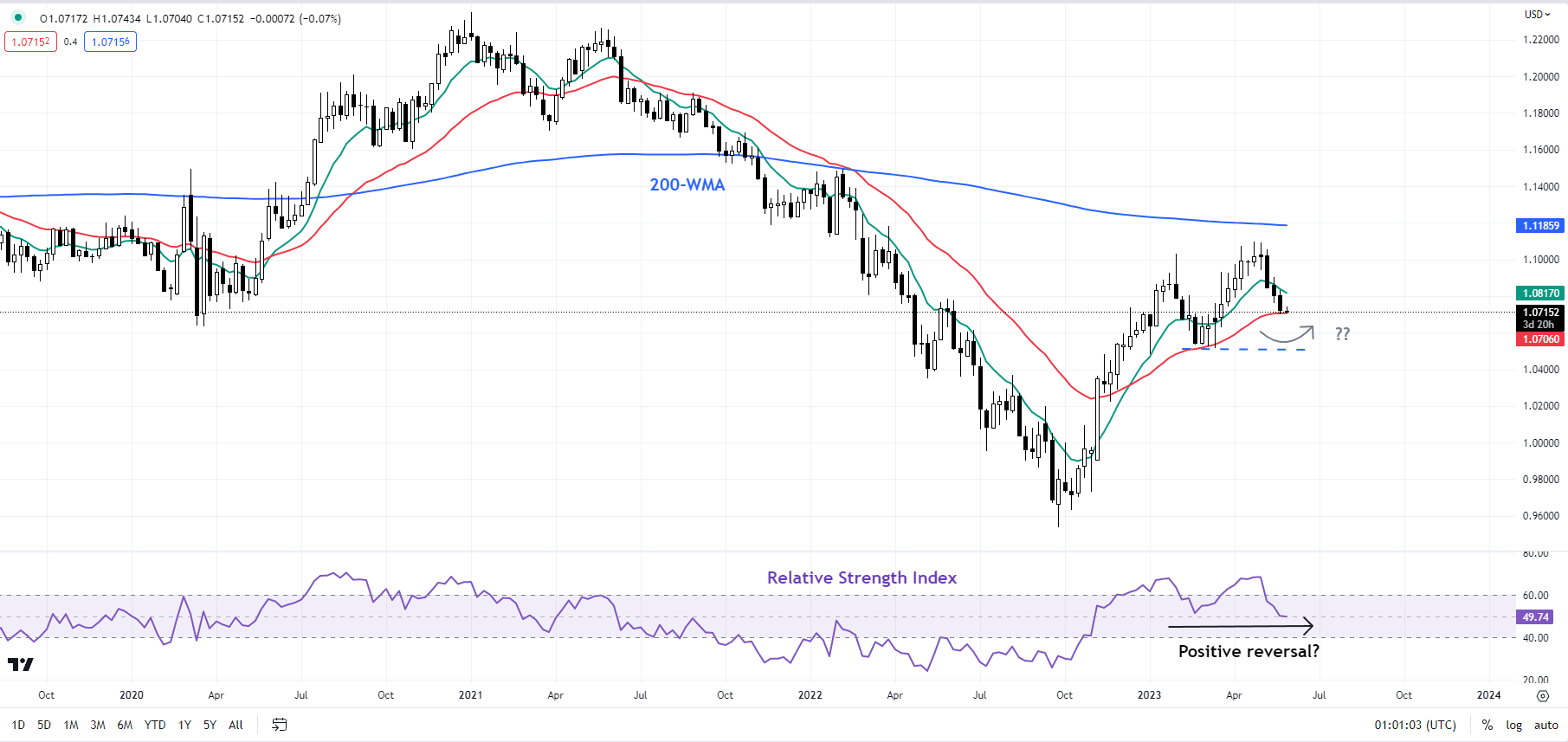

EUR/USD weekly chart

Chart by Manish Gradi using TradingView

Money markets are pricing in more than two price hikes while postponing the peak to December. In this regard, the head of the Central Bank of Ireland, Gabriel Makhlouf, said last week that more than two interest rate hikes by the European Central Bank this year are possible in light of stubborn inflation. In contrast, markets are pricing in a 63% chance of a 25bp rate hike at the June meeting from 25% last week, according to CME FedWatch.

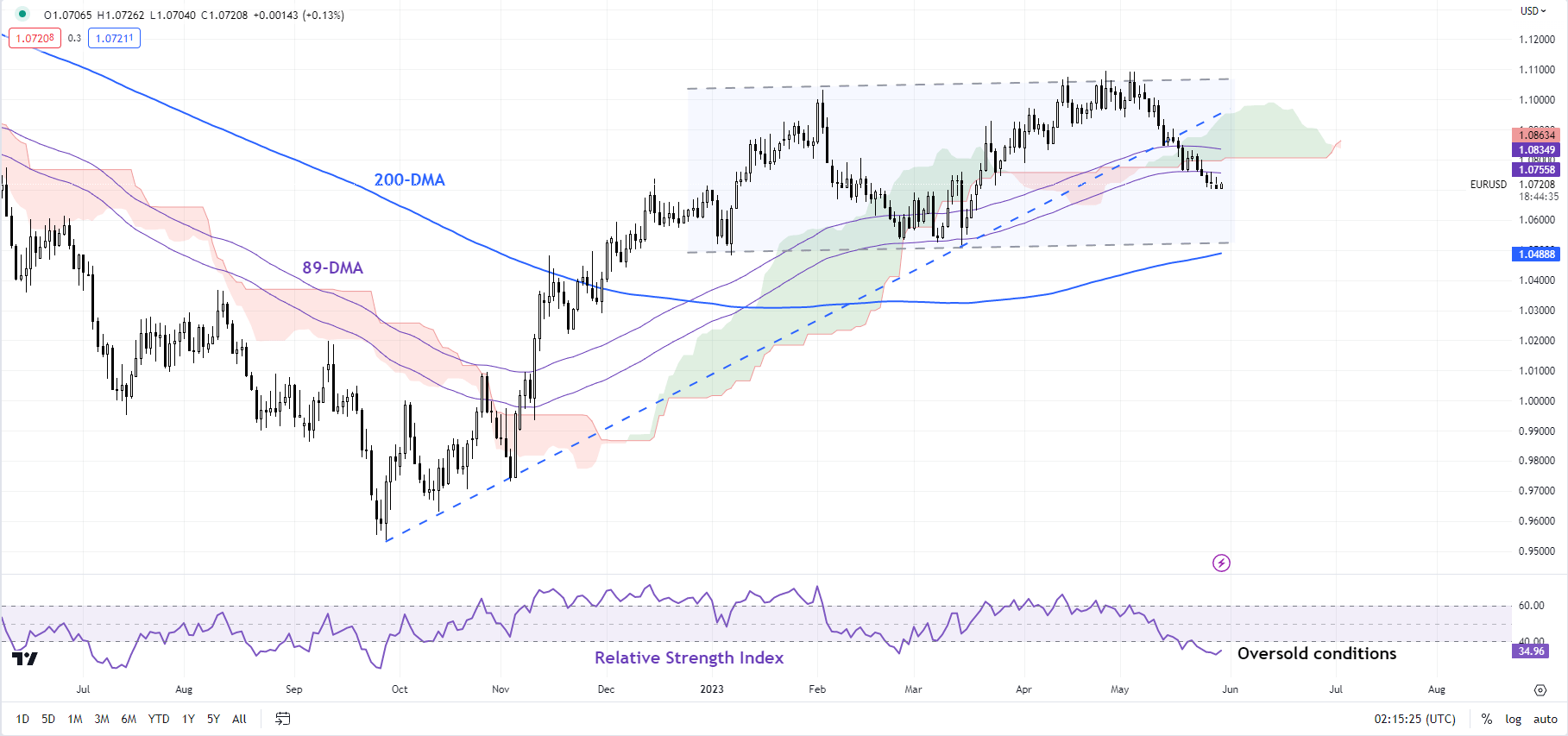

EUR/USD daily chart

Chart by Manish Gradi using TradingView

EUR/USD: The short-term trend is bearish

As the 240-minute color-coded candlestick chart shows, based on trend/momentum indicators, EUR/USD is in a bearish phase. However, on the daily charts, EUR/USD has moved into a consolidation phase within the bullish structure that started in late 2022 – a risk that was highlighted in early May. Please see “Has the European Central Bank put brakes on the euro’s rally? EUR/USD, EUR/AUD, EUR/JPY”, published on May 5.

EUR/USD falling below the lower edge of the Ichimoku Cloud on the daily chart is a sign that the bullish pressure has faded a bit in the short term. A stronger cushion is found at the March low of 1.0510, near the 200-day moving average, which may contain the current downtrend. On the upside, the mid-May high of 1.0900 could be heavy resistance.

EUR/GBP daily chart

Chart by Manish Gradi using TradingView

EUR/GBP: Bias remains subdued

The pause in the downtrend could be a sign of a late decline, rather than a reversal in EUR/GBP’s fortunes. The pair will need to rise above the immediate resistance at 0.8750 for the downside to fade. Until then, a move towards December low at 0.8545 is still inclined.

EUR/AUD daily chart

Chart by Manish Gradi using TradingView

EUR/AUD: Upside may be limited for now

EUR/AUD risks retesting the 1.5950-1.6050 area (including the December high and the 89-day moving average). This follows last month’s decline from a difficult barrier at October 2020 high of 1.6825. For further discussion, see “Australian Dollar Pre-Budget: AUD/USD, AUD/JPY, EUR/AUD Rate Settings,” posted on May 9.

Note: In the color-coded candlestick charts above, the blue candlesticks represent a bullish stage. Red candles represent a bearish phase. Gray candlesticks act as consolidation phases (during a bullish or bearish phase), but they sometimes tend to form at the end of a trend. Note: Candle colors are not predictive – they only indicate the current trend. In fact, the color of the candle can change in the next bar. False patterns can occur around the 200-period moving average, around support/resistance and/or in a sideways/volatile market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Recommended by Manish Grady

How to trade EUR/USD

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish