EUR/USD news and analysis

- The size of the ECB’s hike may depend on the EU Lending Survey, Core Inflation – and Winch from the ECB

- Technical considerations for EUR/USD as the pair reaches a new yearly high

- Earnings season begins in the United States with banks and core inflation in the European Union may support the current bullish trend of the euro against the dollar

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Find out what our analysts forecast for EUR/USD in the second quarter

The size of the ECB’s rise may depend on the EU’s lending survey

European Central Bank policymaker Pierre Wench highlighted the urgency of the European Central Bank to continue its drive to raise interest rates while doing more to cut its massive €3.2 trillion balance sheet.

Wunsch outlined a scenario in which we could see a 50 basis point rally, a proposition that would gain traction if core inflation provides a welcome surprise along with positive data from the ECB’s quarterly lending survey. With a sense of calm returning to the EU and US banking sectors, markets will shift their focus to banks’ willingness to extend credit during this time of rising interest rates and recent instability as lower appetite is essentially an extension of tighter monetary policy. If it is not activated directly by the European Central Bank.

Technical considerations for EUR/USD

EUR/USD has breached the previously set 1.1000 level and as of mid-morning London session, it is trading above the yearly high of 1.1033. The yellow line on the daily chart represents the interest rate differential between the German 10-year note and the US 10-year Treasury note, which helps explain the recent upward movement. The widening spread continues to support the euro while market expectations of US interest rate cuts in the second half of the year, and lower US inflation, continue to deepen the dollar’s decline.

The 61.8% Fibonacci level at 1.1205 becomes the next upside level of resistance with the next resistance area all the way at 1.1500. However, the threat of lower earnings growth ahead of earnings season in the US could see some much-needed support for the safe-haven US dollar, as recession fears could return. Keep an eye out for the mention of a “slump” in the earnings data, especially since the Fed’s March meeting minutes indicated that the US might enter a recession by the end of the year. Support is located at the previous high of 1.1033 ahead of 1.0767.

EUR/USD daily chart

Source: TradingView, prepared by Richard Snow

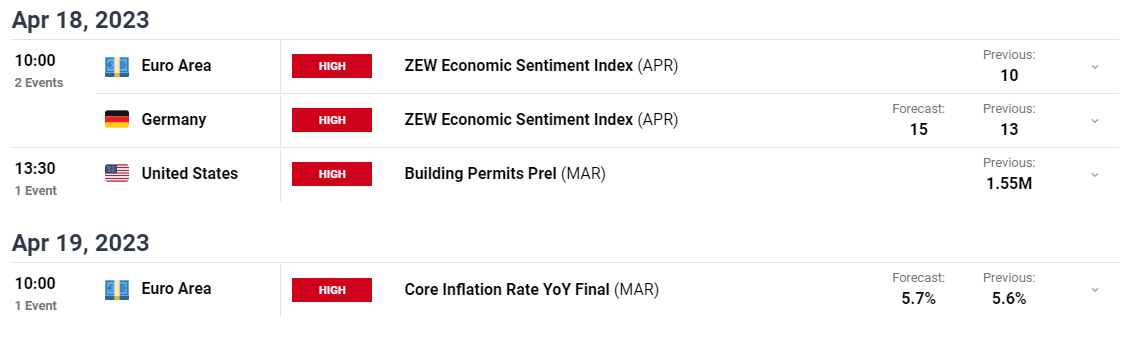

upcoming risk events

Today sees the beginning of earnings for US banks as credit loss provisions will be a major component of interest. If banks were more pessimistic and expected an increase in defaults, that number would go up. Earnings aside, next week will witness inflation data for the month of March for the Eurozone, which is expected to record another rise. This becomes an issue as the ECB has suggested core inflation will hover around 5% before declining and we could see a print of 5.7% for March. Should the consensus hold, this should bode well for the current direction of EUR/USD.

Customize and filter live economic data via DailyFX Economic calendar

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @tweet