Strong growth in consumer prices in the eurozone warrants more rate hikes by the European Central Bank and a “continued tightening bias,” according to the IMF.

Article content

(Bloomberg) — Strong consumer price growth in the eurozone calls for more rate hikes by the European Central Bank and an “ongoing tightening bias,” according to the International Monetary Fund.

Advertising 2

This ad hasn’t been uploaded yet, but your article continues below.

Article content

“Inflation expectations and high doubts about persistent inflation suggest that a more restrictive stance than at present is needed, and maintained for the long term, to keep inflation expectations steady and return inflation to the target in a timely manner,” the International Monetary Fund said on Friday. , a day after policymakers in Frankfurt raised borrowing costs for the eighth consecutive time and signaled another move in July.

Article content

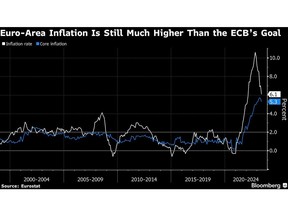

Inflation has eased in the region from a peak of 10.6% in October, but is still more than three times the European Central Bank’s target of 2%. Tight financial conditions — triggered by an unprecedented 400 basis point rally cycle since July — and easing of supply constraints mean the rate will continue to slow and “convergence to target is expected in mid-2025,” the Washington-based fund said.

Article content

Advertising 3

This ad hasn’t been uploaded yet, but your article continues below.

Article content

However, it highlighted that core inflation, which excludes volatile items such as energy and food, “has proven to be more stable and has only recently begun to decline.”

In its closing statement after the so-called Article IV consultation, the IMF also hailed the “remarkable resilience of the eurozone economy in the wake of Russia’s invasion of Ukraine and the biggest terms-of-trade shock in several decades.” However, growth will pick up only “modestly” this year and next, while medium-term output “is likely to remain below the pre-war trend for a long time given the costs of adjusting to ever-high energy prices.”

The International Monetary Fund has urged countries in the region to rein in public spending and urged the bloc to quickly reach agreement on reforming the European Union’s economic and financial governance.

Advertising 4

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Fiscal policy must remain tight through 2023 and 2024. Why? To lower aggregate demand, push inflation down and pressure interest rates down so that we can reduce risks to financial stability and of course lay a sound foundation for growth, Kristalina Georgieva, managing director of the International Monetary Fund, told reporters in Luxembourg on Friday.

The Fund also warned that “relaxing state aid rules” — allowing EU members to grant subsidies or tax incentives to match what is offered elsewhere — “could lead to higher financial costs as well as economic inefficiencies and distortions.”

– With help from James Regan.

(Updates with the head of the IMF in the penultimate paragraph)

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now get an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation