Ammunition manufacturers are working to secure supplies of chemicals and cotton as they prepare for a massive increase in demand for explosives and propellants.

Article content

(Bloomberg) — The last stages of gunpowder manufacture at Nitrochemie Aschau look a bit like making pasta. A mass of fibers is squeezed through rollers until it is flat and gelatinous, which is then coiled tightly by hand and fed through a press that squeezes it into a thick cord. Finally, it is passed through a matrix that cuts it into pellets, each measured to within a hundredth of a millimeter.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

Article content

Article content

Article content

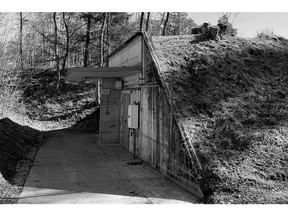

It is a surprisingly manual process. “You cannot simply put large amounts of explosive materials onto a conveyor belt, no one would want that,” said Oliver Becker, senior vice president of operations at the site, which sprawls across 90 hectares of Bavarian countryside near Munich.

Nitrochemie Aschau is a subsidiary of the German defense giant Rheinmetall. Since Russia’s full-scale invasion of Ukraine in 2022, the factory has increased production capacity by 60% and is building new facilities to add another over 40% by mid-2025. It has hired around 300 people, picking up workers from the struggling automotive and chemicals sector to bolster its workforce so it can keep production running 24/7, and help meet Europe’s surging demand for ammunition.

European governments dug into their munitions stockpiles to arm Ukraine, exposing how shallow their reserves were. Since then, they have been trying to boost production of artillery shells, missiles and bullets. That strained the continent’s supplies of gunpowder, TNT and other explosives and propellants to the limit. As Europe prepares for a massive boost in defense spending, the small number of producers of these volatile materials are racing to increase their capacity. Rheinmetall alone is aiming to increase its powder output by more than 50% by 2028, but even that won’t be enough. CEO Armin Papperger said on a recent earnings call that the company may have to nearly double its production to more than 20,000 metric tonnes to meet the need.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

However, the supply chain that explosives manufacturers rely on is tangled, global, and full of bottlenecks. Governments and manufacturers need to incentivize civilian chemical industries to switch to military production, simplify regulations to allow new factories to be built and dangerous cargoes to move around the continent — and even secure supplies of the most basic materials that are currently shipped in from China.

“A coordinated national defense strategy would aim to secure the resource of cotton, a kind of foresight I don’t see right now,” Michael Blendinger, president of the Association of German Gunsmiths and Arms Dealers, said.

Volatile Markets

Even before the inauguration of US President Donald Trump, European Union members had set a target of making 2 million artillery shells in 2025, up from 1.4 million last year. In spring 2023, the European Commission established the Act in Support of Ammunition Production, or ASAP, program, which allocates €500 million ($526 million) to help expand the bloc’s ability to manufacture munitions.

Since then, Trump’s administration temporarily suspended military aid to Ukraine, sowed doubt over the future of longstanding American security guarantees in Europe, and indicated a willingness to negotiate with the Kremlin despite the objections of the Ukrainian government and European allies. The continent’s need for munitions is only going to grow.

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

“Up until now, too little has been done in the area of ammunition provision,” said Joachim Peter, co-head of the global defense industry sector at consultancy Brunswick Group. “This is now taking its toll as the situation continues to deteriorate.”

Shells need two volatile components: propellants, which are used to fire projectiles; and explosives, which detonate. Europe doesn’t produce enough of either to meet its demand.

The most important ingredient in propellants for modern shells is nitrocellulose, or guncotton. As its name suggests, it is made from high-grade cotton, which is then soaked in a mix of acids. Just one round of artillery ammunition requires up to 12kg (26lb) of gunpowder. Europe only has a handful of propellant manufacturers, including Rheinmetall and the French contractor Eurenco. Under ASAP, Europe wants to increase production of propellants by more than 50%, or 10,000 metric tonnes per year — equivalent to nearly six new facilities the size of Nitrochemie Aschau’s.

The explosives supply is in a similar situation to propellants. The EU is planning to increase explosives production by more than 4,300 metric tonnes, an estimated increase of over 30%, but it currently only has one major TNT factory serving local production, run by the company Nitro-Chem in Poland, with another one to be built in Finland.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Makers of alternative agents, such as PETN, HMX and RDX, which are used in plastic explosives, are overwhelmed. Norwegian manufacturer Chemring Nobel has seen unparalleled demand since Russia’s invasion of Ukraine, according to a spokesperson. The company says that its Norwegian business has been running at full capacity, and its order book extends for a number of years.

Just as explosives and propellants are a bottleneck for defense companies, manufacturers of gunpowder and TNT have to navigate their own supply chain constraints.

Some European countries, such as Germany, the Netherlands, Belgium and Poland, have a well-established chemicals industry, but explosives precursors only make up a small share of their capacity, according to the German chemical industry association, VCI. High energy costs and environmental regulations make it cheaper to produce chemicals abroad, and many companies now source precursors, such as nitric acid, from China.

Most of the cotton used in nitrocellulose also has to be imported from China, which is the world’s largest producer — and, on friendly terms with Russia. While there are alternatives to cotton made from wood pulp and other materials, they aren’t currently produced at the scale the market needs.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Nitrochemie has spent the last three years working to secure its supply chain, according to Pascal Schreyer, CEO of Rheinmetall’s propulsion systems business unit. Although it still needs to source cotton from outside the continent, the company has been getting its cotton linters — a processed form of cotton fibers — from Europe and countries that have good relationships with the EU. Nitrochemie has also built up a stockpile of several years’ worth of linters, according to Schreyer. “In the past, where raw materials came from was not a priority for us. This has changed, and now we are focused on bringing capacity to Europe,” he said.

Most of the major producers of nitrocellulose and other specialty chemicals in the explosives supply chain have received grants from the ASAP program, according to Bloomberg analysis of the program’s filings.

The European Union has proposed €150 billion in loans to boost defense spending as part of its latest effort to compensate for waning US support. The European Defense Industry Program would provide another €1.5 billion of EU funding to industry players from 2025 to 2027, but the Commission’s regulation has not yet been passed by the European Parliament.

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

Long-term markets and financing will be crucial if the supply chain issues are to be solved, experts said. “The industry has been receiving significant orders in the past two years, but it is unclear whether this momentum will last,” said Amos Dossi, head of defense policy research at ETH Zurich’s Center for Security Studies.

The cost of switching production from civilian to military use is high. The plastics and paint industries, for example, do use a form of nitrocellulose that has a lower nitrogen content than military-grade guncotton. But to move from one to the other would be technically and legally very complex, experts said.

Governments also need to find ways to ease the regulatory burden on the industry, experts said. The logistics behind transporting volatile cargoes are complex and highly regulated, according to Sven Schröder, a former soldier and CEO of Essing Sprengtechnik, which has produced, transported, stored and destroyed explosives for military and civilian customers for more than 30 years. Regulation in the sector ensures the safety of workers and the general public, he said, but regulatory barriers can also be a major hindrance. Lorries end up being stuck at the Ukrainian border for weeks, and getting approvals for storage sites can take years, Schröder said.

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

But, he added, these challenges are secondary to the shortage of raw materials. “Defense companies’ hands are tied when raw materials are lacking,” he said. “This has been ignored for years.”

Lowering regulatory hurdles, giving companies guarantees, and overcoming Europe’s social and fiscal barriers to investing in weapons and their components will be vital to meeting the continent’s needs, experts said, in particular because its biggest strategic threat, Russia, has few of these constraints.

“We have to rearm everywhere, simultaneously and in large numbers,” Brunswick’s Peter said. “An authoritarian state that has switched to a war economy at the expense of the population simply ramps up. And it must therefore be clear that we need to pick up the pace.”

Article content