-

Fundstrat’s Tom Lee is bullish on the stock market in 2024, but he doesn’t expect stocks to go up in a straight line.

-

Lee warned that the stock market is due for a sell-off in the first quarter of 2024.

-

These are the 4 reasons why Lee expects a stock market pullback to occur within the next few months.

Fundstrat’s Tom Lee is one of the most bullish strategists on Wall Street for 2024, but he doesn’t expect the stock market to go up in a straight line.

Lee warned clients in a note on Friday that the stock market is due for a sell-off within the first few months of 2024.

To be clear, Lee does expect the S&P 500 to rise to an all-time high during the month of January, and he expects gains in the stock market to continue over the next year, with a 2024 year-end S&P 500 price target of 5,200.

“Reaching an all-time high is a significant market milestone. And stocks do not suddenly reverse from there,” Lee said.

But the stock market hitting record highs in January will likely soon be followed by a pullback of about 5% sometime in February or March, representing a period of consolidation for the stock market after it staged a 16% rally since the end of October.

“In the current context, we could see S&P 500 4,400 to 4,500 once we make all-time highs, or a modest pullback,” Lee warned. “This is consistent with our 2024 Year Ahead Outlook, where our base case is the S&P 500 makes most of its gains in (the) second half of 2024.”

Lee offered the following four reasons why he expects stocks to stage a pullback after January.

1. The market could be getting ahead of the Federal Reserve in terms of interest rate cuts. While the Fed expects only three interest rate cuts in 2024, the market is currently pricing in six interest rate cuts next year. Any pullback in expectations of how many times the Fed cuts interest rates next year could lead to downside volatility in stocks.

2. “AI timeline could be pushed out due to a ‘systematic hack’ by malevolent AI,” Lee said.

3. “Equity markets need to consolidate the parabolic gains from late 2023,” Lee said.

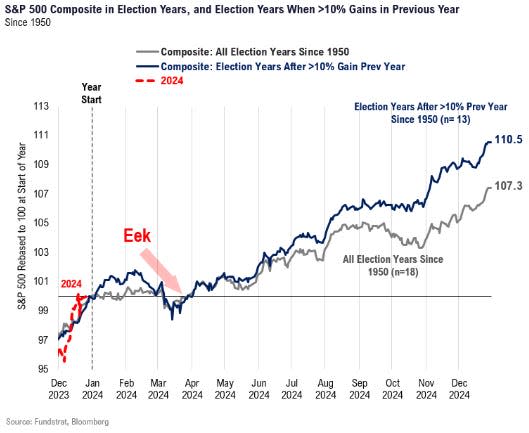

4. “A drawdown in February/March timeframe is consistent with election year seasonal returns,” Lee said.

Any dips in the stock market next year should ultimately be bought, Fundstrat says, as technical strategist Mark Newton said in a note last week that trillions of dollars of cash on the sidelines should provide enough fire power to make any dips in stocks short-lived.

Read the original article on Business Insider