The Federal Open Market Committee cut interest rates by 50 basis points to 4.75% to 5.00% at its September meeting, marking a strong start to the monetary policy easing cycle.

It was also the first cut in borrowing costs since the start of the pandemic in 2020, as major central banks announced emergency relief measures. The last time the Fed cut interest rates by 0.50% was during the financial crisis in 2008.

According to their official statement “The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and it judges that the risks to achieving its employment and inflation goals are roughly balanced.”

Link to the Official Statement of the Federal Open Market Committee (September 2024)

In addition, their updated economic forecasts downgraded headline inflation from 2.6% to 2.3% and core inflation from 2.8% to 2.6% this year. The committee also raised its unemployment estimate to 4.4% from 4% in June, confirming the view that “Job gains have slowed and the unemployment rate has risen but remains low.”

Meanwhile, the dot chart of interest rate expectations revealed that policymakers expect to cut rates by an additional 50 basis points over the rest of the year.

The dot chart also forecasts an additional 1.00% rate cut in 2025, plus another 0.50% cut in 2026.

Link to FOMC Summary of Forecasts

During the press conference, Federal Reserve Chairman Jerome Powell stressed that the bank is committed to restoring price stability without sacrificing employment.

Although he noted that longer-term inflation expectations remain well-established and the economy is generally strong, Powell also cautioned that there was broad support for a 0.50% rate cut at the September meeting. Ultimately, a majority of policymakers voted in favor of the move, with only one dissenter (Michele Bowman) calling for a smaller 0.25% cut.

Market Reactions

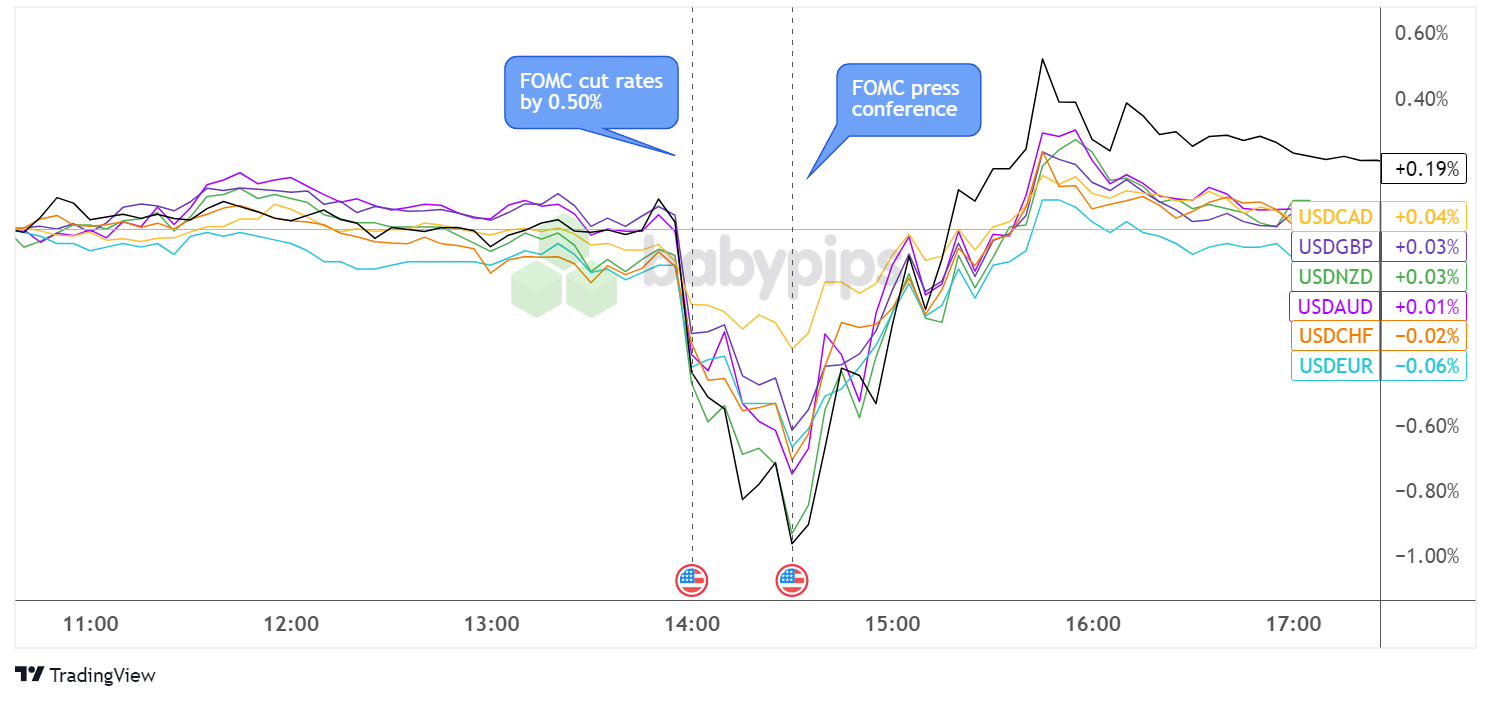

US Dollar vs Major Currencies: 5 minutes

US Dollar Overlay Against Major Currencies Chart by TradingView

After trading in tight ranges against its FX counterparts a few hours before the FOMC decision, the US dollar fell broadly after hearing the Fed’s larger 0.50% rate cut.

The US dollar continued to decline after the official announcement, as the FOMC’s summary of expectations also reflected downgrades to inflation and employment expectations, before rallying during the press conference.

Comments from Federal Reserve Chairman Jerome Powell appeared to dampen hopes for another massive 0.50% cut in borrowing costs, as he said the U.S. economy remains strong thanks to robust consumer spending, even as chart forecasts point to two more easing moves before the end of the year.

With that, the US currency managed to recover back to pre-FOMC levels about an hour after the press conference, with USD/JPY and USD/CHF trading at higher levels throughout the rest of the session.