Federal Reserve officials will cut interest rates this month for the third straight time and will scale back the number of rate cuts they expect next year, according to economists surveyed by Bloomberg News.

Article content

(Bloomberg) — Federal Reserve officials will cut interest rates this month for a third straight time and scale back the number of rate cuts they expect next year, according to economists surveyed by Bloomberg News.

Article content

Article content

Fed Chairman Jerome Powell and his colleagues are expected to deliver another quarter-point rate cut at their meeting on December 17-18, lowering the central bank’s key interest rate to a range of 4.25% to 4.50%. That would represent a full percentage point of cuts since September.

Advertisement 2

This ad has not loaded yet, but your article continues below.

Article content

Interest rate cuts next year are expected to slow by more than officials expected three months ago, with a majority of economists forecasting just three cuts in 2025 amid less progress in cooling inflation towards the central bank’s 2% target.

“The case for further cuts in US interest rates after this month has diminished significantly,” said Dennis Shin, an economist at Scope Ratings. “Inflation has remained flat, the economy and financial markets are overheating, the uptick in unemployment earlier this year has reversed, and the incoming Trump administration threatens further near-term inflation risks.”

After next week’s meeting, economists expect the Fed to hold interest rates steady at its January meeting and cut them again in March. The remaining two cuts for 2025 will come in June and September, according to median estimates in a Bloomberg survey of 50 economists. The survey was conducted from December 6 to 11.

The outlook for the US economy and monetary policy has changed markedly from just a few months ago, when concerns about a weak labor market led many economists to forecast a more aggressive path for interest rate cuts in 2025.

Article content

Advertisement 3

This ad has not loaded yet, but your article continues below.

Article content

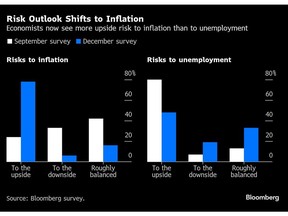

In September, most respondents were more concerned about the employment picture deteriorating than inflation progress stalling. Now that dynamic has flipped.

After slowing significantly from a four-decade high in 2022, inflation has remained at roughly the same high level for several months. Data released earlier this week showed that the main measure of consumer prices that excludes food and energy costs rose 3.3% year-on-year, a point first reached in June.

Without additional progress toward the central bank’s target, policymakers may be forced to keep interest rates at higher levels to further reduce inflation. Economists expect Fed officials to slightly raise their price growth forecasts in 2025 while continuing to see 2% inflation in 2026.

Sustained price pressures and continued strong economic growth are likely to raise policymakers’ estimates of the neutral interest rate, where policy neither stimulates nor influences the economy, to 3% from 2.9% in September.

Trump effect

While economists are divided on how much President-elect Donald Trump’s policy proposals — including mass deportations, a new round of tariffs and renewed tax cuts — will ultimately impact the economy, most forecasters expect smaller interest rate cuts in 2025 as a result. Policies. .

Advertisement 4

This ad has not loaded yet, but your article continues below.

Article content

“We look to the Fed to hold interest rates steady early next year as it assesses potential policy changes under the Trump administration and assesses the economic and inflationary environment at that time,” said Kathy Bostjancic, chief economist at Nationwide.

Economists don’t see much change in key parts of the post-meeting statement this time. A large majority of them see Fed officials maintaining their current characterization of inflation as moderately high and unemployment low.

But they could signal an intention to move at a more gradual pace in the part of the statement that signals future policy adjustments, according to Brett Ryan, chief U.S. economist at Deutsche Bank.

Nearly a third of those surveyed said there might be opposition at this meeting, most likely from Governor Michel Bowman, who voted against a big interest rate cut in September and expressed concern about inflation.

Economists are more mixed about the future of balance sheet policy. While most believe the current caps on the number of Treasuries and mortgage-backed securities that the Fed allows to mature from its balance sheet may be lowered in the first half of 2025, there is less certainty about when they will arrive. The process known as quantitative tightening has come to an end. Complete end.

About 36% of economists believe that this will happen in the first half of next year, but 38% do not believe that the matter will end until 2026.

Article content