Jerome Powell is likely to tell lawmakers that Federal Reserve officials need more confirmation that inflation is slowing before they are in a position to cut interest rates, even as evidence mounts of weak growth and employment.

Article Content

(Bloomberg) — Federal Reserve Chairman Jerome Powell is likely to tell lawmakers that Fed officials need more confirmation that inflation is slowing before they’re in a position to cut interest rates, even with evidence of weak growth and employment.

June’s CPI data is expected to be another step toward that goal, but the numbers are only due out on Thursday — after the Fed chairman wraps up two days of congressional testimony. Powell speaks before the Senate Banking Committee on Tuesday, followed by an appearance before a House committee on Wednesday.

Advertisement 2

This ad has not yet loaded, but your article continues below.

Article Content

With new data showing the highest unemployment rate since late 2021, and other figures showing weak economic growth, Powell is likely to come under more pressure from some lawmakers about why the Fed has been reluctant to lower borrowing costs.

Powell said Tuesday that recent data suggest that inflation is returning to a downward path, but he and his colleagues want to see that progress continue.

The core CPI, which strips out food and energy costs and is seen as a better gauge of underlying inflation, is expected to rise 0.2% in June for a second straight month. That would mark the smallest consecutive gain since August, a pace more acceptable to Fed officials.

The inflation report is also expected to show a modest 0.1% increase in the overall consumer price index compared to the previous month. Compared to June last year, the price gauge is expected to rise 3.1%, the smallest annual advance in five months.

- For more information, read the full Bloomberg Economics report on the week ahead for the United States.

Meanwhile, Friday’s monthly payrolls report showed that the unemployment rate, while still at a historically low 4.1%, is trending higher. Minutes from the Federal Reserve’s June policy meeting revealed that several officials pointed to the risk that a further slowdown in demand could push unemployment higher.

Advertisement 3

This ad has not yet loaded, but your article continues below.

Article Content

Economists on Friday will parse the government’s report on producer prices to assess the impact of certain categories — such as portfolio management and health care — that feed into the Fed’s preferred inflation gauge, the personal consumption expenditures price index.

What Bloomberg Economics says:

“We expect weak inflation data for June, July and August to give the Fed enough confidence to start cutting interest rates by the time the FOMC meets in September.”

—Estelle Au, Stuart Paul, Eliza Winger, Chris J. Collins, and Anna Wong, economists. For the full analysis, click here

In the North, it will be a light week for data, but June home sales on Friday will shed light on whether the Bank of Canada’s interest rate cut that month shook the market out of its slumber.

Elsewhere, inflation figures from China to Sweden and the aftermath of the French parliamentary election runoff will be among the highlights.

Click here to see what happened last week, and here’s our summary of what’s coming in the global economy.

Asia

China may get some fairly positive news on prices, with data due on Wednesday expected to show consumer inflation rose in June and factory price deflation slowed to the slowest pace since January 2023. It remains to be seen whether that will help support manufacturing.

Article Content

Advertisement No. 4

This ad has not yet loaded, but your article continues below.

Article Content

In other data, Japanese workers’ wage figures on Monday may show real wages fell for a 26th month in May, casting doubt on the prospects for the virtuous cycle the Bank of Japan has long sought.

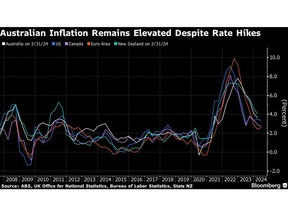

India’s consumer price growth may have picked up slightly in June, and Australia will unveil its consumer inflation forecasts on Thursday.

Trade statistics are due out from China, the Philippines and Taiwan, while Singapore is due to release second-quarter GDP data during the week.

On the policy front, a number of regional central banks are expected to remain on hold, while investors look forward to the possibility of interest rate cuts in the second half of the year.

The Reserve Bank of New Zealand meets after a weak composite PMI reading pointed to slowing economic growth, potentially opening the door to a cut in the fourth quarter.

The Bank of Korea meets a week after inflation slowed more than expected, boosting the chances of a shift to lower borrowing costs as early as August, according to Bloomberg Economics.

Kazakhstan’s central bank is due to decide on Friday whether to cut interest rates again in May.

Advertisement No. 5

This ad has not yet loaded, but your article continues below.

Article Content

- For more information, read Bloomberg Economics’ full report on the week ahead in Asia.

Europe, Middle East and Africa

Investors will focus on Monday on the outcome of the French election. Although financial market concerns have eased, the prospect of a hung parliament leading to a minority government lacking the resolve to fix public finances remains a possible outcome.

In the UK, whose election saw a landslide victory for Keir Starmer’s Labour Party, investors will remain on the lookout for any early decisions that will affect the economy and its strained fiscal stance. Meanwhile, data on Thursday could show growth rebounded in May after stagnating the previous month.

European Central Bank policymakers have until the end of the game on Wednesday to publicly address the next interest rate decision on July 18 before the blackout period begins. With a sparse calendar, Bundesbank President Joachim Nagel and Executive Board member Piero Cipollone are scheduled to appear.

It’s also a quiet week for eurozone data. Among the highlights of Monday’s data were German exports and Italian industrial production figures on Wednesday.

Advertisement 6

This ad has not yet loaded, but your article continues below.

Article Content

- For more information, read next week’s full Bloomberg Economics report for Europe, the Middle East and Africa.

There’s more on the calendar outside the single currency area, with several inflation releases scheduled for June.

- Hungary on Tuesday, followed by Norway and the Czech Republic on Wednesday, is expected to see consumer price growth slow, albeit by notable margins of more than 2%.

- On the same day, Russian data could show inflation hitting a new high in 2024, highlighting the challenge facing the central bank. After keeping its key interest rate at 16% so far this year, the Bank of Russia is likely to consider a 100-200 basis point hike at its July meeting, Deputy Governor Alexei Zabotkin said recently.

- In Egypt, officials on Wednesday hoped inflation would slow for a fourth straight month from its peak of 36% in February, which was before the central bank raised interest rates as part of a massive bailout from the International Monetary Fund, the United Arab Emirates and others.

- Ghana’s inflation is also expected to slow for the third straight month on Wednesday – from 23% in May – due to favourable base effects. The central bank remains concerned about monthly price increases which are expected to accelerate due to the depreciation of the cedi.

- In Sweden, the Swedish central bank’s inflation target is expected to fall below 2% on Friday for the first time in nearly three years.

Advertisement 7

This ad has not yet loaded, but your article continues below.

Article Content

The central bank is set to issue two noteworthy decisions in the wider region:

- Israel’s Monetary Policy Committee is likely to ignore mounting inflation pressures on Monday and keep its key interest rate at 4.5% for a fourth straight meeting to help an economy strained by the war in Gaza and rising tensions with Hezbollah in Lebanon.

- Serbia’s central bank issues its monthly decision on Thursday, when officials may provide clues on their next move on the key interest rate after cutting rates in June, the first in more than three years.

latin america

Data released on Monday may show that Chilean consumer prices accelerated for a third straight month above target — while more than a year of sustained deflation appears to have come to a halt in Colombia.

In Mexico, inflation is likely to rise for a fourth straight month, which is by no means the “benevolent CPI data” that central bank Deputy Governor Jonathan Heath says the board wants to see before easing monetary policy again.

The Bank of Mexico, which holds its next meeting in August and has held at 11% in the last two meetings, will publish the minutes of its June 27 decision on Thursday.

Inflation is rising in Brazil, along with the erratic temper of President Luiz Inacio Lula da Silva. The Brazilian leader is furious about “excessive” interest rates that have exceeded 10%, and the “Bolsonaro-nominated” central bank chief, Roberto Campos Neto. Campos Neto told Brazilian newspaper Valor that Lula’s verbal attacks are making it harder to control inflation.

Advertisement No. 8

This ad has not yet loaded, but your article continues below.

Article Content

A string of single-digit monthly readings in Argentina has finally slowed the annual inflation rate after hitting 289.4% in April. Analysts polled by the central bank expect Friday’s monthly reading to come in higher than May’s 4.2%.

Peru’s central bank meets on Thursday after keeping its key interest rate at 5.75%. A rise in core inflation in June could force the central bank to postpone its meeting to a second one.

- For more information, read Bloomberg Economics’ full report on the week ahead for Latin America.

—With assistance from Robert Jameson, Laura DeHillon Kane, Tony Halpin, Monique Vanek, Brian Fowler, Paul Wallace, and Zoe Schnoes.

Article Content