Biodiesel enthusiasts will be eagerly awaiting an announcement this week from the US Environmental Protection Agency about the amount of renewable products that should be blended into the country’s fuel supply. Meanwhile, European natural gas traders will be watching to see if the biggest weekly rally since August can continue. Here are five charts to consider in the global commodity markets.

Article content

(Bloomberg) — Biodiesel enthusiasts will be eagerly awaiting an announcement this week by the U.S. Environmental Protection Agency about the amount of renewable products that should be blended into the nation’s fuel supply. Meanwhile, European natural gas traders will be watching to see if the biggest weekly rally since August can continue. Here are five charts to consider in the global commodity markets.

Advertising 2

This ad hasn’t been uploaded yet, but your article continues below.

Article content

Article content

natural gas

Gas prices in Europe posted their first weekly gain since March, as hotter weather forecasts pointed to stronger-than-previously-expected demand amid signs of emerging competition from Asia for heating fuels and power generation. Benchmark gas in the first month in the Netherlands rose 35% last week, the biggest rise since August. That prompted U.S. dollar-equivalent futures to a premium on the Japanese-Korean index, the Asian benchmark, for the first time since mid-May. Europe and Asia are competing for LNG shipments from the United States and the Middle East.

Renewable sources

Renewable diesel production is taking off in the United States — with capacity on track to reach about 385,000 barrels per day by 2025 — more than double what it was at the end of 2022, according to EIA data. Generous federal incentives have helped increase production of green fuels made from crop and animal fats that can replace petroleum diesel. The Environmental Protection Agency is set to decide this week how much biomass-based diesel should be blended into the country’s fuel supply in 2023, 2024 and 2025, amid concerns that the proposed targets dilute potential production.

Article content

Advertising 3

This ad hasn’t been uploaded yet, but your article continues below.

Article content

agriculture

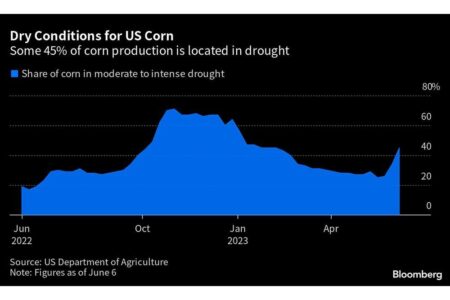

The US corn belt will be a major focus for the markets with crop conditions due on Monday and the weekly drought report on Thursday. Maize crops experiencing moderate to severe drought have seen a steady increase to 45% of the total. This compares to just 19% for the same period last year. Last week, the USDA refrained from changing its estimate for domestic corn production, despite the dry weather. This will keep traders guessing about the state of the crop until the next estimate is published in July. Corn for December delivery is down 13% this year in Chicago.

minerals

Cobalt is sure to be in focus this week as the Democratic Republic of the Congo – the world’s largest producer of primary batteries – hosts a mining conference. The price of the metal used in electric vehicle batteries and electronics has fallen nearly 30% this year to $13.90 a pound, according to Fastmarkets data, amid weak global demand and oversupply from new second producer Indonesia. Goldman Sachs Group Inc. expects Softer battery metals including cobalt, lithium and nickel in the second half of 2023 amid oversupply.

Advertising 4

This ad hasn’t been uploaded yet, but your article continues below.

Article content

oil

The volatile nature of oil trading continues, with futures emerging from a second weekly decline after advancing for the same time period in a constant struggle for sustained momentum. Despite shocks from sudden production cuts by both OPEC+ and Saudi Arabia, futures have fallen about 13% this year amid persistent concerns about economic growth and a slower-than-expected recovery in China. Oil traders will be closely watching monthly reports this week from the Organization of the Petroleum Exporting Countries (OPEC) on Tuesday and the International Energy Agency on Wednesday for clues to the path of supply and demand, which could further impact prices.

– With assistance from Gerson Freitas Jr., Mark Burton, Michael Hertzer, Dominic Curry, Jennifer A. Dlouhy, Kim Chipman, and Liesl Hill.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now receive an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation