The USD is closing today mixed. US stocks moved higher for the 4th consecutive day led by the NASDAQ once again . US yields moved lower out the curve.

Near the start of the US trading day, the US PPI data was released and came in stronger than expected

Data highlights showed:

- Headline PPI increased by +0.5% month-over-month (m/m), surpassing the expected +0.3%.

- YoY the final demand came in at 2.2% vs 1.6%. The Producer Price Index (PPI) was revised from +1.6% to +2.0%.

- Excluding food and energy, the year-over-year (y/y) increase was +2.7%, higher than the expected +2.3% (prior month 2.5% vs 2.2%)

- The month-over-month increase, excluding food and energy, remained at +0.2%, consistent with the revised prior data.

The market’s initial reactions showed the:

- The US dollar initially rose around 20 pips upon the release of the data but quickly retraced those gains and then moved to new lows vs some of the major currencies including the EUR, GBP, and CHF.

- US 10-year yields experienced a brief increase of 2 basis points but also retraced.

What analyst said:

- Treasuries benefited from a flight-to-quality bid, and were unaffected by the PPI release.

- Geopolitical uncertainty, especially developments in the Middle East, remains the primary market influence.

In addition, investors were likely cautious ahead of the more important CPI data scheduled for release tomorrow at 8:30 AM ET.

As the day progressed, the USD weakness went too far – especially with the CPI ahead – and declines in the greenback were retraced in the EURUSD, and GBPUSD. Meanwhile, the USDJPY moved to new session highs.

The Fed minutes were released later in the day. Although most officials are still concerned about inflation, there was a belief that there should be a shift in the focus to the duration of restrictive rates rather than their peak levels. That idea has been expressed more recently by Fed officials as well.

Below is a summary of the minutes by topic:

Economic Growth and Forecasts

- The Fed staff assumed GDP growth for the rest of 2023 would be slightly dampened by the UAW strike, but effects are expected to be unwound in 2024.

- Economic forecast was stronger than the July projection due to resilient consumer and business spending.

Policy and Rate Decisions

- Several participants noted that the balance sheet run-off could continue for “some time,” even after rate cuts begin.

- With the policy rate at or near peak, the focus should shift to the duration of restrictive rates rather than their peak levels.

- Most participants continued to see upside risks to inflation, and inflation was described as “unacceptably high.”

Economic Risks and Uncertainties

- Participants highlighted the highly uncertain future path of the economy.

- Data volatility and potential data revisions support a case for proceeding carefully in determining the extent of additional tightening.

- Risks included longer lag effects from financial tightening, the impact of union strikes, slowing global growth, and continued weakness in commercial real estate.

Labor Market and Unemployment

- Below-trend growth and a softer labor market were seen as necessary for restoring economic balance.

- There were continued downside risks to economic activity and upside risks to the unemployment rate.

Inflation Concerns

- Inflation was described as “unacceptably high,” with more evidence needed to be confident that price pressures are ebbing.

- Most participants continued to see upside risks to inflation.

Policy Meeting Insights

- During the Fed’s Sept. 19-20 policy meeting, participants generally judged that risks to achieving FOMC’s goals had become more two-sided.

In the US debt market today, the 2nd leg of the coupon auctions this week saw the auction of 10-year notes (well…the reopening of the 10 year note). Similarly to the 3-year note auction yesterday, the final auction results showed a larger tail vs the previous 6-months, the bid to cover was lower,, and international demand was also light. Yields did move higher soon after the results were announced, but by the end of day, yields had move back lower.

For the trading day, the shorter end of the treasury curve was marginally higher but the longer end saw sharply lower yields. A snapshot of the yield curve shows:

- 2-year yield 4.99%, +0.9 basis points

- 5-year yield 4.589%, -3.0 basis points

- 10-year yield 4.576% -7.8 basis points

- 30-year yield 4.716% -11.3 basis points

The 2 – 10 year spread – which got to within 26.8 basis points of a flat yield curve – is suddenly back to -41.8 basis points. The 2 – 30 year spread which reached -8.3 basis points just 2 days ago, is now negative by -27.8 basis points.

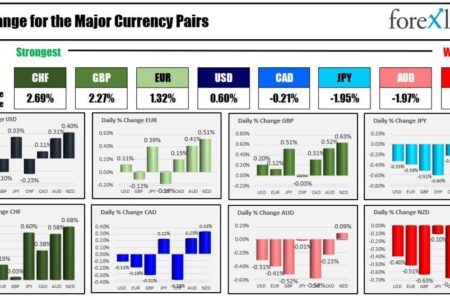

In the currency market, the CHF is ending the day as the strongest of the major currencies. The NZD is the weakest. The USD is ending the day near the middle of the pack and mixed with gains vs the JPY, CAD, AUD and NZD, and declines vs the EUR, GBP and CHF.

The strongest of the weakest of the major currencies

US stocks closed higher for the 4th consecutive day with the NASDAQ index leading the way again.

- Dow industrial average rose 65.57 points or 0.19% at 33804.88

- S&P index rose 18.71 points or 0.43% at 4376.94

- NASDAQ index rose 96.82 points or 0.71% at 13659.67.

The NASDAQ index closed above both its 100 and 50-day moving averages near 13605 (closed at 13659.67).

Tomorrow, the US CPI data will be released at 8:30 AM ET. The expectations are for a 0.3% rise in the headline number and the core. The year-on-year is expected to decline to 3.6% from 3.7%. Also of significance will be the weekly unemployment claims which are skimming just above the 200 K level. The expectations are for a modest increase to 211K from 207K last week. The U.S. Treasury will complete their coupon auctions with the auction of 30-year bonds at 1 PM ET.