Negotiations on raising the US debt ceiling have been suspended. Democrats pointed the finger at the Republican Party. The Republican Party pointed an accusing finger at the Democrats. Bryce. Biden returned from the G7 over the weekend, and I’m sure both sides know what’s at stake. However, the development worried market participants as they headed into the weekend. Initially, returns moved from highs as the focus was on expected low growth. The dollar fell. Gold rebounded. Stocks fell. However, the moves were somewhat limited.

Meanwhile (and at the same time), Fed’s Powell was participating in a panel discussion with former Fed Chairman Bernanke. Powell chose his words closely and covered most of the bases in the process. Powell points out that because bank credit conditions have tightened, interest rates may not need to rise to the level that might otherwise be expected. However, he noted that market pricing points to a different rate path than the Fed, presumably expecting a faster drop in inflation. However, he stresses that current data supports the view that it will take time to bring down inflation. It also highlights the inclusion of risk compensation in market rates (cutting rates below what even analysts expect). Finally, Powell stated that while the Fed has not yet determined whether rates are sufficiently constraining (inflation is still very high), the goal is to reach a sufficiently constraining policy stance. The Fed has not decided how much tightening might be necessary, but Powell notes that the balance between doing too much and too little is becoming more balanced.

After the dust settled and the events ended, US stocks ended the day slightly lower. Yields end up higher, but they are near the middle of the ranges. The US dollar ended the day as the weakest of the majors (despite rising interest rates) but far from the lows.

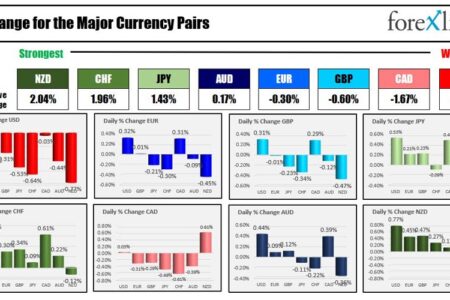

Looking at the strongest to weakest ranking, the NZD and CHF end up as the strongest of the major currencies. The US dollar and the Canadian dollar are the weakest.

From the strongest to the weakest among the major currencies

During the trading week, the US dollar closed mixed as the greenback moved further to the upside against the Japanese yen, but lower against the New Zealand dollar. US dollar changes showed:

- EUR + 0.40%

- Japanese yen, +1.51%

- GBP + 0.06%

- CHF + 0.11%

- Canadian Dollar, -0.46%

- Australian dollars, -0.09%

- NZ – 1.37%

The price of Oil increased by 2.61% which benefited the Canadian dollar (the dollar was down -0.46% against the Canadian dollar). Meanwhile, gold is down -1.67% this week. The downward move did not hurt the Australian dollar (it ended little changed against the greenback). The Dollar rose modestly against the EUR by +0.40%. Overall, the Dollar Index (DXY) was up 0.47%.

For US stocks this week:

- The Dow rose 0.38%.

- The S&P rose 1.65%

- The Nasdaq rose 3.04%.

In the US bond market, yields rose this week with the biggest weekly move in the two years since September 2022. The 10 year end the week with the largest gain since February.