US March employment data came in below expectations at 175K versus estimates of 243K. The prior month was revised higher to 315K from the previously reported 303K. The unemployment rate rose to 3.9% from 3.8%, while average hourly earnings reached 3.9% year over year, the lowest level since 2021. The average workweek also fell to 34.3 from 34.4 last month.

Information jobs fell by -8k and professional and business services showed a decline for the month of -4k. Other weak sectors included government (+8k), financial activities (6k), leisure and hospitality (+5k), and construction (+9k).

Goods production jobs added just 14K while special services production jobs added 153K driven by a 95K gain in education and health.

Data is for one month only. The Fed chairman hinted after the Fed meeting that he would need a slowdown in the US labor market to help convince the Fed that growth and inflation are likely to decline further. The Fed Chairman this week spoke less hawkish than expected, saying a rate hike is not likely (at least for now). There was concern that the Fed was moving toward a more consistent policy stance.

Today's report allowed a sigh of relief, but should be followed by signs that inflation is easing and that job growth has already begun to decline.

Later in the day, the ISM-driven non-manufacturing component of prices did not help, rising to 59.2 from 53.4 last month. The report on the CPI and PPI later this month will be relevant again.

In other news, masks were lifted for other Fed officials today along with Fed Governor Bowman and the Chicago Fed President. Both Golsby spoke after the US jobs report.

Fed Governor Michelle Bowman (more of a hawk) lamented the complexity of managing inflation and interest rates amid mixed economic indicators. She stressed that while inflation is expected to decline with current interest rates, the Fed remains open to further interest rate increases if inflationary trends do not improve or if they worsen.

Bowman noted several potential risks that could negatively impact the economic outlook, including doubts about whether supply-side improvements will continue to help lower inflation. In addition, factors such as strong consumer demand, high immigration rates, and a tight labor market can consistently lead to higher inflation for basic services. She also noted that any fiscal stimulus could boost consumer demand further, complicating efforts to control inflation.

Despite the challenges posed by large data revisions in recent years, Bowman highlighted the flexibility of monetary policy, stressing that it is not on a predetermined path and that decisions will be designed according to the latest economic data. She reiterated the importance of restoring price stability to support long-term employment goals. Term.

Later, Federal Reserve official Austin Goolsbee expressed confidence that the economy is not overheating, as evidenced by jobs reports that resemble pre-coronavirus conditions. Goolsbee acknowledged a temporary spike in inflation earlier in the year but noted that continued job growth without overheating could indicate a stabilizing economy. He also pointed to the need to re-evaluate labor market dynamics in light of high migration rates and the absence of supply chain bottlenecks, which were previously a concern. In addition, feedback from manufacturing business contacts indicates a stable economic environment.

Goolsby stressed the importance of balancing restrictive monetary policies to avoid negatively impacting employment, noting that the Federal Reserve is carefully monitoring these developments to ensure they are consistent with long-term economic stability and inflation control.

Today's moderate data helped push US stocks sharply higher, US bond yields lower and the US dollar lower.

Looking at stock closing levels, we find that all three major indexes rose by more than 1% (and the Nasdaq by about 2%). The Russell 2000 small-cap index rose just under 1% (0.97%).

- The Dow Jones Industrial Average rose 1.18%.

- The Standard & Poor's index rose 1.26%.

- The Nasdaq rose 1.99%.

- The Russell 2000 rose 0.97%.

All major indexes rose during the week, with the Nasdaq up 1.43% and the Russell 2000 up 1.68% leading the way.

In the US debt market, yields were lower but far from their closing lows

- The two-year yield is 4.805% after trading as high as 5.046% this week. Over the course of the week, the two-year bond yield fell by -18.0 basis points

- The 10-year yield is 4.497% after trading at a high of 4.695% this week. Over the course of the week, the 10-year bond yield fell by -15.5 basis points.

- The 30-year yield is 4.660% after trading as high as 4.800% this week. Over the course of the week, the 30-year bond yield fell by -11.0 basis points

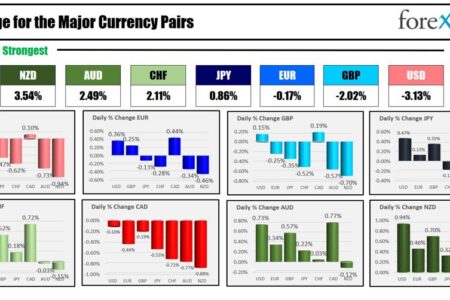

Today in the Forex market, the New Zealand Dollar and the Australian Dollar were the strongest major currencies in terms of risk flows. The Canadian dollar and the US dollar were the weakest among the major currencies.

From strongest to weakest among major currencies

During the trading week, the DXY index decreased by -0.958%.

Against major currencies, the US dollar fell:

- -0.63% against the euro

- -0.45% against the British pound

- -3.38% against the Japanese yen

- -1.03% against the Swiss franc

- -1.18% against the Australian dollar, and

- -1.24% against the New Zealand dollar

The US dollar rose 0.12% against the Canadian dollar this week

Things calm down next week as the earnings calendar gets lighter. Only Nvidia on May 22 is a potential big market mover.

About events and the calendar of economic releases:

- Reserve Bank of Australia interest rate decision on Tuesday. No change expected

- US 10-year bond auction on Wednesday

- Bank of England interest rate decision on Thursday. No change expected

- 30-year US bond auction on Thursday

- UK GDP on Friday

- Employment statistics in Canada on Friday

- Consumer confidence index in Michigan, US on Friday