Core PCE prices in the US (excluding food and fuel costs) for May increased by 0.3% as expected but the yearly level was mostly lower at 4.6% versus 4.7% last month and expected. The personal consumption expenditures price index decreased from 4.3% to 3.8%. It was the first decline below 4% since early 2021. Personal consumption (adjusted for inflation) was flat after 0.2% last month. Personal income increased 0.4% versus 0.3% last month. Adjusted for inflation, May spending was flat.

Later consumer sentiment surpassed the University of Michigan’s preliminary index of 63.9 with a rise of 64.4. The gain was much higher than 59.2 last month. Within the report, one-year inflation expectations were held steady at 3.3% (versus 4.2% last month). The 5-year inflation forecast was also flat at 3.0% (same as initially) and marginally down from 3.1% last month.

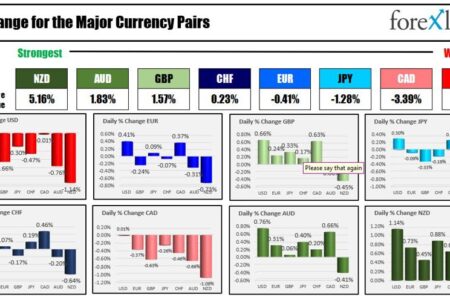

The US dollar fell as traders focused on hopes of lower inflation ahead. The US dollar ends the day as the weakest of the major currencies. NZD is the strongest.

From the strongest to the weakest among the major currencies

Coming to the end of the month and looking at the major currencies against the US dollar this month, the US dollar is mostly lower. The exception is against the Japanese yen as the dollar gained 3.58% against that currency.

Here are the percentage changes in the US dollar against the respective currencies in June.

- Euro: -2.06%

- Japanese yen: + 3.58%

- GBP -2.07%

- CHF, -1.71%

- -2.38% Canadian

- Australian dollar: -2.45%

- New Zealand dollar: -1.96%

In the first half of 2023, the US dollar was mixed with a solid gain of 10%+ against the Japanese yen. The dollar also rose against the Australian and New Zealand dollars, but fell against the euro, British pound, Swiss franc and Australian dollar. The dollar was weakest against the British pound (down 5%):

- Euro: -1.96%

- Japanese Yen + 10.07%

- GBP: -5.03%

- CHF: -3.16%

- Canadian Dollar: -2.16%

- Australian dollar: +2.27%

- New Zealand dollar: + 3.33%

Consider other markets today:

- West Texas Intermediate crude futures rose $0.61, or 0.4%, to $70.45. For the month, prices were up 3.47% (an increase of $2.34).

- Gold rose $11.95, or 0.63%, at 1919.36. For the month, the price is down -2.21% (down $43.41)

- Silver rose today by $0.19, or 0.84%, to $22.74. For the month, prices are up 3.45% (an increase of $2.36)

- Bitcoin had a volatile day as the price fell to $29,508 after trading as high as $31,268. It is trading at $30,339. For the month, bitcoin is up 12%, or $3,178

Looking at US stocks today, all of the major indices closed with a strong rise. The gains were led by the Nasdaq, which posted its best first half of the year in 40 years.

- The Dow Jones Industrial Average rose 285.18 points, or 0.4%.

- The S&P was 53.92, or 1.23%.

- The Nasdaq rose 196.60 points, or 1.45%.

For the trading month:

- The Dow Industrial Average rose 4.56%.

- The S&P rose 6.47%.

- The Nasdaq rose 6.59%.

Gains in 2023 were driven by big tech stocks.

Among the big gainers at 1H include:

- Nvidia rose 189.46%

- Meta up 1.38.47%

- Tesla rose 112.51

- Microsoft rose 42%

- Apple rose 49.15%

- Amazon increased by 50.13%

- Alphabet rose 35.67%

- Broadcom rose 55.14%

- Chipotle rose 54.16%

Next week begins with a trading holiday in the US due to the Fourth of July holiday on Tuesday. The stock and bond markets will close early.

The week will end with the all important US jobs report as the Non-Farm Payrolls are expected to add 222K (last month plus 339K). The unemployment rate is expected to decline to 3.6% from 3.7% last month, and average hourly earnings are expected to increase by 0.3%.

Canada will also release jobs data on Friday, with limited change expected at 22,000 (vs -17.3k last month.

Among them, other major events include:

- The Reserve Bank of Australia will announce its latest interest rate decision on Wednesday in Australia. Market participants are torn between no change and a 25 basis point hike

- ISM data will be released on Monday in Europe and the United States.

- Minutes of the FOMC meeting will be released on Wednesday at 2 p.m

- The US services PMI will be released on Thursday.

thanks for your support. I wish you a nice weekend.