Article by IG Chief Market Analyst Chris Beauchamp

FTSE 100, DAX 40, S&P 500 Analysis and Charts

FTSE 100 in bullish short-term form

The rally off the 7300 continued on Thursday, with impressive gains for the index that have resulted in a move back through 7400. This now leaves the index on the cusp of a bullish MACD crossover, and could now see the price on course to test the 200-day SMA, and then on to 7700.

A reversal back below 7320 would negate this view.

FTSE 100 Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 13% | -25% | 0% |

| Weekly | -9% | 19% | -3% |

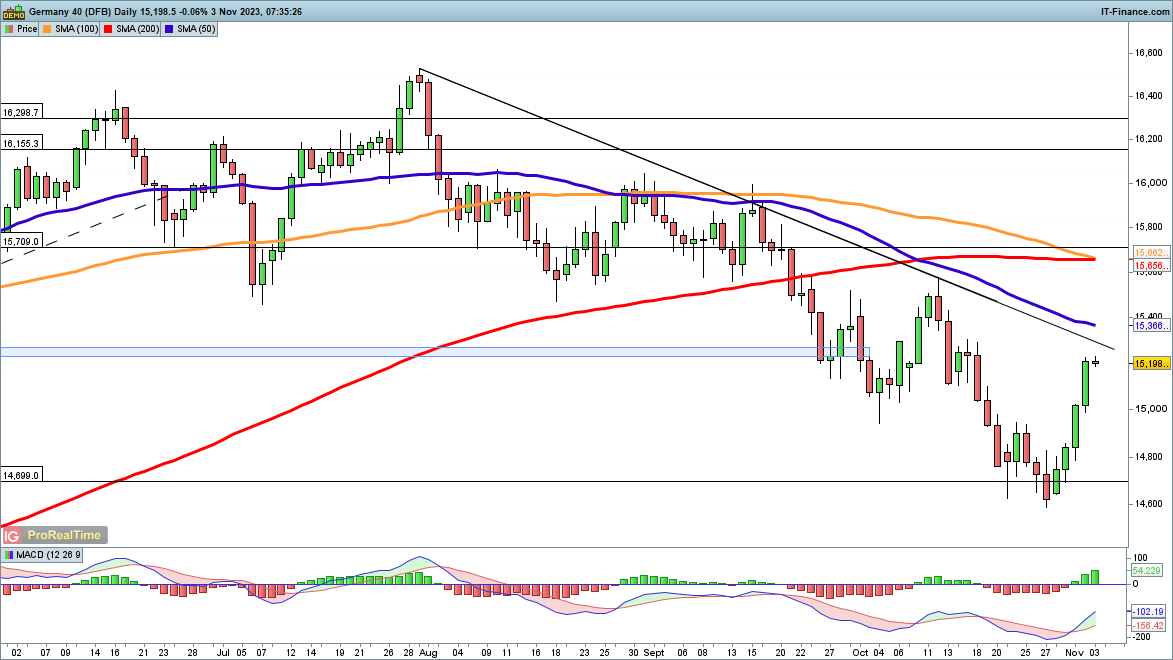

Dax 40 at two-week high

The index made big gains for a second consecutive day, and with a fresh bullish MACD crossover the buyers appear to be firmly in charge.The next stop is trendline resistance from the August record high, and then on the declining 50-day SMA, which the index has not challenged since early September.

A failure to break trendline resistance might dent the bullish view, though a close below 15,000 would be needed to give a firmer bearish outlook. This would then put the lows of October back into view.

DAX 40 Daily Chart

S&P 500 in strong form ahead of non-farm payrolls

The index has recouped a significant amount of the losses suffered in October, and like the Dax is now barrelling towards trendline resistance and then the 50-day SMA.Beyond these lies the 4392 peak from early October, and a close above here would solidify the bullish view.

A reversal back below the 200-day SMA would signal that the sellers have reasserted control and that a move back towards 4100 could be underway.

S&P 500 Daily Chart

Recommended by IG

Get Your Free Equities Forecast