A busy week for central banks means forex has a lot of repricings!

Less optimistic than expected meeting minutes from the Bank of Japan and the Reserve Bank of Australia pulled the Aussie and the yen in the course of the week, while growth concerns also sent the British pound lower.

Meanwhile, the US dollar benefited from upbeat testimonials from Powell as well as some good old risk aversion, falling against the Canadian dollar only by Friday’s close.

US dollar pairs

Overlaying the US dollar against major currencies Planned by TV

Risk aversion and expectations of upbeat testimonials from Fed Governor Powell gave the greenback a boost early in the week, especially against “risky” bets such as the Australian dollar and the New Zealand dollar.

The US dollar gave back some of its gains during the week when Powell hinted at rate hikes at least twice this year, but he wasn’t very clear about when those hikes would happen.

Traders finally addressed the Fed’s rate-hike intentions on Thursday, and the dollar quickly hit new highs for the week against its major peers.

🟢 Ascending main arguments

Treasury Secretary Yellen She said she sees less recession risk in the US, and a consumer slowdown is needed to contain inflation.

In her remarks at a community event, Federal Reserve Board Member Michael Bowman he said thatFurther increases in the policy rate will be necessary to bring inflation down to our target over time.“

Powell on Thursday: FOMC Members’I think there are more price increases coming but we want to make it at a pace that allows us to see the information coming in.“

Existing Home Sales For May: +0.2%m/m to 4.3m units (forecast -0.5%m/m; -3.2%m/m prior);

During his testimony before the House Financial Services Committee, Fed Chairman Powell Be warned that less than trend growth is likely to be needed; It is possible that there will be a price increase in the future but it is likely that it will be at a more moderate pace and dependent on the data.

Building permits For May: 1.49 million (1.425 million forecast; 1.42 million prior); Housing starts at 1.63M vs. 1.4M expected

Love: US housing construction sentiment It jumped from 50 to an 11-month high of 55 in June as limited supply continued to encourage new construction.

🔴 descending main arguments

current account For the first quarter of 2023: – $219.3 billion (forecast $218.2 billion; – $216.2 billion previously)

Chicago Fed National Activity Index For May: -0.15 (expected 0.15; prior 0.14)

Initial weekly unemployment claims For the week ending June 17: 264k vs. 271k for the previous week

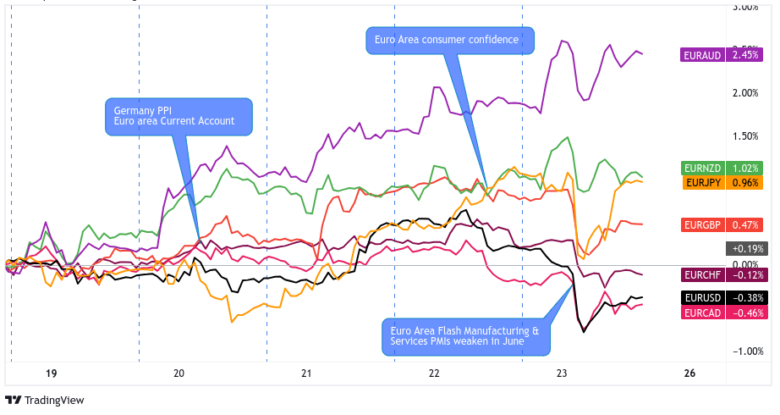

euro pairs

Overlay the euro against major currencies Planned by TV

The EUR started the week mixed as traders focused more on currencies with central bank events such as the Australian Dollar, Japanese Yen, Sterling and the US Dollar.

The single currency started to gain traction in the middle of the week when the ECB’s hawkish bias came to the fore while markets worried about global growth trends.

The euro fell sharply on Friday, however, when manufacturing and services PMIs from Germany, France and the eurozone hit multi-month lows, but was still able to emerge as a net winner at Friday’s close.

🟢 Ascending main arguments

Consumer Confidence Index for the Eurozone for the month of June: +1.3 points to -16.1; The European Union was +1.1 points vs. -17.2

Member of the Executive Board of the European Central Bank Schnabel He sees prices rising due to corporate profits and higher salaries

The current account of the eurozone For the month of April: a surplus of 4 billion euros compared to a surplus of 31 billion euros in March

Slovak Central Bank President Peter Casimir said on Monday that The European Central Bank should raise interest rates again in july

🔴 descending main arguments

HCOB Eurozone manufacturing PMI It fell from 44.8 to a 37-month low of 43.6 in June, PMI Services It also recorded a five-month low from 55.1 to 52.4.

Deteriorating demand conditions dragged HCOB German Manufacturing PMI from 43.2 to 41.0 (37-month low) in June while PMI Services It fell from 57.2 to a 3-month low of 54.1

HCOB France Manufacturing PMI it fell from 45.7 to a 37-month low of 45.5 in June; PMI Services It also fell from 52.5 in May to a 28-month low of 48.0 in June.

German producer price index For May: -1.4% m/m (-0.6% m/m expected; +0.3% m/m previously)

Sterling pairs

Overlay GBP against major currencies Planned by TV

The pound was all over the place in the first half of the week as traders priced in their expectations of the BoE’s decision.

The pound hit new lows in the week when the UK inflation rate fell more than expected in May. UK consumer price inflation rose 8.7% year-on-year in May, which could force the Bank of England to raise rates above a potentially recession-inducing 6.0%.

The currency regained some of its losses when the Bank of England surprised markets by raising interest rates by 50 basis points instead of the 25 basis points that markets had expected, and then extended its gains when the United Kingdom printed better-than-expected consumer confidence and retail sales data on Friday.

🟢 Ascending main arguments

retail It slowed from 0.5%m/m to 0.3%m/m in May (but against -0.2%m/m expected) thanks in part to warm weather boosting out-of-store retail activity

GfK Consumer Confidence It rose for the fifth consecutive month, up from -27 to -24 in June despite higher inflation and interest rates.

The Bank of England surprised by raising interest rates by 50 basis points to 5.00%. on Thursday by a vote of 7-2

UK inflation Still at 8.7% year-on-year in May, the fourth consecutive month that the CPI beat market estimates.

🔴 descending main arguments

S&P Global UK Manufacturing PMI It fell from 47.1 to a six-month low of 46.2, while the services PMI also fell from 52.8 to a three-month low of 52.8.

Factory gate prices It rose 2.9% year-on-year in May versus a 5.2% increase in April

product input prices It rose 0.5% year over year in May, down 4.2% in April

rightmove: Asking for British house prices It fell in June for the first time in six years, thanks to higher mortgage expectations and interest rates

Swiss Franc pairs

Overlay the Swiss Franc against major currencies Planned by TV

The safe-haven franc lost a few pips on Tuesday as traders favored the US dollar ahead of Powell’s testimony.

The Swiss Franc started to make gains midweek as markets were shifting their focus to higher interest rates and possibly lower global growth prospects.

The franc has remained largely within wide ranges except against the Australian and New Zealand dollars which have been affected by risk aversion.

🟢 Ascending main arguments

The Swiss National Bank raised interest rates by 25 basis points, to 1.75%.This is the highest rate since April 2002. President Jordan does not rule out further price hikes.

trade surplus It expanded from CHF 2.56 billion to CHF 5.48 billion in May as exports (+21.1%) outpaced imports (+7.3%) growth

AUD pairs

Overlay the Australian dollar against major currencies Planned by TV

The Australian dollar was the biggest loser this week thanks to general risk aversion and it appears that the RBA was not as hawkish as investors had earlier thought when members raised interest rates in June.

The Australian dollar lost a number of pips against all of the major currencies, with the Canadian dollar and the US dollar seeing the highest gains against the greenback.

🟢 Ascending main arguments

BMI manufacturing It rose from 48.4 to a three-month high of 48.6 in June as output contracted at the slowest pace since February.

🔴 descending main arguments

PMI Services It fell from 52.1 to 50.7 even as companies continued to hire additional staff in June

Westpac – Melbourne Leading Index Further decline from -0.78% to -1.09% in May, the 10th consecutive negative reading for the index

RBA meeting minutes It showed that the arguments for raising interest rates were “quite balanced,” with members weighing the risks of inflation, a tightening labor market, and rising home prices.

CAD pairs

Overlaying the Canadian dollar against major currencies Planned by TV

The Canadian dollar was the biggest gainer this week despite the drop in oil prices and widening risk-off sentiment.

An argument could be made that given the positive Canadian updates (which further boosted the resilience of the Canadian economy), the Loonie was an attractive short-term alternative to the negative net currency and risk aversion sentiment that persisted this week.

🟢 Ascending main arguments

retail In April 2023: +1.1% m/m (+0.2% m/m expected; -1.5% m/m previously); Core retail sales were +1.3% m/m (+0.2% m/m expected; -0.4% m/m prior)

The new home price index For May: +0.1% m/m (-0.2% m/m expected; -0.1% m/m previously)

🔴 descending main arguments

Industrial PPI For May: -1.0% mom versus -0.6% mom in April; The raw material price index fell -4.9%m/m vs. +1.8%m/m in April

NZD Pairs

NZD overlay against major currencies Planned by TV

Like the Australian dollar, the New Zealand dollar also fell victim to growth concerns in China and general risk aversion in the first half of the week.

Unlike the Australian dollar, though, the New Zealand dollar recovered some of its losses and even maintained its wide ranges against most of its peers until a sell-off late Thursday pushed it to its lowest levels for the week towards the end of the week.

🟢 Ascending main arguments

Global dairy trade price indexAverage price: fixed at $3,479 at the most recent auction

Westpac: New Zealand Consumer Confidence The index rose from 77.7 to 83.1 in June, but households remain very pessimistic amid rising costs of living and mortgage rates.

BusinessNZ Services Index It increased by 3.2 points from an upwardly revised 50.1 in April to 53.3 in May. All five procedures showed expansion.

🔴 descending main arguments

New Zealand’s trade surplus It contracted from NZD148.2m to NZD46m in May as imports (+4.4% yoy) outpaced exports (+2.8% yoy)

Japanese yen pairs

Overlaying the Japanese Yen against major currencies Planned by TV

Global growth concerns early in the week sent the safe-haven yen higher against its peers.

The BoJ rained down on showing the yen’s rise, though, when minutes from its meeting hinted that BoJ members remain confident in keeping their policies accommodative while their peers tighten.

The yen fell almost steadily on Wednesday and Thursday. It wasn’t until Friday when the Euro-Zone released disappointing PMI reports that the JPY had recovered slightly, but eventually fell to the JPY selling pressure at the weekend.

🟢 Ascending main arguments

CPI National Corewhich excludes volatile fresh food prices, came in at 3.2% yoy in May, higher than the expected 3.1% yoy but slower than April’s reading of 3.4% yoy.

Bank of Japan meeting minutes One member showed a desire to ensure their policy is “not behind the curve” as wages and inflation accelerate

🔴 descending main arguments

Flash bank au gibbon Japan Manufacturing PMI Decreased from 50.6 to 49.8 contraction in June as both output and new orders fell while new orders fell at their sharpest pace since February