GBP Analysis (GBP/USD, EUR/GBP)

- All eyes are on a highly anticipated Fed rally this evening

- GBP/USD Remains Supported, Moving Up Inside the Ascending Channel

- EUR/GBP is testing long-term resistance ahead of tomorrow’s ECB decision

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Find out what’s in store for Sterling in the second quarter

All eyes are on the highly anticipated Fed rally this evening

The Federal Open Market Committee is set to announce this evening one of the most anticipated rate hikes of the current tightening cycle. Despite the volatility of bond movements, the Fed has already decided in advance that the FUD funds rate will peak at 5.1% (the median value), indicating that a rise above 5% will be the last.

Just yesterday, markets had a pricing in over a 97% chance that we’d actually see a 25 basis point rally this evening, a figure that has been pulled back in light of the undeniable risk aversion seen yesterday with the US going online. Renewed banking concerns made their way through the industry again after JP Morgan absorbed First Republic Bank, as oil traded sharply lower while safe-haven gold rose above its recent range.

Source: CME FedWatch

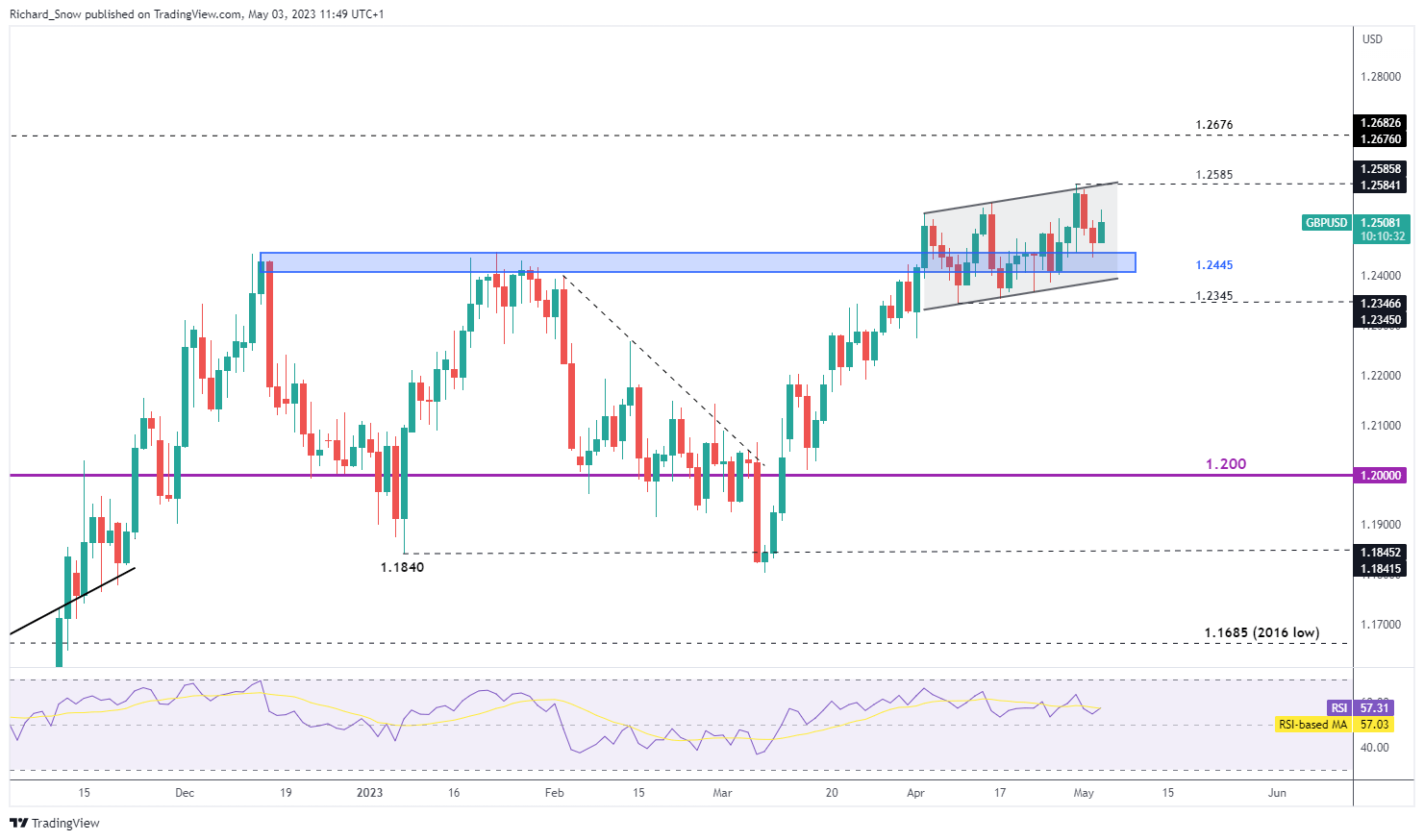

GBP/USD remains supported, moving higher within the ascending channel

Cable certainly benefited from the slow decline in the dollar, as the pair saw a fresh yearly high on Friday. Interest rate hikes usually tend to support the local currency, but markets are already eyeing a 50 basis point rate cut in anticipation of worsening economic conditions.

With the Fed expected to peak this evening, the BoE continues on a walking path where inflation remains in double digits – the highest in Western Europe and among developed countries. With this in mind, the cable is heading to the upside – inside the ascending channel, after it recently bounced off the support at 1.2445. The bullish resistance at 1.2585 is still in sight ahead of the FOMC meeting.

GBP/American dollar daily chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Learn about the #1 mistake traders make and avoid it

EUR/GBP is testing long-term resistance ahead of tomorrow’s ECB decision

The chart below reveals a narrowing in price action as lower highs and higher lows emerged in 2023 for the EUR/GBP. The lack of a long-term trend is not surprising given that both central banks are eager to continue raising interest rates in their fight against inflation.

On the technical front, the pair faced rather stiff resistance at 0.8865 in the run-up to disappointing US GDP data on April 27 which added to growing concerns surrounding global growth. The move reversed sharply higher after reaching 0.8760 and is now testing key trendline resistance. Upside challenges remain above current levels as 0.8865 proves difficult to break if we see more follow through. On the downside, 0.8760 indicates the next important support level.

EUR/GBP daily chart

Source: TradingView, prepared by Richard Snow

Important data this week

For sterling, there is a distinct lack of event risk as the Brits look to the king’s coronation the weekend before Bank of England meet next week. The Federal Reserve dominates the risk events scheduled for today with ISM PMI Services Print ahead of the Fed’s interest rate decision and important press conference. Tomorrow, it is the European Central Bank’s turn with its own press conference and we end the week with the Non-Farm Payroll report after the US Job Opportunities (JOLTS) data revealed that about 384K jobs were removed. Could this provide an early sign of a tight labor market? Possibly, but that would have to be accompanied by a significant drop in NFP data.

Customize and filter live economic data via DailyFX Economic calendar

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @employee