British Pound (GBP/USD)Analysis and Charts

- The first UK rate cut is likely at the end of Q2.

- US CPI and monthly UK GDP data near.

Most Read: EUR/GBP – Respecting Multi-Month Boundaries

Download our Complimentary Q1 2024 British Pound Technical and Fundamental Outlook

Recommended by Nick Cawley

Get Your Free GBP Forecast

The first UK interest rate cut forecast has been pushed back in recent days with the May 9th meeting now seen as the first opportunity for the Bank of England (BoE) to begin easing monetary policy. Financial markets are currently pricing in a total of 116 basis points of cuts this year, compared to the five quarter-point reductions forecast at the end of last year when rate cut euphoria was at its peak. This trimming of expectations has helped to underpin the British Pound against the US dollar and the Euro.

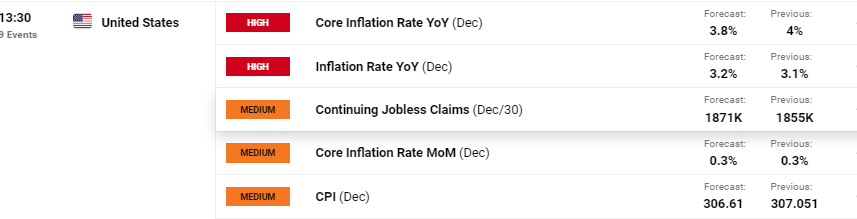

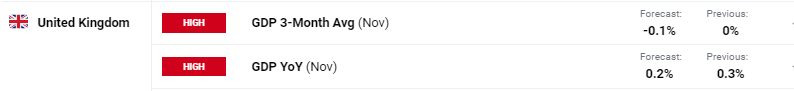

The economic calendar has three notable events later this week that may steer GBP/USD in the weeks ahead. On Wednesday BoE governor Andrew Bailey will appear, along with Sarah Breeden (BoE deputy governor for financial stability), Carolyn Wilkins (external FPC member), and Jon Hall (external FPC member), in front of the Treasury Select Committee to discuss December’s Financial Stability Report. On Thursday, the latest US inflation report will hit the screens at 13:30 UK, while on Friday the latest UK GDP data will be released by the Office for National Statistics at 07:00 UK, along with November’s manufacturing and industrial production data.

January 11th

January 12th

For all market-moving economic data and events see the DailyFX Economic Calendar

The daily GBP/USD chart shows GBP/USD back above 1.2700 but struggling to hold yesterday’s gains. The 20-day simple moving average may provide short-term support, currently at 1.2698, before 1.2667 and a cluster of prior lows around 1.2615 come into focus. A break above the 1.2770-1.2775 zone would see GBP/USD target the December 28th high of 1.2828.

GBP/USD Daily Price Chart

Chart using TradingView

Retail trader GBP/USD data show 43.05% of traders are net-long with the ratio of traders short to long at 1.32 to 1.The number of traders net-long is 1.19% lower than yesterday and unchanged from last week, while the number of traders net-short is 16.67% higher than yesterday and 23.76% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

What Does Changing Retail Sentiment Mean for GBP/USD Price Action?

| Change in | Longs | Shorts | OI |

| Daily | 5% | 4% | 5% |

| Weekly | 1% | 27% | 13% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.