Gold, XAU/USD – price action and forecast:

- XAU/American dollar rose sharply after US retail sales rose less-than-expected in June.

- gold It met a bullish inverse head and shoulders pattern.

- What’s next for the yellow metal and what are the key levels to watch in XAU/USD?

Find out what kind of forex trader you are

Gold jumped after US retail sales rose less-than-expected in June, weighing on US Treasury yields and the dollar.

Although core retail sales came in below expectations, core consumer spending looked solid, thanks to a tight labor market. The mixed retail sales report came on the heels of US CPI and PPI data. However, broader economic data, according to the Economic Surprise Index, remains strong – the US ESI index hit a two-year high earlier this month before easing slightly.

The outsized response in the US dollar to weak inflation and retail sales, which continues to portray a resilient economy, suggests that the market is in no mood to buy dollars amid a growing perception that the Fed is about to end the tightening cycle.

Interest rate futures show a 99% chance of a quarter percentage point hike at the July 25-26 meeting, according to CME FedWatch. However, the market is pricing in rate cuts starting around mid-2024, with approximately 5 rate cuts by the end of next year. Market expectations contrast with two rate hikes by the Fed before the end of the year and no rate cuts until 2025.

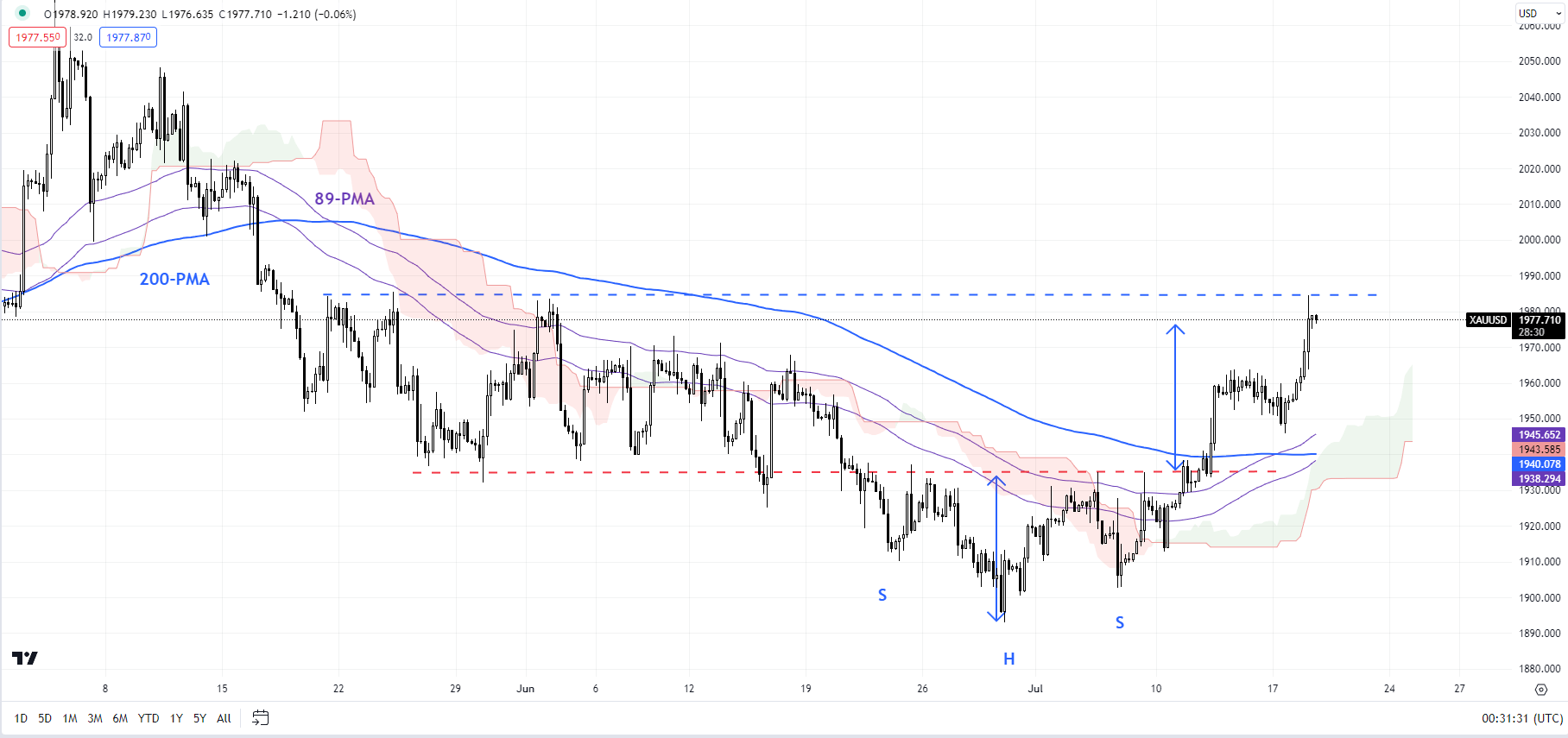

XAU/USD 240 minute chart

Chart by Manish Gradi using TradingView

The US 10-year TIPS Index has fallen sharply since last week after US inflation data confirmed that price pressures are easing. Gold’s rebound mirrors decline in real yields – the yellow metal tends to move inversely to real (adjusted for inflation) yields. The higher opportunity cost (real returns) tends to reduce the yellow metal’s attractiveness.

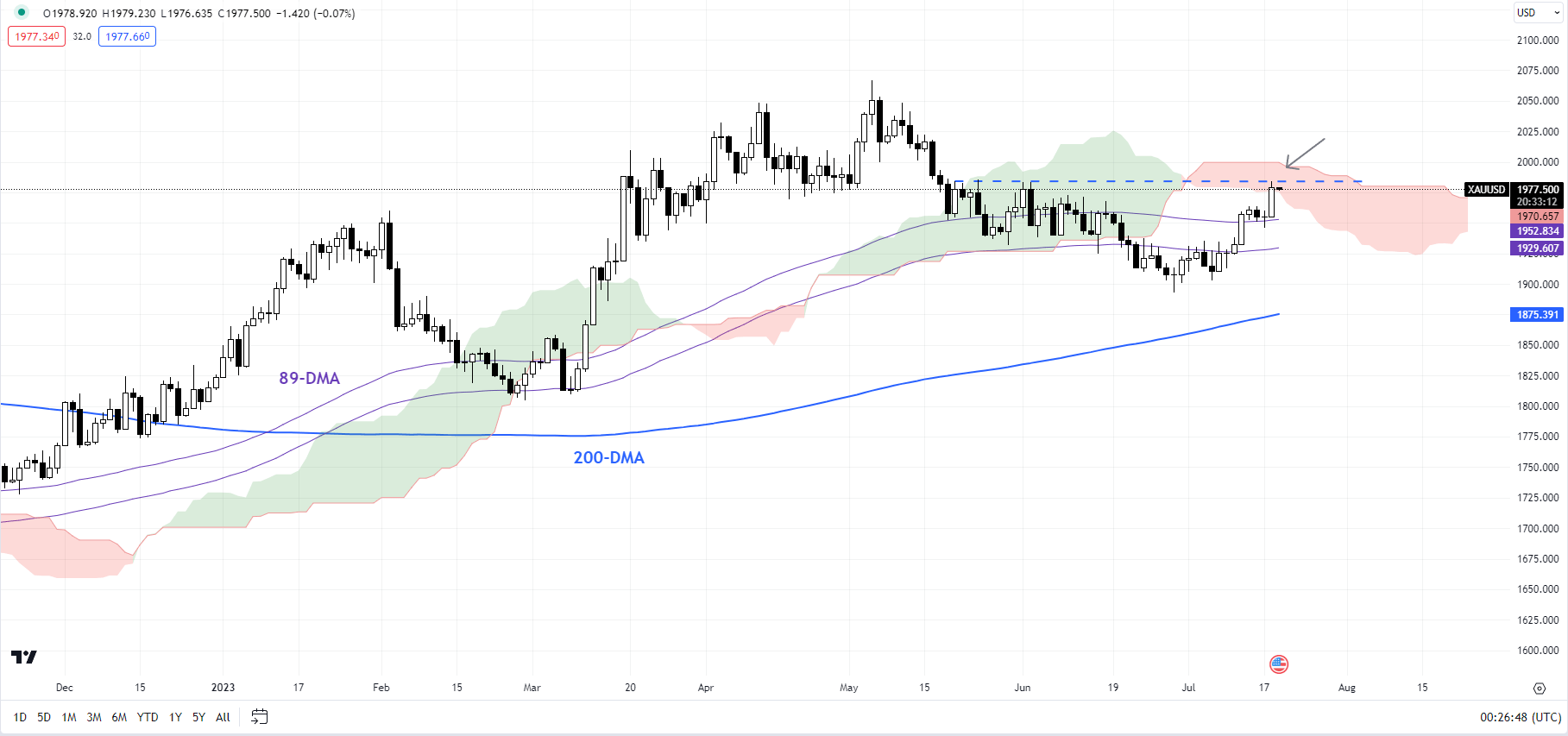

XAU/USD daily chart

Chart by Manish Gradi using TradingView

On the technical charts, XAU/USD has met the price target of the secondary inverse head and shoulders pattern launched last week. See “Gold Bolstered by US CPI; Reversal Head and Shoulders Indicators in XAU/USD,” published on July 13. The left shoulder is lowest in late June, the head is lowest for the end of June, and the right shoulder is lowest in early July. The price target for this pattern is around 1980.

From a sentiment perspective, roughly 60% of retail traders are still net gold, although some longs have been curtailed recently, according to IG Customer Sentiment (IGCS).

XAU/USD is now testing a solid barrier at the early June 1983 high, just below the upper edge of the Ichimoku Cloud on daily charts (now circa 1998). The momentum and temporary trend has definitely shown up on the intraday charts (particularly the upward sloping 89-period moving average on the 240-minute charts). However, gold will need to filter 1983-1998 for the medium-term downward pressure to fade.

Recommended by Manish Grady

Get your free stock forecast

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish