Outlook for gold prices

- gold prices Lacking directional conviction, he oscillates back and forth between profit and loss

- Despite the price action on Wednesday, the precious metal may come under pressure after the recent hike in interest rates

- US Treasury yields rose after the first quarter gross domestic product It was revised sharply higher and Unemployment Claims surprise to the downside

Recommended by Diego Coleman

Get your free gold forecast

Most read: Gold price is approaching a major Fibonacci support as Powell maintains bullish expectations

Gold price (XAU/USD) lacked directional conviction on Thursday in a choppy session. Early in the morning, the metal fell to its lowest level since March 15 after the strong US economic data, but then managed to reverse its decline to trade slightly higher near $1,910.

Key stats released this morning showed that US gross domestic product grew by 2.0% year-on-year during the first quarter, much higher than the initial estimate of 1.3%, but the good news didn’t end there. The latest batch of Initial Jobless Claims surprised lower by a wide margin, coming in at 239,000 vs. 265,000 expected, reversing the upward trend of recent weeks and suggesting that the job market remains healthy.

US economic data

source: DailyFX Economic Calendar

Strong macroeconomic results lifted US Treasury yields across the curve, with the two-year note up more than 15 basis points and close to 4.9%, the highest level since March 9.

Price action, in turn, boosted the US dollar against its lower-yielding counterparts, leading the DXY to erase losses from the overnight session and climb into positive territory, creating a negative backdrop for the precious metals, at least initially.

The remarkable resilience of the US economy is likely to give the FOMC coverage to raise interest rates again in the coming months, in line with its guidance. The Fed paused its hiking campaign in June, but indicated the process is not over, and expected 50 basis points of additional tightening through the end of the year.

Markets were initially skeptical of the Fed’s hawkish roadmap, based on the assumption that the country was heading for a recession, but the information received seriously undermined that hypothesis. Not only is the economy not collapsing, but it seems to be stabilizing and improving on the margins.

Against this background, we can see a quarter-point rise in July and another of the same magnitude in September. This scenario could keep both the nominal and real yields biased to the upside, weighing on gold prices in the near term. This could mean more losses for bullion heading into the third quarter.

Recommended by Diego Coleman

How to trade gold

Technical analysis of gold prices

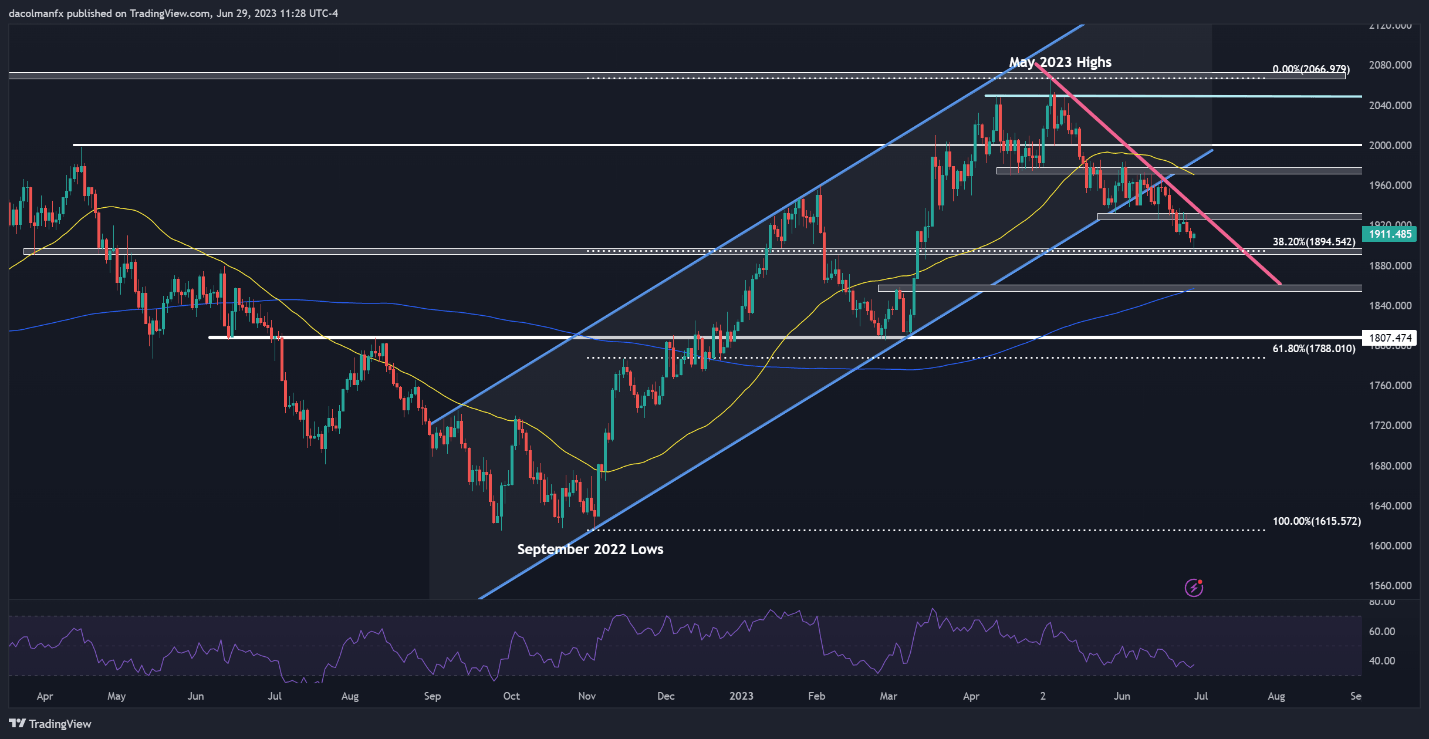

In terms of technical analysis, gold is hovering slightly above the support at $1,895, which corresponds to the 38.2% Fibonacci retracement of the September 2022 lows/May 2023 highs. Traders should watch this area carefully, as the breakdown reinforces downward pressure, paving the way for a decline towards the 200-day moving average near $1,855.

Conversely, if buyers come back into the market and trigger a recovery, the initial resistance lies at $1,925/$1,930. If this ceiling is breached, we could see a rally towards $1970, around the 50-day SMA. For more strength, the focus moves to the psychological $2000 level.