Billionaire hedge fund manager Stanley Druckenmiller has a dire prediction for the US economy: a recession is looming, and it’s likely to happen next June. Druckenmiller’s forecast comes as US consumer spending continues to decline, largely due to credit card use. Druckenmiller, the veteran investment tycoon, warns that it would be foolish to ignore the possibility of a “really bad” scenario.

Druckenmiller points to falling consumer spending and disruption to the banking industry as indicators of a recession

At the 2023 Sohn Investment Conference in San Francisco, Stanley Druckenmiller sounded the alarm about the US economy. While others may be optimistic about the “soft landing,” the veteran hedge fund manager is preparing for the impact, anticipation “hard landing” instead.

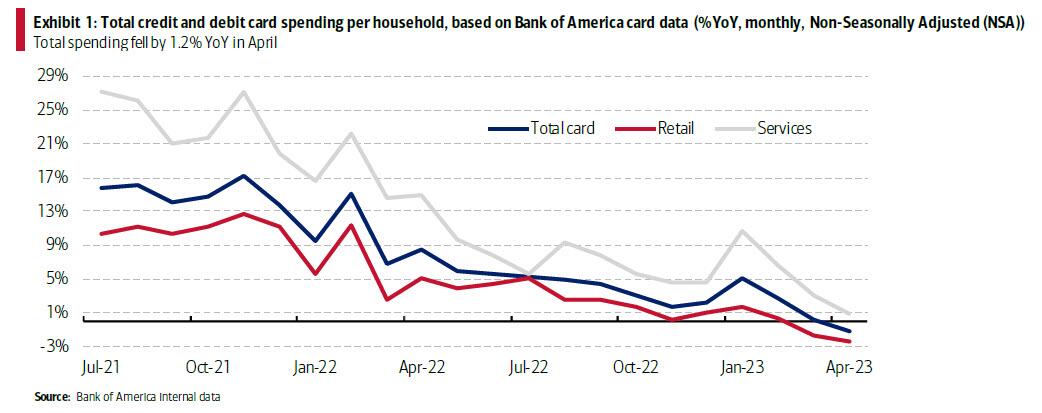

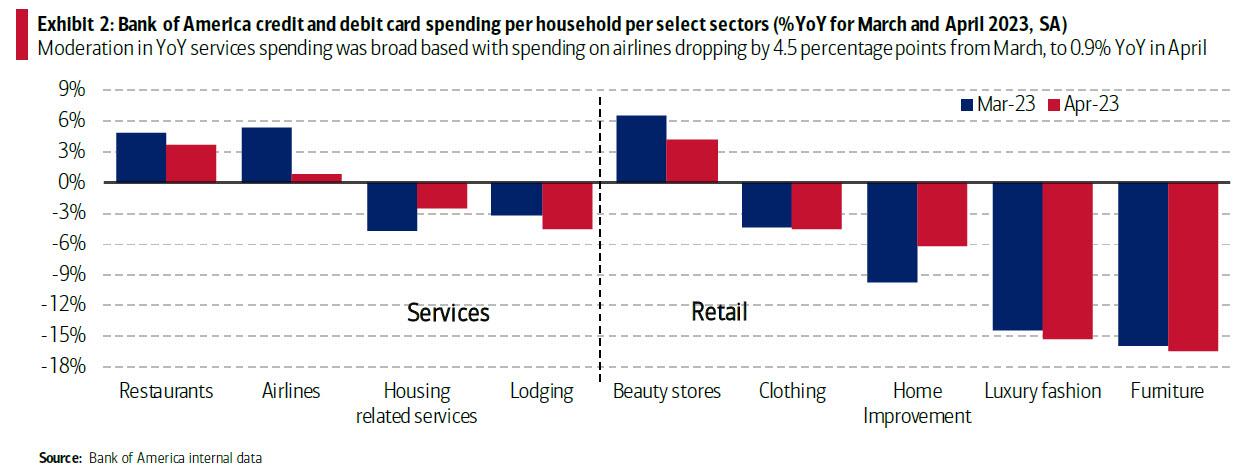

Druckenmiller, who has enjoyed 30 years of success in the hedge fund industry, cited A sharp decline in consumer spending And the recent turmoil in the banking industry as major factors behind his forecast. Druckenmiller’s warnings about the US economy echo other notable warnings in the financial world.

Other well-known investors, including Barry Sternlicht, David Rosenberg and Jeffrey Gundlach, have also expressed concerns about the “hard landing” in the US. At the Son conference, Druckenmiller laid out his forecast, citing rising unemployment, a 20% drop in business profits, and increasing bankruptcies as leading indicators of a recession.

However, he was quick to clarify that he did not expect a crisis worse than the 2008 financial meltdown. Druckenmiller said:

I don’t expect anything worse than 2008. It’s naive not to be open about something really bad, really happening.

Druckenmiller remains optimistic about post-recession prospects

While some experts such as Goldman Sachs Global Investment research And Wendy Edelberg from Project Hamilton, they are anticipation A “soft landing” for the US economy, Druckenmiller has a very different view. Druckenmiller is preparing for a recession, but he’s also optimistic about the future.

In fact, he believes there will be “incredible opportunities” in the coming years, particularly in the field of artificial intelligence (AI). Druckenmiller sees the post-recession landscape as a breeding ground for innovative technologies and cutting-edge solutions that “present themselves.”

Druckenmiller stated:

AI is very real and can have as much impact as the Internet – AI could eventually produce $100 billion (in) businesses.

At the Sohn Investment Conference, Stanley Druckenmiller didn’t mince words when he commented what he thought of the Fed’s current policy. Druckenmiller believes that the US central bank has exhausted its resources fighting inflation and recession. He lamented, “We wasted all our bullets.”

What do you think of Stanley Druckenmiller’s predictions for the US economy? Do you agree with his assessment or do you have a different view? Share your thoughts in the comments section below.

Image credits: shutterstock, pixabay, wikicommons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services or companies. Bitcoin.com It does not provide investment, tax, legal or accounting advice. Neither the Company nor the author shall be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.