Helium (HNT) stock has gained 158.15% since the beginning of July, showing a strong uptrend. The main question now is whether Helium stock will continue its upward trend or if there will be a pullback on the horizon.

While the rally in Helium (HNT) stock has been exciting, it could soon turn into a disappointment for investors. The lack of consolidation or pullback during this rally raises concerns that a pullback could be imminent. Here’s why a pullback could be imminent.

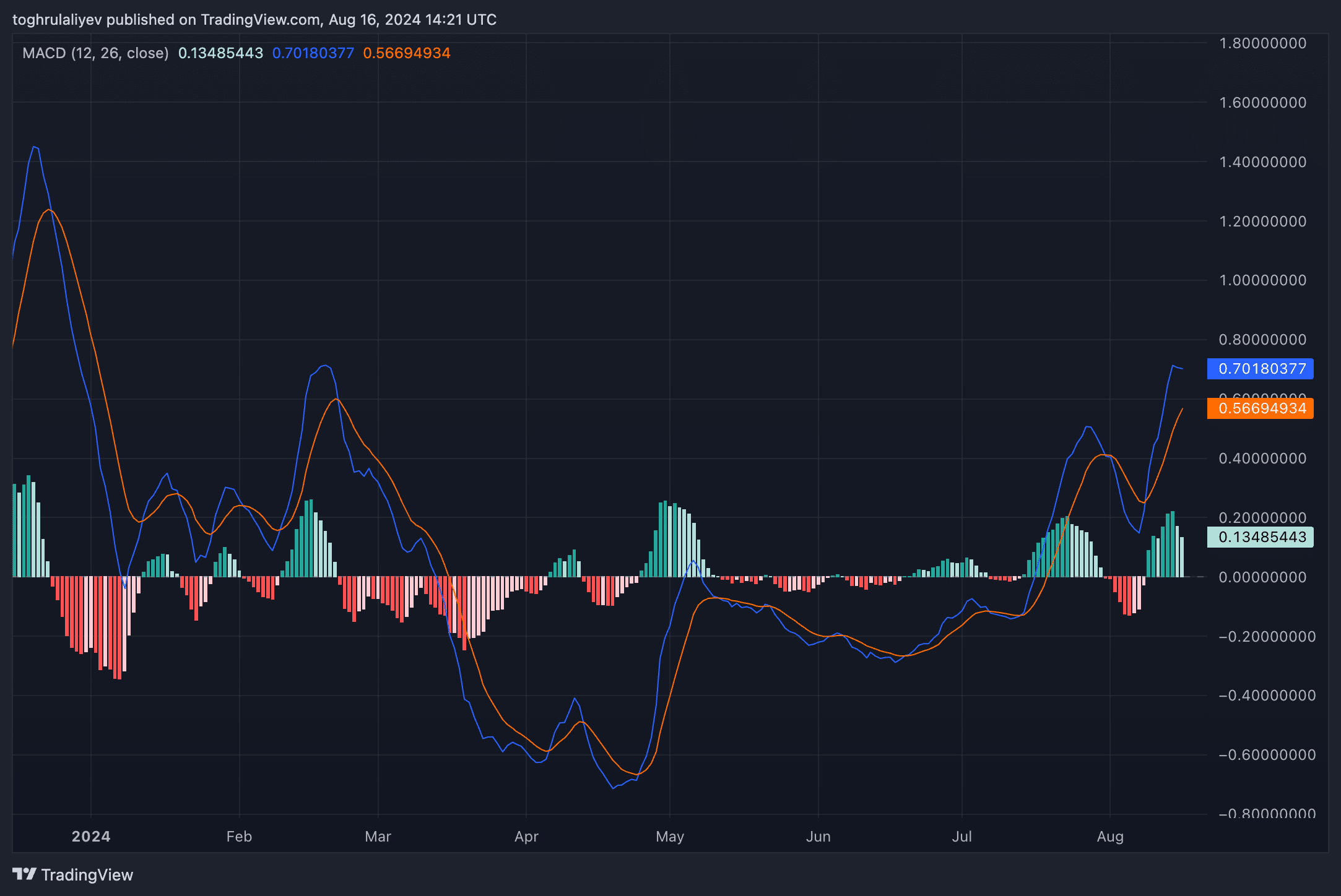

Moving Average Convergence Divergence

When examining the daily Moving Average Convergence Divergence (MACD) indicator, we notice that the histogram has turned from dark green to light green, indicating a weakening of the bullish momentum. The MACD lines have also started to converge, indicating that the current uptrend may be losing strength. A potential bearish crossover could signal a reversal in the trend.

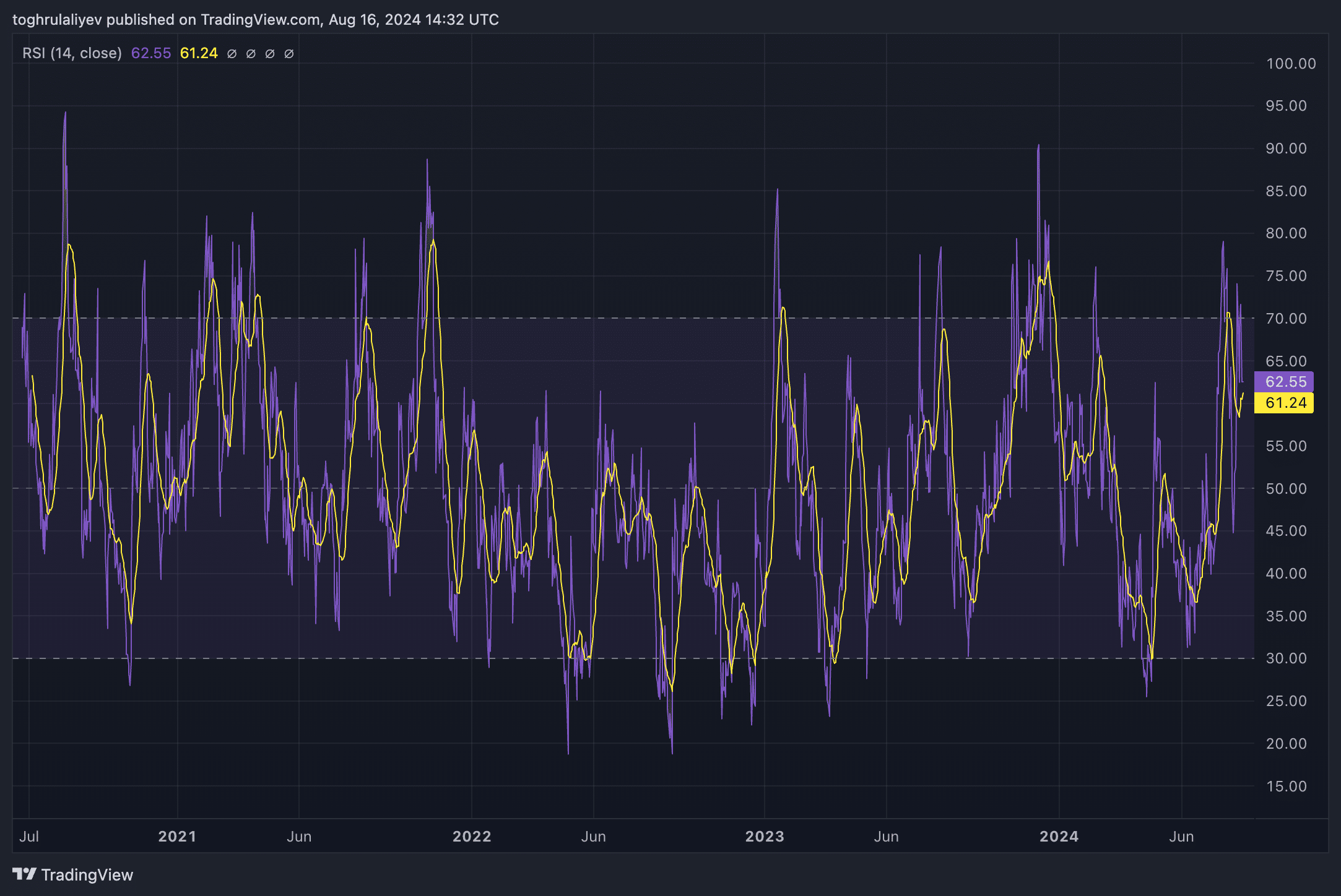

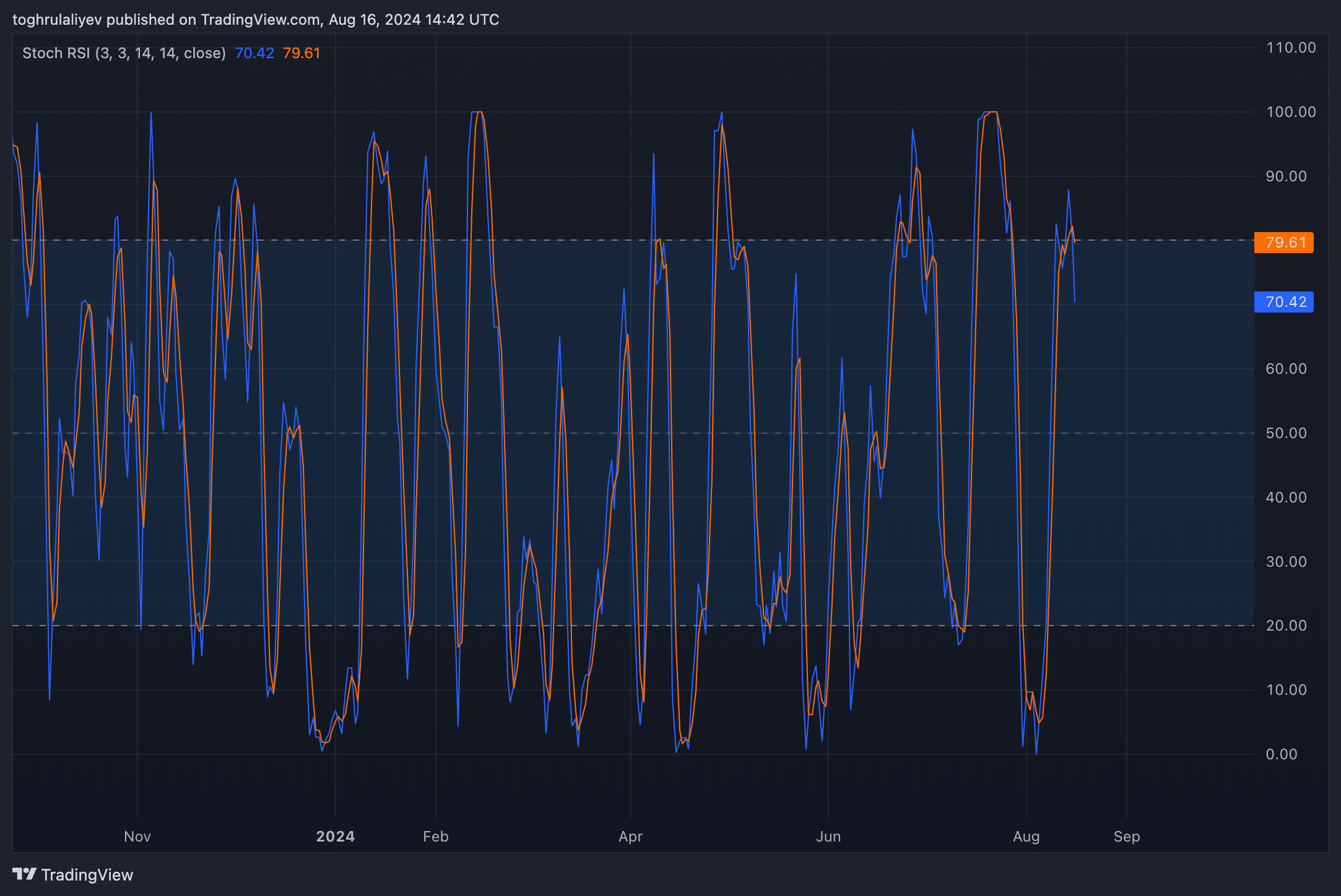

RSI and Stochastic RSI

Both the RSI and Stochastic RSI are in overvalued territory, with readings above 60. Historically, when the RSI and Stochastic RSI reach levels of 60+, they tend to decline significantly, often accompanied by a sharp decline in price.

Support and resistance levels

The current price action is showing strong resistance levels at $8.5 and $10. These levels have proven difficult to break or have acted as strong support levels in the past. Meanwhile, the $7 level is acting as a weak area. At the moment, it is acting as resistance, but its role may change if HNT breaks above it. If the price fails to break $7, a more pronounced downtrend is likely to begin.

Fibonacci confluence levels

By applying Fibonacci retracement levels from three different time frames – the first day of trading to a recent high, the June low to a recent high, and the March high to the June low – we identify multiple confluence levels. These confluence levels are clustered around $6 and $4.7.

The area between $4.7 and $6 forms what we refer to as the “opportunity box.” This range represents a potential target area for a short position, with HNT stock expected to pull back from this area if the downtrend continues.

Historical support is at the $3 level, but a drop to that level seems unlikely unless there are major negative events in the broader market, similar to what happened with the surprise interest rate hike in Japan and the Jump Trading sell-off in late July and early August.

Strategic Considerations

Before initiating a short position, it is important to confirm the downtrend. Although the trend has recently reversed, there is always the possibility of a bearish trap. To minimize the risk, we recommend waiting for HNT to break below $6.3958, which is the 23.6% Fibonacci retracement level from the June low to August high. Once HNT breaks below this level and acts as resistance, the short selling opportunity becomes safer.

Another factor to consider is the volume profile of the visible range, which shows a thin volume zone between $5.5 and $6.5. Prices tend to move quickly through such low volume zones, further supporting the potential for a downside move. However, HNT is currently sitting within a high volume zone, which could act as a potential consolidation zone.

Disclosure: This article does not constitute investment advice. The content and materials on this page are for educational purposes only.