The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Football price for lion and players soft. All Arcu Lorem, Intrimies, any children or, ulamcorper, hate football.

This article is also available in Spanish.

Analytics has unveiled the Solana price levels that may be important to watch, based on series accumulation data.

It reveals the distribution of the basis for the cost of Solana, where the offer is more concentrated

In a new post on X, Glass knot Discuss the distribution of the valid price (URPD) from Solana. URPD is an indication that mainly tells us about the amount of price purchased levels. Of course, the scale uses the last treatment price of any trading code as a basis for cost.

Related reading

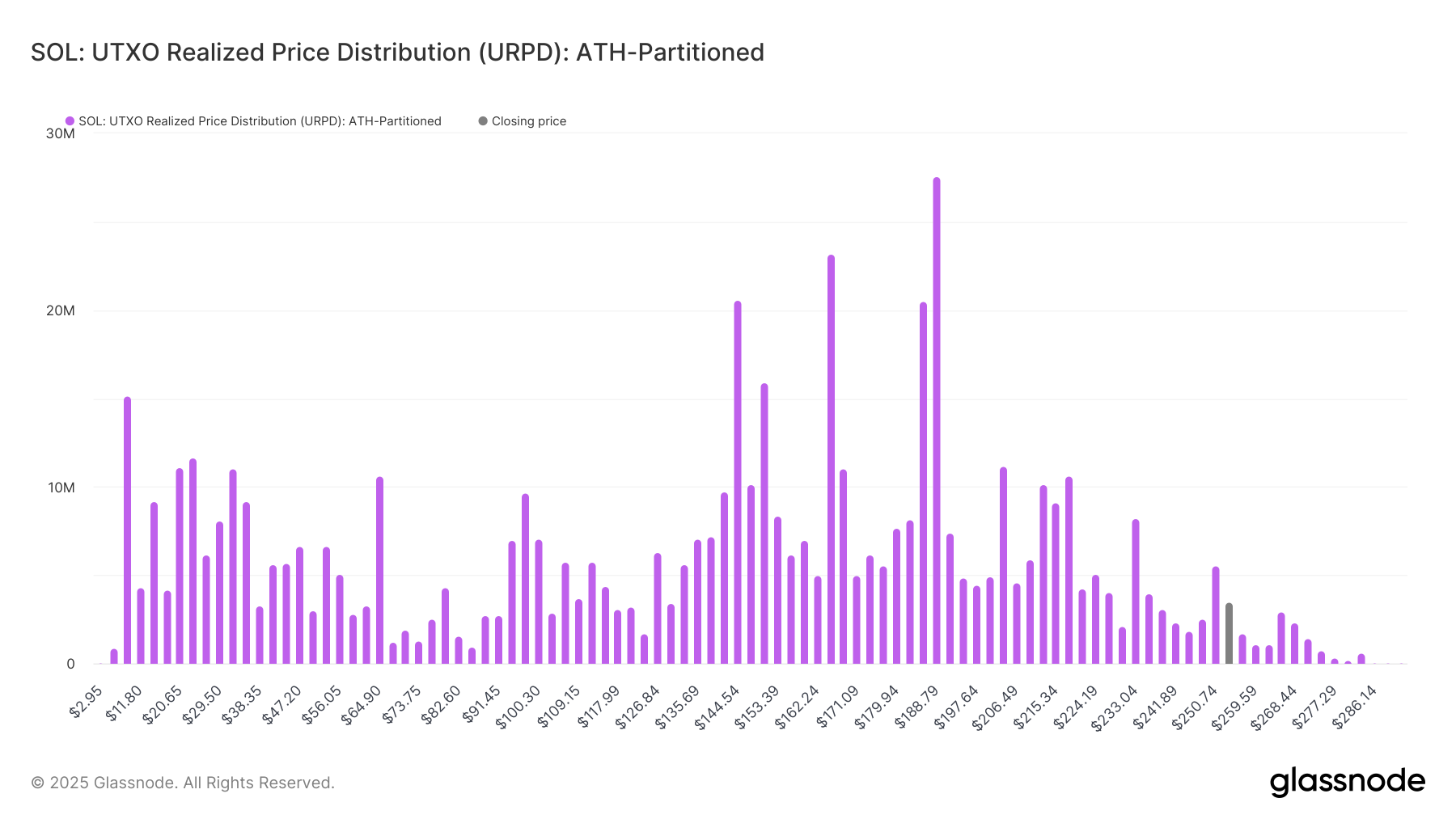

First, here is how URPD seemed when the cryptocurrency has identified a new return (ATH) in January:

From the graph, it is clear that there are a few price levels like $ 144 in terms of how much the supply they hosted. At price levels closest to the new ATH, the supply was very thin, which means that many coins have not changed there.

In the series analysis, the capabilities of any level of work are measured as support or resistance in terms of the amount of the width it hosts. This means that the levels that have a large group around them on URPD are important to the original.

The reason for this, the answer lies in the investor's psychology: sensitive holders to re -test the cost basis. When the price touches a large group of cost, investors who carry these coins may respond by making some panic moves.

These moves can tend to purchase if the re -test occurs from above, as investors may want to defend the limits of profit loss. In the re -tests that occur from the bottom, traders can interact through sale instead, as they may seek to go out in the tie period.

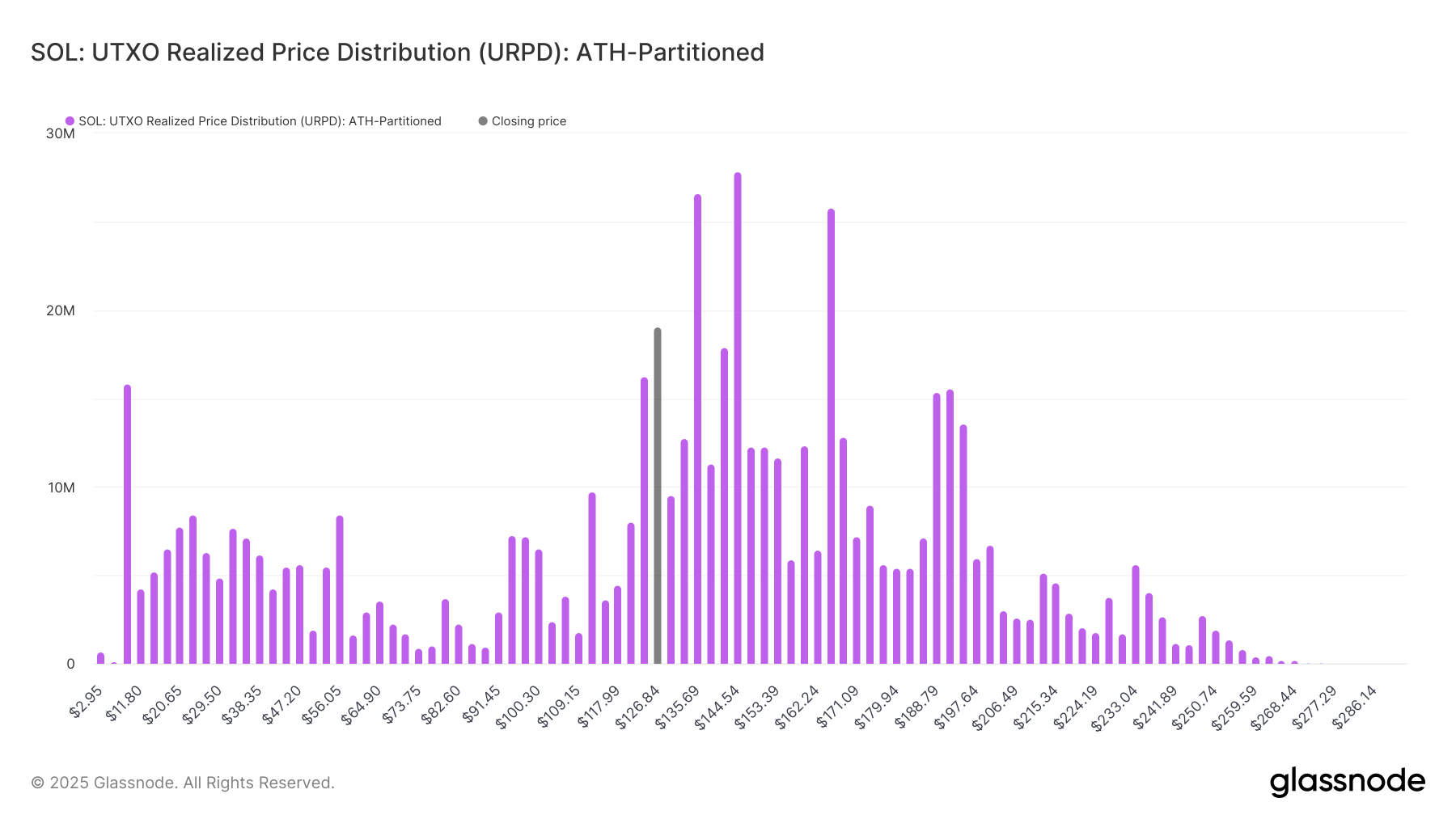

When Sol arrived at ATH, there was a shortage of support near. This may be the reason that the original ended in the group that carries a large amount of offer. Below is a scheme that shows how URPD changed after withdrawing the price.

From the graph, it is clear that if Sol continues to have a declining tension, it may have to end up relying on the level of $ 112 recently. In January, this level hosted the basis of 4 million icons, but today, this number grew to 9.7 million, equivalent to 1.67 % of the entire offer.

Behind this level, Glassnode notes, “94 dollars, 97 dollars and $ 100, approximately 21 million Sol (3.5 % of the offer). “In the scenario that these support levels are failing, Solana may find herself in trouble, as there are no major supplies to $ 53.

Related reading

Regarding the above -mentioned levels, levels of $ 135 and $ 144 are highlighted, with a acquisition level of 26.6 million and 27 million coins, respectively. These levels can serve as great obstacles to the recovery of Sol.

Soul price

Solana has jumped over 5 % over the past 24 hours to recover to the level of $ 130.

Distinctive photo of Shutterstock.com, Glassnode.com, Chart from TradingView.com