Euro (EUR/USD, EUR/GBP) Analysis

- ZEW economic sentiment inches higher but confidence remains low

- EUR/USD descending channel heads lower after testing resistance

- EUR/GBP testing crucial support zone – follow through needed

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade EUR/USD

ZEW Economic Sentiment Inches Higher but Confidence Remains Low

Sentiment in the EU and in Germany continue to climb higher but still has a long way to go. Analysts are continuing to gain more confidence in the economic outlook in 6 months’ time, but more worrying is the perception of current conditions which continue to deteriorate.

Customize and filter live economic data via our DailyFX economic calendar

The economic outlook for Europe remains pessimistic as the stagnant economy has barely dodged a technical recession throughout 2023 with little to no reprieve on the horizon in 2024. As such, markets still anticipate over 100 basis points (bpd) of cuts this year while the hot US CPI print for January reeled in Fed rate cut bets which now see a greater likelihood of the first rate cut in June or July – previously March. Therefore, form a fundamental angle, the euro could suffer further setbacks against the dollar.

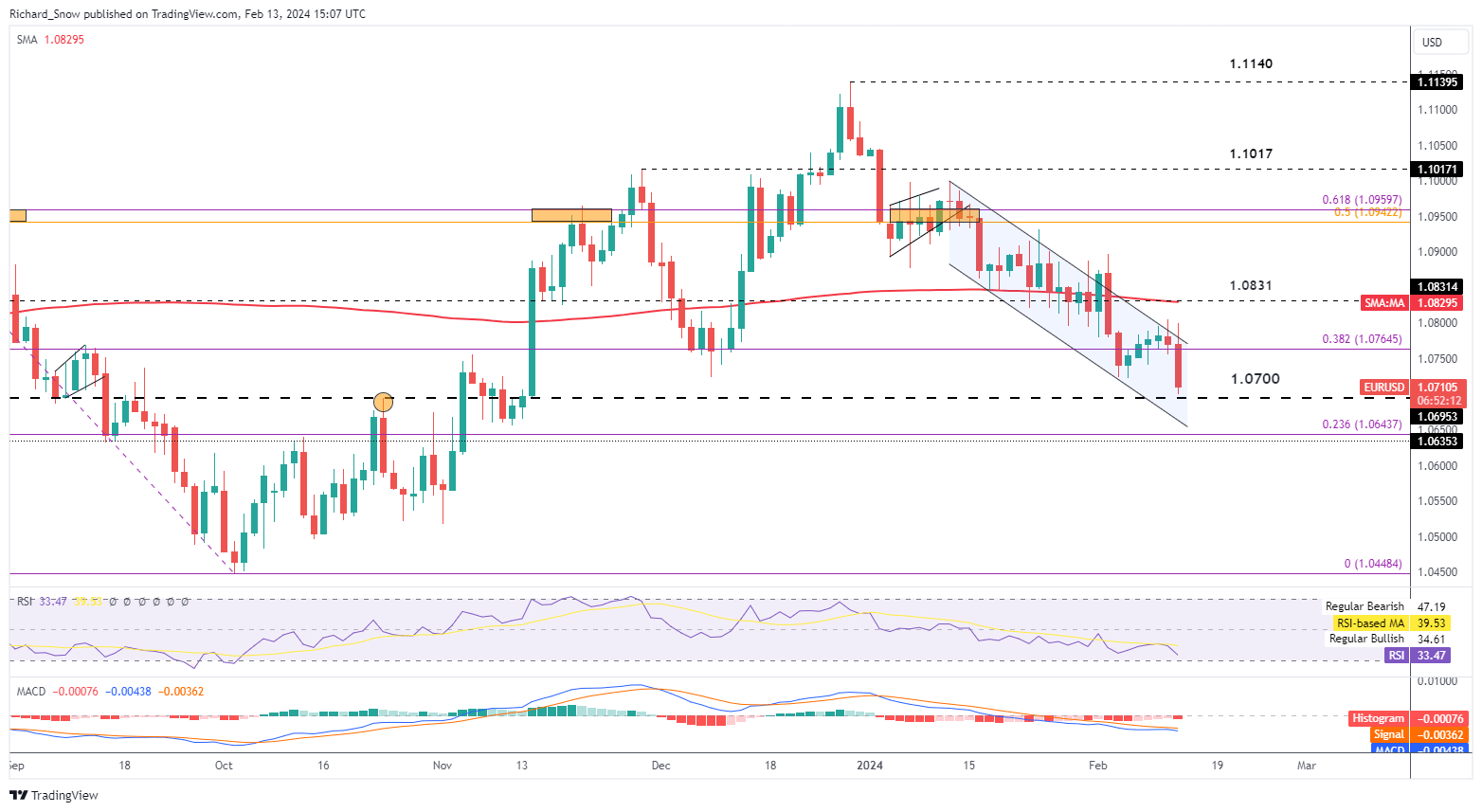

EUR/USD Descending Channel Heads Lower After Testing Resistance

On the weekly EUR/USD chart a double bottom appeared around the December and February lows (1.0724), which suggested a bearish continuation may struggle, requiring a catalyst to push further. US CPI appears to have provided that catalyst seeing the pair head lower, towards support at 1.0700 flat. The next level of support appears in the form of channel support, followed by the 23.6% Fibonacci retracement of the 2023 major decline. Resistance is back at channel resistance and the 38.2% Fib level.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors:

Recommended by Richard Snow

Traits of Successful Traders

EUR/GBP Testing Crucial Support Zone – Follow Through Needed

EUR/GBP has moved lower on the back of positive surprises in both UK employment data and average earnings. Markets now price in less than 65 basis points worth of cuts from the Bank of England, a notable decline after printing above 100 bps not too long ago.

EUR/GBP needs to be monitored for a potential close below the crucial zone of support at 0.8515. Momentum points to the downside with the RSI still a fair distance away from oversold territory and with more high importance UK data still to come, bears will have more data on hand. UK CPI is expected to print higher than the December print, potentially strengthening the pound and sending EUR/GBP even lower. However, the pound may be brought back in line of quarter-on-quarter GDP reveals a technical recession for the UK.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX